3 Form Schedule

What is the 3 Form Schedule

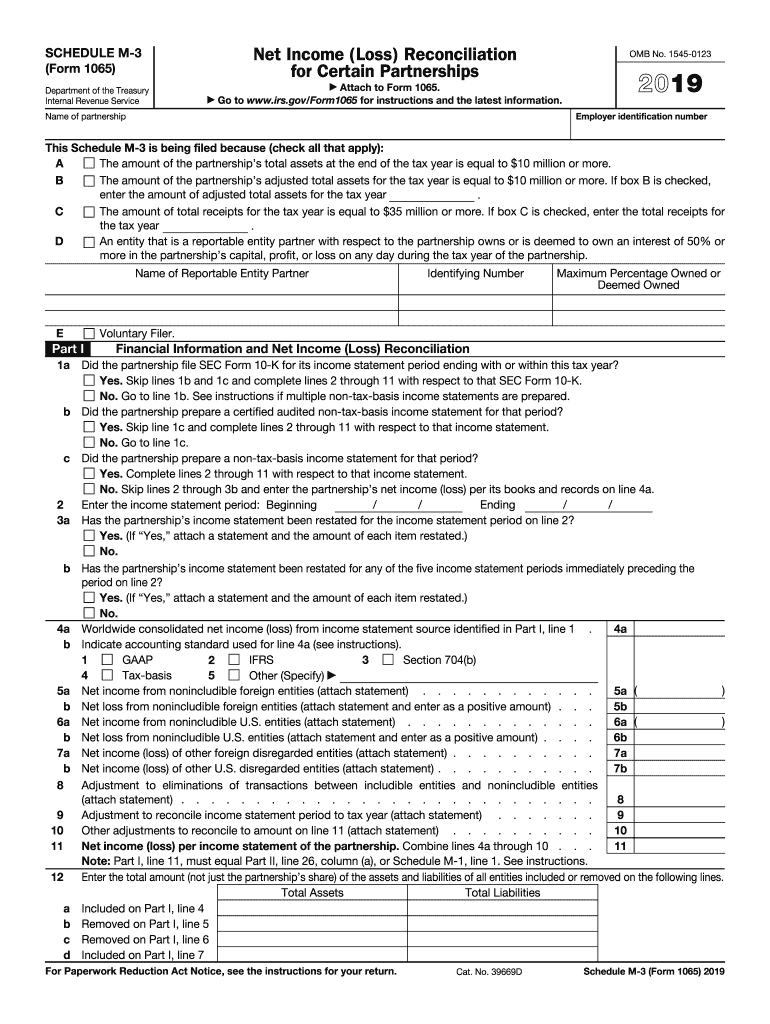

The 3 Form Schedule, also known as the 1065 Schedule M-3, is a tax form used by partnerships to provide detailed information about their income, deductions, and credits. This form is specifically designed for partnerships that have total assets of $10 million or more, allowing the IRS to better understand the financial activities of larger entities. The Schedule M-3 is a supplement to Form 1065, which is the U.S. Return of Partnership Income. It helps ensure transparency and compliance with tax regulations, providing a comprehensive overview of a partnership's financial status.

Steps to complete the 3 Form Schedule

Completing the 3 Form Schedule involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and prior year tax returns. Next, fill out the form by reporting all relevant income, deductions, and credits. It is important to include detailed explanations for any discrepancies between book income and tax income. After completing the form, review it for any errors or omissions. Finally, submit the completed Schedule M-3 along with Form 1065 by the designated filing deadline.

IRS Guidelines

The IRS provides specific guidelines for completing the 3 Form Schedule. These guidelines outline the required information, including how to report various types of income and deductions. It is essential to follow these instructions closely to avoid penalties. The IRS also emphasizes the importance of accurate reporting, as discrepancies can lead to audits or additional scrutiny. Familiarizing yourself with these guidelines can help ensure that the form is completed correctly and submitted on time.

Filing Deadlines / Important Dates

Partnerships must file the 3 Form Schedule along with Form 1065 by the 15th day of the third month after the end of the partnership's tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can file for an extension, which typically allows for an additional six months. However, it is important to note that an extension to file does not extend the time to pay any taxes owed.

Legal use of the 3 Form Schedule

The 3 Form Schedule is legally binding and must be completed accurately to comply with IRS regulations. Failing to file the form or providing incorrect information can result in penalties, including fines and interest on unpaid taxes. Additionally, partnerships may face increased scrutiny from the IRS if discrepancies are found between the Schedule M-3 and other tax documents. Therefore, it is crucial for partnerships to ensure that the information reported is complete and accurate.

Required Documents

To complete the 3 Form Schedule, partnerships need several key documents. These include financial statements, such as balance sheets and income statements, as well as prior year tax returns. Other supporting documents may include schedules detailing specific deductions and credits claimed. Having these documents readily available will streamline the completion process and help ensure that all necessary information is accurately reported on the form.

Quick guide on how to complete 2019 schedule m 3 form 1065 internal revenue service

Prepare 3 Form Schedule effortlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers a perfect environmentally friendly option to traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 3 Form Schedule on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 3 Form Schedule with ease

- Locate 3 Form Schedule and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize signNow sections of your documents or conceal sensitive data with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign 3 Form Schedule and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule m 3 form 1065 internal revenue service

How to generate an eSignature for your 2019 Schedule M 3 Form 1065 Internal Revenue Service in the online mode

How to make an eSignature for the 2019 Schedule M 3 Form 1065 Internal Revenue Service in Google Chrome

How to generate an electronic signature for putting it on the 2019 Schedule M 3 Form 1065 Internal Revenue Service in Gmail

How to make an electronic signature for the 2019 Schedule M 3 Form 1065 Internal Revenue Service from your mobile device

How to create an eSignature for the 2019 Schedule M 3 Form 1065 Internal Revenue Service on iOS

How to create an eSignature for the 2019 Schedule M 3 Form 1065 Internal Revenue Service on Android

People also ask

-

What is the 3 1065 form used for?

The 3 1065 form is utilized by partnerships to report income, deductions, and credits to the IRS. This form helps ensure that all partners in the business are informed of the tax responsibilities associated with their shares of income or loss. Using airSlate SignNow, you can easily eSign and manage your 3 1065 form, streamlining your filing process.

-

How can airSlate SignNow help with the 3 1065 form?

airSlate SignNow simplifies the signing and sharing of the 3 1065 form, allowing you to electronically sign and send documents efficiently. Our user-friendly platform ensures that all partners can review and sign the form from any device. This reduces delays and enhances collaboration within your partnership.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to meet different business needs, starting from a basic package to more comprehensive solutions. Each plan includes features that facilitate easier eSigning of documents like the 3 1065 form, ensuring you only pay for the tools that suit your operations. For a detailed breakdown, visit our pricing page.

-

Are there any integrations available for the 3 1065 form?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the functionality of your workflows that involve the 3 1065 form. Whether you use CRM software, cloud storage solutions, or financial applications, our integration options help streamline your document management. This ensures you can access, eSign, and store your forms in one place.

-

Can I track the status of my 3 1065 form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking of your documents, including the 3 1065 form, so you can see who has signed and when. This feature helps maintain accountability and ensures that all necessary parties have completed their actions effectively. You can access updates directly from your dashboard.

-

Is airSlate SignNow compliant with legal standards for the 3 1065 form?

Yes, airSlate SignNow complies with all legal requirements for eSigning, ensuring that your 3 1065 form is legally valid and secure. Our platform leverages strong encryption technologies to protect your information and adhere to industry standards, providing peace of mind for your sensitive documents. You can confidently manage your forms knowing they meet compliance regulations.

-

What are the benefits of using airSlate SignNow for the 3 1065 form?

Using airSlate SignNow for your 3 1065 form offers numerous benefits, including faster turnaround times, improved accuracy, and reduced costs associated with printing and mailing. The ease of electronic signing allows partnerships to operate more efficiently, facilitating quicker financial reporting and tax compliance. Ultimately, it enhances your overall business productivity.

Get more for 3 Form Schedule

Find out other 3 Form Schedule

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement