W 8ben Form 2006

What is the W-8BEN Form

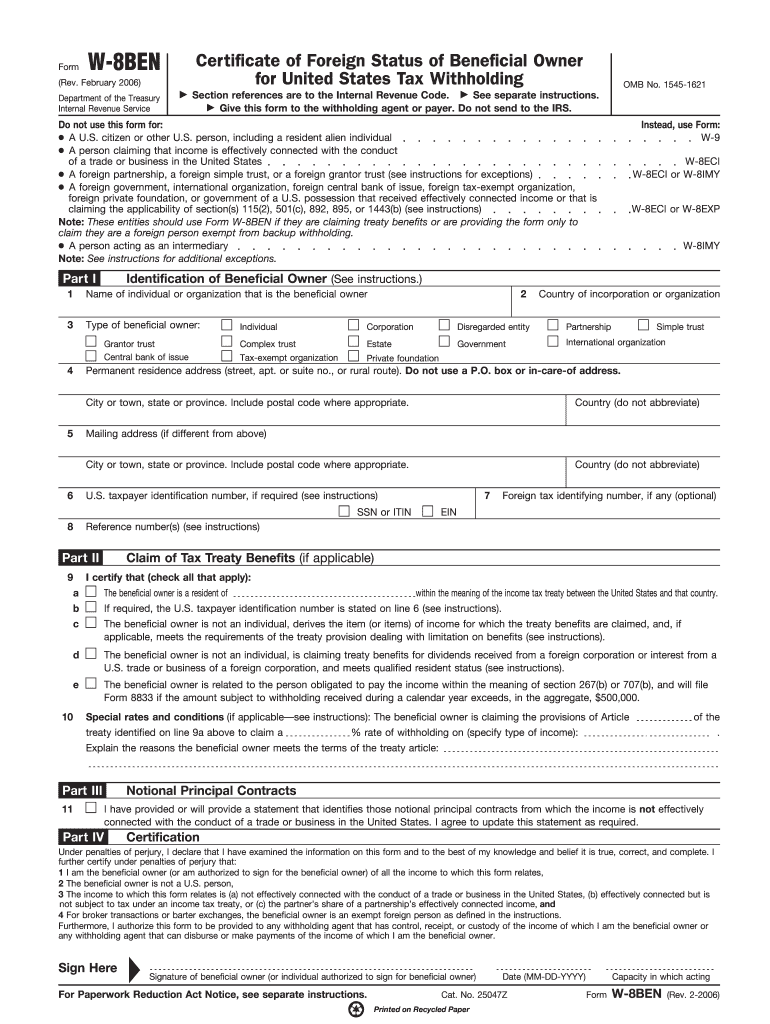

The W-8BEN Form is an IRS document used by foreign individuals and entities to certify their foreign status and claim tax treaty benefits. It is primarily utilized by non-U.S. persons receiving income from U.S. sources, such as dividends, interest, or royalties. By submitting this form, individuals can ensure that they are taxed at the appropriate rate under U.S. tax law, which may be lower than the standard withholding tax rate. The form helps establish that the individual is not subject to certain U.S. tax obligations.

How to use the W-8BEN Form

Using the W-8BEN Form involves several steps to ensure compliance with IRS regulations. First, the individual must fill out the form accurately, providing personal details such as name, country of citizenship, and address. Next, the individual must indicate the type of income they are receiving and any applicable tax treaty benefits. Once completed, the form should be submitted to the U.S. withholding agent or financial institution that requires it, rather than to the IRS directly. This ensures that the correct withholding tax rate is applied to the income received.

Steps to complete the W-8BEN Form

Completing the W-8BEN Form requires careful attention to detail. Follow these steps:

- Provide your full name as it appears on your official documents.

- Enter your country of citizenship.

- Fill in your permanent address outside the United States.

- Include your mailing address if it differs from your permanent address.

- Indicate your U.S. taxpayer identification number (if applicable) or foreign tax identification number.

- Specify the type of income you expect to receive.

- Sign and date the form to certify that the information is accurate.

Legal use of the W-8BEN Form

The W-8BEN Form is legally binding when filled out correctly and submitted to the appropriate parties. It is essential for ensuring compliance with U.S. tax laws and avoiding unnecessary withholding taxes on income. The form must be updated periodically, especially if there are changes in circumstances, such as a change in residency or tax status. Failing to provide an accurate and up-to-date form can lead to penalties and higher tax withholdings.

Key elements of the W-8BEN Form

Several key elements must be included in the W-8BEN Form to ensure its validity:

- Name: The full name of the individual or entity.

- Country of citizenship: The country where the individual holds citizenship.

- Permanent address: A complete address outside the U.S.

- Tax identification numbers: U.S. taxpayer identification number or foreign tax identification number.

- Income type: The specific income types for which the form is being submitted.

- Signature and date: The individual must sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

While the W-8BEN Form does not have a specific filing deadline, it is crucial to submit it before receiving income from U.S. sources to avoid higher withholding taxes. Updating the form is necessary when there are changes in residency or tax status. It is advisable to keep track of any changes in tax treaty agreements that may affect the form's applicability.

Quick guide on how to complete 2006 w 8ben form

Effortlessly Prepare W 8ben Form on Any Device

Web-based document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage W 8ben Form on any device via the airSlate SignNow apps for Android or iOS and streamline any document-related process now.

How to Alter and eSign W 8ben Form with Ease

- Find W 8ben Form and hit Get Form to commence.

- Utilize the tools at your disposal to complete your form.

- Emphasize necessary sections of your documents or redact sensitive details with the tools offered by airSlate SignNow specifically for this reason.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Revise and eSign W 8ben Form to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2006 w 8ben form

Create this form in 5 minutes!

How to create an eSignature for the 2006 w 8ben form

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a W 8ben Form and why is it important?

The W 8ben Form is a tax form used by foreign individuals to signNow their non-U.S. status for tax withholding purposes. It's crucial for non-resident aliens to submit this form to avoid excessive tax deductions on income earned in the United States. Using airSlate SignNow, you can easily fill out and eSign your W 8ben Form securely, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with filling out the W 8ben Form?

airSlate SignNow provides an intuitive platform that streamlines the process of completing the W 8ben Form. With user-friendly templates and guided prompts, you can quickly fill out the necessary fields and eSign the document, making it efficient to submit to the IRS.

-

Is there a cost associated with using airSlate SignNow for the W 8ben Form?

airSlate SignNow offers various pricing plans, allowing you to choose one that fits your needs for handling documents like the W 8ben Form. The service is designed to be cost-effective, providing great value for businesses while ensuring you can manage your forms efficiently.

-

Can I integrate airSlate SignNow with other applications for the W 8ben Form?

Yes, airSlate SignNow supports integration with numerous applications, enhancing your workflow when managing the W 8ben Form. You can connect it with popular tools like Google Drive, Salesforce, and more, ensuring seamless document management across platforms.

-

What features does airSlate SignNow offer for managing the W 8ben Form?

airSlate SignNow includes features like customizable templates, secure eSigning, and document tracking specifically for the W 8ben Form. These features simplify the signing process, allowing you to manage your tax documents efficiently and securely.

-

Is airSlate SignNow secure for handling sensitive documents like the W 8ben Form?

Absolutely, airSlate SignNow prioritizes security by using advanced encryption and compliance measures to protect sensitive documents such as the W 8ben Form. You can trust that your information is safe while utilizing our platform for eSigning and document management.

-

How does airSlate SignNow ensure compliance when using the W 8ben Form?

airSlate SignNow is designed to help users comply with IRS regulations when submitting the W 8ben Form. Our platform offers up-to-date templates and guidance to ensure you fill out the form correctly, minimizing the risk of errors and potential issues with tax authorities.

Get more for W 8ben Form

- Gas 1200 form nc

- Dcjc prisoner complaint form va

- Dws esd 61app form

- 1f p 746 form

- Kansas gas service dorm 12159 4 15 form

- Student and spouse will not file and are not required to file a 2018 income tax return with the irs form

- Notice 989 rev 8 2015 commonly asked questions when irs determines your work status is employee form

- One form is required for each request

Find out other W 8ben Form

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF