IRS Form W8 BEN PDF 1998

What is the IRS Form W8 BEN PDF

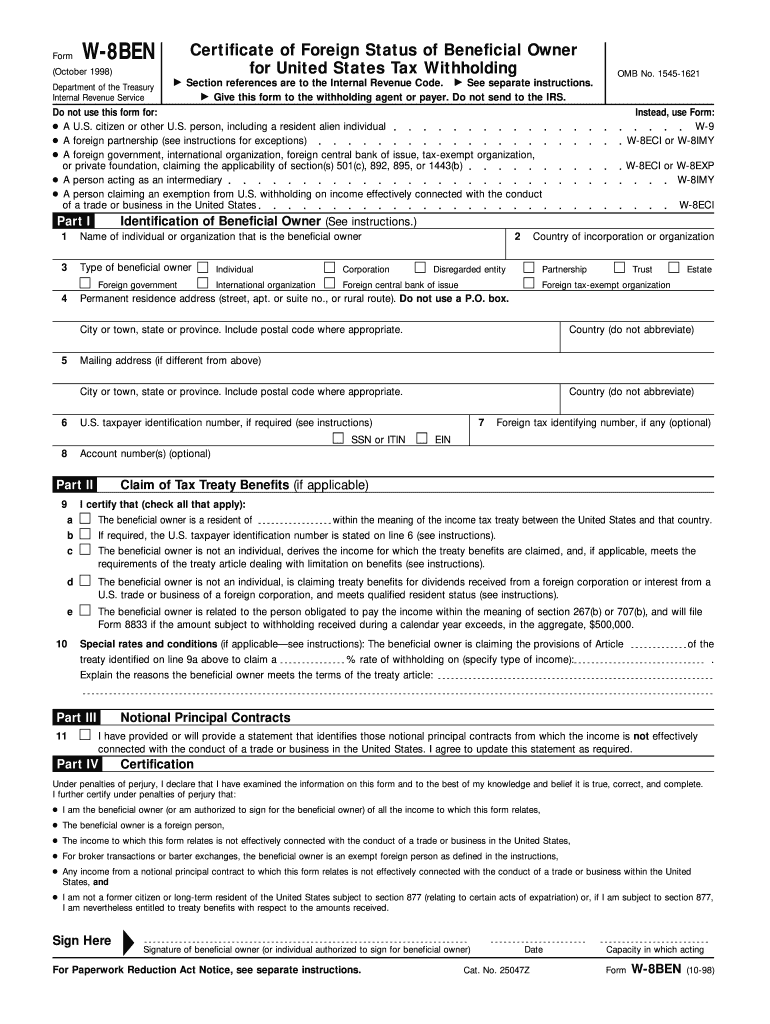

The IRS Form W8 BEN PDF is a tax form used by foreign individuals and entities to certify their foreign status and claim any applicable benefits under an income tax treaty. This form is essential for non-U.S. persons who receive income from U.S. sources, as it helps to establish their eligibility for reduced withholding rates on certain types of income, such as dividends, interest, and royalties. By submitting the W8 BEN, individuals can avoid higher tax rates that apply to foreign entities without treaty benefits.

How to use the IRS Form W8 BEN PDF

To use the IRS Form W8 BEN PDF effectively, individuals must first download the form from the IRS website or obtain it through their financial institution. After acquiring the form, it is important to fill it out accurately, providing personal information such as name, country of citizenship, and taxpayer identification number. Once completed, the form should be submitted to the withholding agent or financial institution that requires it, rather than sent directly to the IRS. This ensures that the correct withholding tax rates are applied to any income received.

Steps to complete the IRS Form W8 BEN PDF

Completing the IRS Form W8 BEN PDF involves several key steps:

- Download the form from the IRS website or request it from your financial institution.

- Provide your full name and country of citizenship in the appropriate fields.

- Enter your permanent address in the U.S. and your foreign address.

- Include your foreign tax identification number, if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the withholding agent or financial institution requesting it.

Legal use of the IRS Form W8 BEN PDF

The IRS Form W8 BEN PDF is legally binding when completed and submitted correctly. It serves as a declaration of the individual's foreign status and eligibility for treaty benefits. To ensure its legal validity, the form must be signed and dated by the individual completing it. Additionally, it is important to keep a copy of the submitted form for personal records, as it may be required for future reference or audits.

Eligibility Criteria

Eligibility to use the IRS Form W8 BEN PDF primarily applies to non-U.S. persons, including individuals and certain foreign entities. To qualify, the individual must not be a U.S. citizen or resident alien and must reside in a country that has a tax treaty with the United States. Additionally, the income being received must be of a type that qualifies for reduced withholding rates under the applicable treaty provisions. Understanding these criteria is crucial for ensuring compliance and maximizing potential tax benefits.

Form Submission Methods

The IRS Form W8 BEN PDF can be submitted using various methods, depending on the requirements of the withholding agent or financial institution. Common submission methods include:

- Directly submitting the form via email or secure online portal, if offered by the institution.

- Mailing a printed copy of the completed form to the withholding agent.

- Hand-delivering the form to the financial institution's office.

It is essential to confirm the preferred submission method with the institution to ensure proper processing.

Quick guide on how to complete irs form w8 ben pdf

Complete IRS Form W8 BEN PDF effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers a superb eco-friendly solution compared to traditional printed and signed forms, allowing you to locate the right document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hold-ups. Handle IRS Form W8 BEN PDF on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and electronically sign IRS Form W8 BEN PDF without hassle

- Locate IRS Form W8 BEN PDF and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools designed by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or through an invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and electronically sign IRS Form W8 BEN PDF while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form w8 ben pdf

Create this form in 5 minutes!

How to create an eSignature for the irs form w8 ben pdf

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the IRS Form W8 BEN PDF, and why is it important?

The IRS Form W8 BEN PDF is a form used by foreign individuals to signNow their foreign status for tax withholding purposes. It is important because it helps facilitate the correct application of tax treaties and ensures you are not overtaxed on your income. Using airSlate SignNow makes it easy to fill out and eSign this document securely.

-

How can airSlate SignNow help me manage the IRS Form W8 BEN PDF?

airSlate SignNow allows for the easy upload, editing, and eSigning of the IRS Form W8 BEN PDF. Its user-friendly interface ensures that you can complete important tax documents efficiently. You can manage your forms in one central location without hassle.

-

Is there a fee associated with using airSlate SignNow for the IRS Form W8 BEN PDF?

Yes, there is a fee for using airSlate SignNow, but it is a cost-effective solution for managing documents such as the IRS Form W8 BEN PDF. Pricing varies based on the features you need, but the investment saves time and reduces errors in document handling.

-

Are there any features in airSlate SignNow specifically for the IRS Form W8 BEN PDF?

Absolutely! airSlate SignNow offers features like customizable templates, in-document comments, and real-time tracking specifically for the IRS Form W8 BEN PDF. These features enhance collaboration and ensure your document is processed efficiently.

-

Can I integrate airSlate SignNow with other tools for handling the IRS Form W8 BEN PDF?

Yes, airSlate SignNow integrates seamlessly with a variety of tools designed for document management and eSigning. This means you can streamline your workflow and ensure all necessary documents, including the IRS Form W8 BEN PDF, are processed efficiently alongside your existing systems.

-

How does airSlate SignNow enhance security for the IRS Form W8 BEN PDF?

airSlate SignNow employs advanced encryption standards to protect your documents, including the IRS Form W8 BEN PDF. With features such as role-based access and audit logs, you can be confident that your sensitive tax information is secure and compliant with regulations.

-

Can I access my IRS Form W8 BEN PDF on mobile devices using airSlate SignNow?

Yes, airSlate SignNow provides a mobile-friendly platform that allows you to access, fill out, and eSign the IRS Form W8 BEN PDF on your smartphone or tablet. This makes it convenient for users on the go, ensuring that you can handle important documents anytime, anywhere.

Get more for IRS Form W8 BEN PDF

Find out other IRS Form W8 BEN PDF

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now