How to Fill Out Streamlined Sales and Use Tax Agreement Form Nc 2008

What is the streamlined sales and use tax agreement form NC?

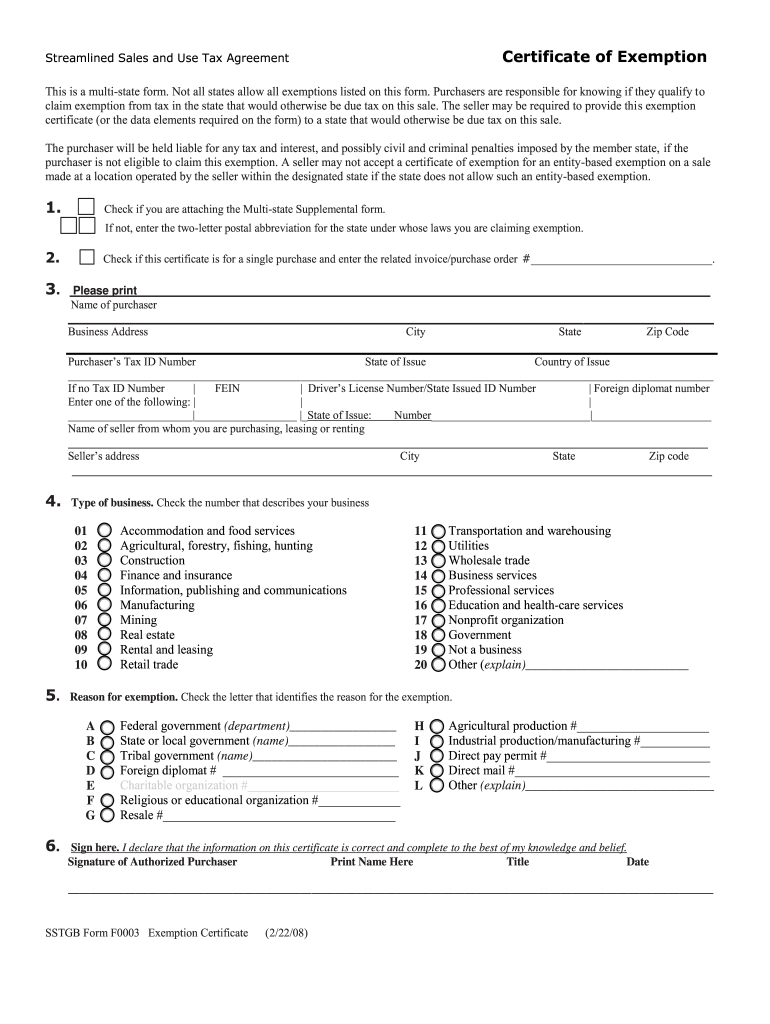

The streamlined sales and use tax agreement form NC is a document designed for businesses operating in North Carolina to simplify the process of collecting and remitting sales tax. This form is part of a broader initiative aimed at standardizing sales tax procedures across participating states, making it easier for businesses to comply with tax regulations. By utilizing this form, businesses can benefit from streamlined processes and reduced administrative burdens related to sales tax compliance.

Steps to complete the streamlined sales and use tax agreement form NC

Completing the streamlined sales and use tax agreement form NC involves several key steps:

- Obtain the form: The form can typically be downloaded from the North Carolina Department of Revenue website or obtained directly from local tax offices.

- Provide business information: Fill in necessary details such as the business name, address, and tax identification number.

- Indicate sales tax collection: Specify whether the business will be collecting sales tax for goods and services.

- Sign and date: Ensure that an authorized representative of the business signs and dates the form to validate it.

Following these steps will help ensure that the form is completed accurately and efficiently.

Legal use of the streamlined sales and use tax agreement form NC

The streamlined sales and use tax agreement form NC is legally binding once properly completed and submitted. It is essential that businesses adhere to the guidelines set forth by the North Carolina Department of Revenue to ensure compliance with state tax laws. This includes maintaining accurate records of sales tax collected and remitted, as well as keeping the agreement on file for auditing purposes. Failure to comply with the legal requirements associated with this form may result in penalties or fines.

State-specific rules for the streamlined sales and use tax agreement form NC

Each state participating in the streamlined sales tax initiative has specific rules that govern the use of the agreement form. In North Carolina, businesses must be aware of the following:

- Sales tax rates applicable to different goods and services.

- Exemptions that may apply to certain transactions.

- Filing frequency and deadlines for remitting collected sales tax.

Understanding these state-specific rules is crucial for ensuring compliance and avoiding potential issues with tax authorities.

Examples of using the streamlined sales and use tax agreement form NC

Businesses may encounter various scenarios where the streamlined sales and use tax agreement form NC is applicable. For instance:

- A retailer selling tangible personal property must collect sales tax on each sale and remit it to the state.

- A service provider offering taxable services needs to register and collect sales tax from clients.

- Online businesses selling to North Carolina residents must also comply with the state's sales tax requirements.

These examples illustrate the form's relevance across different business types and situations.

Form submission methods for the streamlined sales and use tax agreement form NC

Businesses can submit the streamlined sales and use tax agreement form NC through various methods:

- Online: Many states allow for electronic submission through their tax portals.

- Mail: The completed form can be sent via postal service to the appropriate tax office.

- In-person: Businesses may also choose to deliver the form directly to local tax offices.

Selecting the appropriate submission method can help ensure timely processing and compliance with state regulations.

Quick guide on how to complete how to fill out streamlined sales and use tax agreement form nc 2008

Complete How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc effortlessly on any device

Digital document management has become increasingly popular among enterprises and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc without hassle

- Obtain How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to fill out streamlined sales and use tax agreement form nc 2008

Create this form in 5 minutes!

How to create an eSignature for the how to fill out streamlined sales and use tax agreement form nc 2008

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Streamlined Sales and Use Tax Agreement Form NC?

The Streamlined Sales and Use Tax Agreement Form NC is a document designed to simplify sales tax collection and remittance for businesses operating in North Carolina. Understanding how to fill out streamlined sales and use tax agreement form NC is vital for compliance and easing administrative burdens.

-

How can airSlate SignNow help me fill out the Streamlined Sales and Use Tax Agreement Form NC?

airSlate SignNow offers an intuitive platform to easily eSign and manage your forms, including the streamlined sales and use tax agreement form NC. By using our features, you can fill out your forms digitally, ensuring accuracy and saving time.

-

Is there a cost associated with using airSlate SignNow for the Streamlined Sales and Use Tax Agreement Form NC?

Yes, airSlate SignNow provides a cost-effective solution for handling your eSigning needs. We offer different pricing tiers, making it accessible for businesses of all sizes that need assistance with the streamlined sales and use tax agreement form NC.

-

Can I integrate airSlate SignNow with my existing accounting software?

Absolutely! airSlate SignNow provides seamless integrations with various accounting software solutions. This integration facilitates easier management of your financial documents, including the streamlined sales and use tax agreement form NC, optimizing your workflow.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features, including customizable templates, real-time tracking, and automated reminders. These features ensure you know exactly how to fill out the streamlined sales and use tax agreement form NC and manage all your documents efficiently.

-

Are there any tutorials available to help me with filling out the form?

Yes, airSlate SignNow offers comprehensive tutorials and guides for helping users learn how to fill out the streamlined sales and use tax agreement form NC. These resources make the process straightforward, even for those new to eSigning.

-

Can I save and edit the Streamlined Sales and Use Tax Agreement Form NC after filling it out?

Yes, with airSlate SignNow, you can easily save and edit your documents, including the streamlined sales and use tax agreement form NC, before finalizing them. This flexibility allows you to make necessary adjustments without the need to start over.

Get more for How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc

Find out other How To Fill Out Streamlined Sales And Use Tax Agreement Form Nc

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word