W 8ben Form 2014

What is the W-8BEN Form

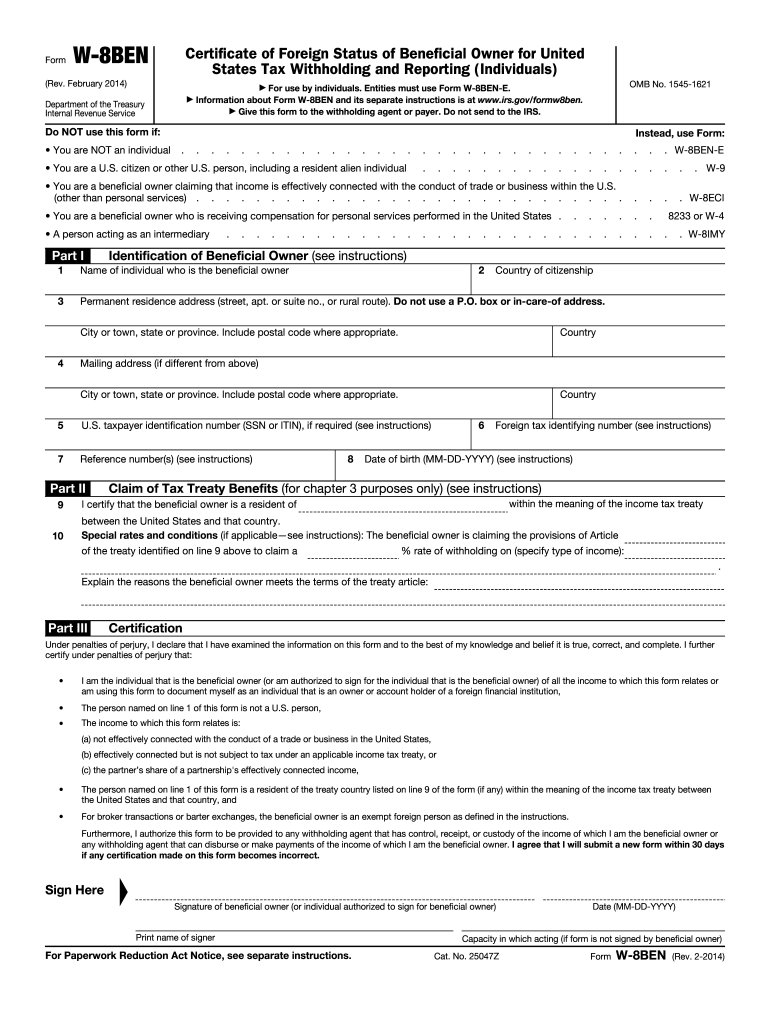

The W-8BEN Form is an IRS document used by foreign individuals and entities to certify their foreign status. This form is essential for non-U.S. residents who receive income from U.S. sources, as it helps them claim tax treaty benefits and avoid or reduce withholding taxes on certain types of income. By submitting the W-8BEN, individuals can ensure that they are not subject to the standard 30% withholding tax on income such as dividends, interest, and royalties. Understanding this form is crucial for anyone engaged in cross-border transactions or investments in the United States.

Steps to Complete the W-8BEN Form

Completing the W-8BEN Form involves several key steps to ensure accuracy and compliance with IRS regulations. Here is a straightforward guide:

- Provide Personal Information: Fill in your name, country of citizenship, and permanent address. Ensure that this information matches your official documents.

- Claim Tax Treaty Benefits: If applicable, indicate the country with which the U.S. has a tax treaty and the specific article that provides the benefit.

- Signature and Date: Sign and date the form to validate your declaration. This confirms that the information provided is correct and complete.

Once completed, the form should be submitted to the withholding agent or financial institution requesting it, rather than sent directly to the IRS.

How to Obtain the W-8BEN Form

The W-8BEN Form can be easily obtained from the IRS website. It is available as a downloadable PDF file, which can be printed and filled out manually. Additionally, many financial institutions and tax professionals provide this form to their clients, ensuring that it is readily accessible for those who need it. It is important to ensure that you are using the most current version of the form, as updates may occur over time.

Legal Use of the W-8BEN Form

The legal use of the W-8BEN Form is governed by IRS regulations, which stipulate that the form must be completed accurately to be considered valid. This form serves as a declaration of foreign status and is essential for claiming reduced withholding rates based on tax treaties. Failing to provide a valid W-8BEN can result in the application of the default withholding rate, which is typically higher. It is crucial to understand the legal implications and ensure compliance to avoid unnecessary tax liabilities.

Key Elements of the W-8BEN Form

Several key elements must be included in the W-8BEN Form for it to be valid:

- Identification of the Beneficial Owner: This includes the name and address of the individual or entity claiming the benefits.

- Claim of Tax Treaty Benefits: If applicable, the specific tax treaty provisions must be referenced.

- Signature and Certification: The form must be signed by the beneficial owner or an authorized representative, certifying the accuracy of the information.

Each element plays a vital role in ensuring that the form serves its purpose effectively, allowing for proper tax treatment of income received from U.S. sources.

Filing Deadlines / Important Dates

While the W-8BEN Form does not have a specific filing deadline, it is important to submit it before receiving any income subject to withholding. This ensures that the appropriate withholding rates are applied. If the form is not submitted in a timely manner, the default withholding rate may apply, which is generally higher. It is advisable to check with the withholding agent or financial institution for any specific timelines they may have regarding the submission of the W-8BEN.

Quick guide on how to complete w 8ben 2014 form

Complete W 8ben Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without disruption. Handle W 8ben Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign W 8ben Form with ease

- Find W 8ben Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your edits.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign W 8ben Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 8ben 2014 form

Create this form in 5 minutes!

How to create an eSignature for the w 8ben 2014 form

How to generate an eSignature for your W 8ben 2014 Form online

How to create an eSignature for your W 8ben 2014 Form in Google Chrome

How to make an eSignature for putting it on the W 8ben 2014 Form in Gmail

How to make an eSignature for the W 8ben 2014 Form straight from your smartphone

How to generate an electronic signature for the W 8ben 2014 Form on iOS devices

How to create an electronic signature for the W 8ben 2014 Form on Android

People also ask

-

What is the W 8ben Form?

The W 8ben Form is a tax form used by foreign individuals and entities to signNow their foreign status and claim beneficial tax rates. This form is crucial for ensuring compliance with U.S. tax laws when receiving certain types of income from U.S. sources.

-

How can airSlate SignNow help with completing the W 8ben Form?

airSlate SignNow simplifies the process of filling out the W 8ben Form with its user-friendly eSigning and document management features. Users can easily upload, edit, and send the form for signature, ensuring a streamlined workflow.

-

Is airSlate SignNow an affordable option for managing the W 8ben Form?

Yes, airSlate SignNow offers cost-effective solutions tailored for businesses that need to manage documents like the W 8ben Form. Competitive pricing plans ensure that you can utilize this essential tool without breaking the bank.

-

Can I save and store my completed W 8ben Form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to securely save and store completed W 8ben Forms digitally. This ensures you have easy access to your documents at any time while keeping them safe and organized.

-

Are there any features that enhance the management of the W 8ben Form?

airSlate SignNow offers features such as customizable templates, audit trails, and automatic reminders that enhance the management of the W 8ben Form. These tools help ensure that you never miss deadlines and keep your documents in order.

-

What integrations does airSlate SignNow offer for the W 8ben Form?

airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems, making it easy to manage your W 8ben Form alongside other business processes. This enhances productivity and streamlines document management.

-

How secure is airSlate SignNow when handling the W 8ben Form?

Security is a top priority at airSlate SignNow. The platform uses industry-standard encryption and authentication protocols to ensure that your W 8ben Form and all other documents are safely handled and protected from unauthorized access.

Get more for W 8ben Form

- Division of child support enforcement application dhss delaware form

- Delaware water well licensing board application for license form

- Application for construction letter of approval form

- Dnrec division of water application for construction of wastewater form

- Instructions form 2 notice of termination not dnrec delaware

- Chelsea piers certificate of occupancy form

- Mo food pantry tax credit fill out ampamp sign online form

- Property owners afdavit of evidence form

Find out other W 8ben Form

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple