Form F0003 Exemption 2011

What is the Form F0003 Exemption

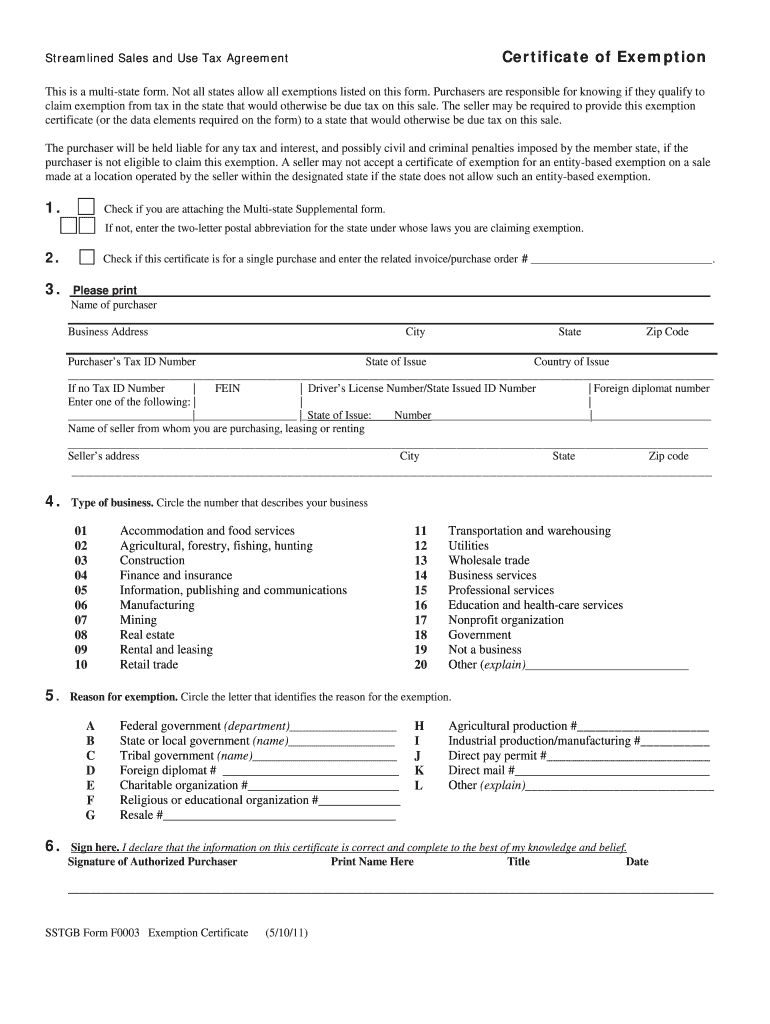

The Form F0003 Exemption is a specific document used for tax purposes in the United States. It allows eligible taxpayers to claim an exemption from certain tax obligations. This form is particularly relevant for individuals or entities that meet specific criteria set forth by the Internal Revenue Service (IRS). Understanding the purpose and requirements of this form is essential for ensuring compliance with tax regulations and avoiding penalties.

Steps to complete the Form F0003 Exemption

Completing the Form F0003 Exemption involves several clear steps:

- Gather necessary information, including personal identification details and relevant financial data.

- Download the form from the IRS website or obtain it through authorized channels.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified guidelines, either electronically or via mail.

Legal use of the Form F0003 Exemption

The legal use of the Form F0003 Exemption is governed by IRS regulations. It is crucial for taxpayers to understand that this form must be filled out truthfully and accurately to maintain its validity. Misrepresentation or errors can lead to legal repercussions, including fines or audits. Therefore, it is advisable to consult with a tax professional if there are any uncertainties regarding the completion or submission of the form.

Eligibility Criteria

To qualify for the Form F0003 Exemption, taxpayers must meet specific eligibility criteria outlined by the IRS. These criteria typically include:

- Filing status, such as being a self-employed individual or a specific type of business entity.

- Income thresholds that determine exemption eligibility.

- Other factors that may affect tax liability, such as residency status or special circumstances.

It is important for individuals to review these criteria carefully to ensure they qualify before submitting the form.

Form Submission Methods

The Form F0003 Exemption can be submitted using various methods, depending on the taxpayer's preference and the guidelines provided by the IRS. The available submission methods include:

- Online submission through the IRS e-filing system, which is often the quickest option.

- Mailing the completed form to the appropriate IRS address, as specified in the instructions.

- In-person submission at designated IRS offices, if applicable.

Each method has its own processing times and requirements, so it is important to choose the one that best fits the taxpayer's situation.

Required Documents

When completing the Form F0003 Exemption, certain documents may be required to support the information provided. These documents can include:

- Proof of income, such as pay stubs or tax returns.

- Identification documents, like a Social Security card or driver's license.

- Any additional documentation that verifies eligibility for the exemption.

Having these documents ready can streamline the completion process and help ensure accuracy.

Quick guide on how to complete form f0003 exemption 2011

Discover how to seamlessly complete the Form F0003 Exemption with these simple guidelines

Online eFiling and document certification are becoming more prevalent and the preferred choice for a diverse range of clients. This approach provides numerous advantages over traditional printed documents, including convenience, time savings, enhanced precision, and security.

With resources such as airSlate SignNow, you can locate, edit, authenticate, enhance, and transmit your Form F0003 Exemption without the hassle of endless printing and scanning. Follow this concise guide to begin and finalize your form.

Utilize these steps to access and complete Form F0003 Exemption

- Begin by clicking the Get Form button to access your form in our editor.

- Refer to the green indicator on the left that highlights required fields to ensure you do not overlook them.

- Make use of our advanced tools to comment, modify, sign, secure, and refine your form.

- Protect your document or transform it into an interactive form using the appropriate tab features.

- Review the form and check for mistakes or inconsistencies.

- Select DONE to complete the editing process.

- Rename your form or keep its original title.

- Choose the storage option where you wish to save your form, send it via USPS, or click on the Download Now button to save your file.

If Form F0003 Exemption is not what you were searching for, you can explore our extensive assortment of pre-filled forms that you can complete effortlessly. Check out our platform today!

Create this form in 5 minutes or less

Find and fill out the correct form f0003 exemption 2011

Create this form in 5 minutes!

How to create an eSignature for the form f0003 exemption 2011

How to generate an eSignature for the Form F0003 Exemption 2011 in the online mode

How to make an electronic signature for the Form F0003 Exemption 2011 in Google Chrome

How to create an eSignature for signing the Form F0003 Exemption 2011 in Gmail

How to create an eSignature for the Form F0003 Exemption 2011 from your mobile device

How to make an electronic signature for the Form F0003 Exemption 2011 on iOS

How to make an eSignature for the Form F0003 Exemption 2011 on Android

People also ask

-

What is the Form F0003 Exemption?

The Form F0003 Exemption is a specific form used to apply for exemptions under certain regulations. This form allows businesses to streamline their compliance processes and avoid unnecessary taxation or fees. Understanding how to properly utilize the Form F0003 Exemption can lead to signNow savings.

-

How can airSlate SignNow help with the Form F0003 Exemption?

airSlate SignNow simplifies the process of preparing and submitting the Form F0003 Exemption by providing an easy-to-use electronic signing platform. With our solution, you can quickly fill out, sign, and send the form with just a few clicks. This not only saves time but also ensures accuracy and compliance.

-

What are the pricing options for airSlate SignNow when handling Form F0003 Exemption?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes when managing the Form F0003 Exemption. Our competitive pricing ensures that you can access essential eSigning features without breaking the bank. Visit our pricing page to find a plan that fits your needs.

-

Are there any specific features in airSlate SignNow for managing the Form F0003 Exemption?

Yes, airSlate SignNow includes specific features designed to simplify the management of the Form F0003 Exemption. These features include customizable templates, real-time tracking, and automated reminders to ensure timely submissions. Additionally, you can store and retrieve past forms easily for your records.

-

What are the benefits of using airSlate SignNow for Form F0003 Exemption submissions?

Using airSlate SignNow for Form F0003 Exemption submissions offers numerous benefits, including enhanced efficiency, improved collaboration, and heightened security. Our platform ensures that documents are signed securely and stored safely, allowing for quick access whenever needed. It ultimately helps you maintain compliance while saving valuable time and resources.

-

Can airSlate SignNow integrate with other tools to aid in Form F0003 Exemption processing?

Absolutely! airSlate SignNow offers integrations with a variety of popular tools and platforms that can assist in the processing of the Form F0003 Exemption. Whether you use project management software, CRM systems, or cloud storage solutions, our integrations ensure a seamless workflow, enhancing productivity.

-

Is there customer support available for questions about Form F0003 Exemption submission?

Yes, airSlate SignNow provides excellent customer support for any inquiries regarding the Form F0003 Exemption submission process. Our knowledgeable support team is available to assist you via chat, email, or phone, ensuring that you receive the help you need for a smooth experience. We're committed to helping you navigate your compliance requirements.

Get more for Form F0003 Exemption

- West michigan regional purchase agreement wmlar form

- Visit mckinleyparkcenter mckinleyparkcenter form

- Domestic violence risk and needs assessment dvrna scoring manual form

- Prairie view aampm university application packet pvamu form

- Declaration by medical doctor dentist form

- Name date period lesson 7 homework practice compute with scientific notation evaluate each expression form

- Ff sre 006 convenio de renuncia para adquisicin de bienes inmuebles fuera de zona restringida 4 form

- Comparison table fourth money laundering thomson reuters form

Find out other Form F0003 Exemption

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF