Pa 003 2020

What is the PA-003?

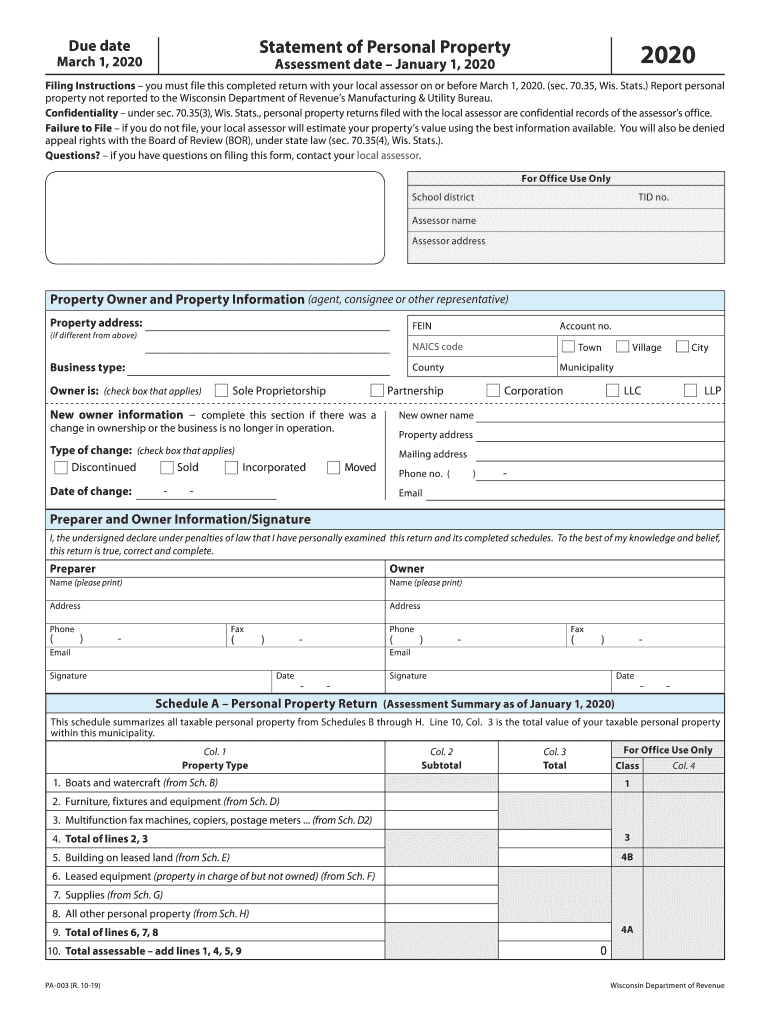

The PA-003, also known as the Wisconsin Personal Property Tax Form, is a crucial document for reporting personal property owned by businesses and individuals in Wisconsin. This form is used to declare personal property such as machinery, equipment, and other tangible assets that may be subject to local taxation. Understanding the PA-003 is essential for ensuring compliance with state tax regulations and for accurately assessing property tax obligations.

How to Use the PA-003

Using the PA-003 involves several steps to ensure that all required information is accurately reported. First, gather all relevant details about the personal property you own, including descriptions, purchase dates, and values. Next, fill out the form with this information, ensuring that each section is completed thoroughly. After completing the form, review it for accuracy before submission. Proper use of the PA-003 can help prevent issues with tax assessments and ensure that you meet your reporting obligations.

Steps to Complete the PA-003

Completing the PA-003 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about your personal property, including types, values, and acquisition dates.

- Obtain the PA-003 form from the appropriate local government office or download it from the Wisconsin Department of Revenue website.

- Fill out the form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to your local assessor's office by the specified deadline.

Legal Use of the PA-003

The PA-003 is legally binding and must be completed in accordance with Wisconsin state law. It is essential to provide accurate and truthful information on the form, as submitting false information can lead to penalties. The form serves as a declaration of personal property ownership and is used by local governments to assess property taxes. Understanding the legal implications of the PA-003 ensures that taxpayers remain compliant with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the PA-003 are critical to avoid penalties. Typically, the form must be submitted by May 15 of each year. It is important to keep track of this date and ensure that the form is filed on time. Missing the deadline can result in additional fees or complications with property tax assessments. Always verify the specific deadlines with your local tax authority, as they may vary by jurisdiction.

Required Documents

When completing the PA-003, certain documents may be required to support your claims. These can include:

- Purchase invoices or receipts for personal property.

- Previous tax returns that include personal property information.

- Any documentation that verifies the value of the property being reported.

Having these documents ready can facilitate the completion of the form and ensure that all reported values are accurate and substantiated.

Quick guide on how to complete wi dor pa 003 2020

Effortlessly Prepare Pa 003 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any holdups. Manage Pa 003 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Simplest Way to Edit and eSign Pa 003 with Ease

- Locate Pa 003 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of the documents or redact sensitive information using the features that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Pa 003 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi dor pa 003 2020

Create this form in 5 minutes!

How to create an eSignature for the wi dor pa 003 2020

How to make an eSignature for the Wi Dor Pa 003 2020 in the online mode

How to generate an eSignature for your Wi Dor Pa 003 2020 in Chrome

How to create an eSignature for signing the Wi Dor Pa 003 2020 in Gmail

How to generate an electronic signature for the Wi Dor Pa 003 2020 straight from your mobile device

How to make an eSignature for the Wi Dor Pa 003 2020 on iOS

How to generate an eSignature for the Wi Dor Pa 003 2020 on Android

People also ask

-

What is Wisconsin 003 in relation to airSlate SignNow?

Wisconsin 003 refers to a specific form identification used in the state of Wisconsin. With airSlate SignNow, you can easily create, send, and eSign documents, including those related to Wisconsin 003, making it a streamlined process for both individuals and businesses.

-

How much does airSlate SignNow cost for Wisconsin 003 users?

The pricing for airSlate SignNow is designed to be cost-effective for all users, including those handling Wisconsin 003 forms. You can choose from various plans that fit different business needs, ensuring you get the features necessary to manage your document workflow efficiently.

-

What features does airSlate SignNow offer for managing Wisconsin 003 documents?

airSlate SignNow provides a range of features to help manage Wisconsin 003 documents efficiently. These include customizable templates, the ability to add electronic signatures, and secure cloud storage, all aimed at improving workflow for businesses in Wisconsin.

-

Can I integrate airSlate SignNow with other software tools for Wisconsin 003 processing?

Yes, airSlate SignNow offers integration capabilities with various software tools that can assist in processing Wisconsin 003 forms. This means you can seamlessly connect your existing applications, enhancing your overall document management system.

-

What are the benefits of using airSlate SignNow for Wisconsin 003 transactions?

Using airSlate SignNow for Wisconsin 003 transactions greatly benefits businesses by saving time and reducing paperwork. Its user-friendly interface allows for quick document processing and ensures compliance with state-specific regulations efficiently.

-

Is airSlate SignNow secure for handling Wisconsin 003 documents?

Yes, airSlate SignNow places a high priority on security, making it a reliable option for handling Wisconsin 003 documents. They employ advanced encryption and security protocols to protect sensitive data and ensure that your documents are safe throughout the signing process.

-

How does airSlate SignNow improve the eSigning experience for Wisconsin 003?

airSlate SignNow enhances the eSigning experience for Wisconsin 003 forms by making the process quick and intuitive. Users can sign documents from any device, track their status in real-time, and receive notifications, ensuring a seamless experience.

Get more for Pa 003

Find out other Pa 003

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter