W 8ben Form 2017

What is the W-8BEN Form

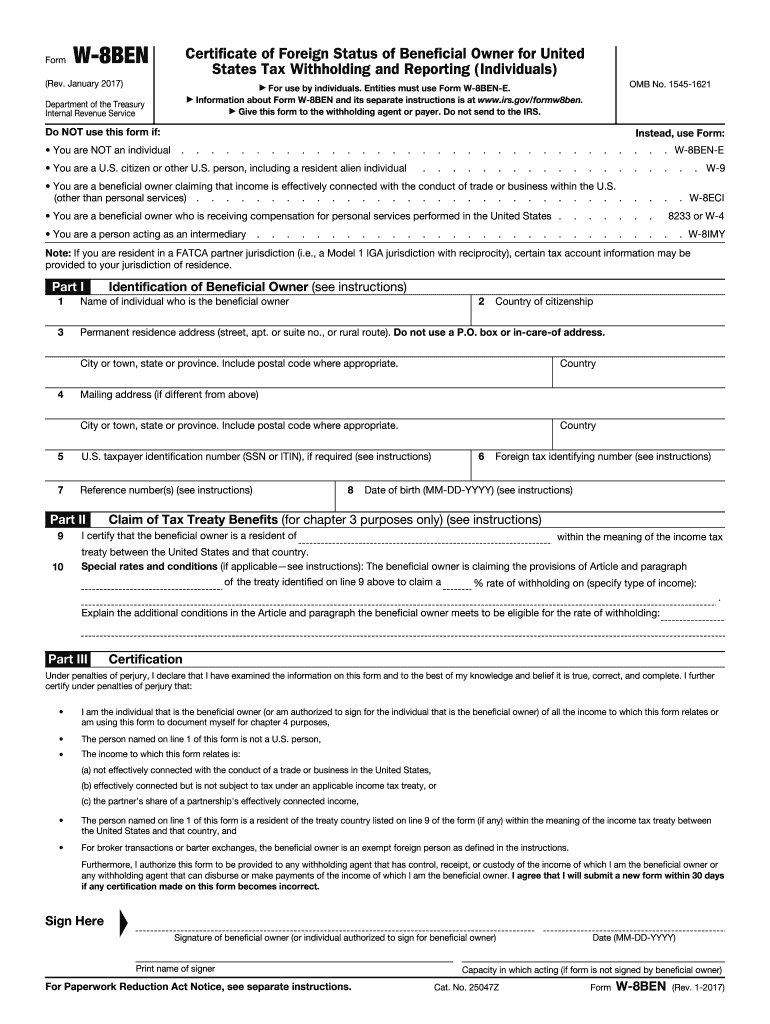

The W-8BEN Form is an IRS document used by foreign individuals and entities to certify their foreign status for tax purposes in the United States. This form helps to establish that the individual or entity is not subject to certain U.S. tax withholding on income received from U.S. sources. By submitting the W-8BEN Form, foreign persons can claim a reduced rate of, or exemption from, U.S. withholding taxes, as specified by tax treaties between their country of residence and the United States.

How to use the W-8BEN Form

To use the W-8BEN Form effectively, individuals must fill it out accurately and submit it to the withholding agent or financial institution that requests it. The form is typically used when receiving income such as royalties, dividends, or other payments from U.S. sources. It is essential to ensure that the information provided on the form is correct and complete to avoid delays in processing or issues with tax withholding. Once submitted, the form remains valid for a period of three years unless there is a change in circumstances that affects the information provided.

Steps to complete the W-8BEN Form

Completing the W-8BEN Form involves several key steps:

- Provide your name and country of citizenship in Part I.

- Include your permanent address in your country of residence.

- Fill in your mailing address if it differs from your permanent address.

- Indicate your taxpayer identification number (TIN) in your country of residence, if applicable.

- Claim any applicable tax treaty benefits in Part II, specifying the country and the type of income.

- Sign and date the form to certify that the information is accurate.

Legal use of the W-8BEN Form

The W-8BEN Form is legally recognized by the IRS as a means for foreign individuals to establish their foreign status and claim tax treaty benefits. It is crucial to use the form correctly to comply with U.S. tax laws. Failure to provide a valid W-8BEN Form can result in higher withholding tax rates on U.S. income. It is advisable to consult with a tax professional if there are uncertainties regarding the completion or submission of the form.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the W-8BEN Form, it is important to provide it to the withholding agent before any payments are made to ensure the correct withholding tax rate is applied. If the form is submitted after payments have been made, the withholding agent may be required to withhold taxes at the maximum rate until a valid form is received. Regular updates or renewals of the form may be necessary every three years or when there are changes in circumstances.

Eligibility Criteria

To be eligible to use the W-8BEN Form, the individual must be a non-U.S. person, which includes foreign individuals and entities. The form is specifically designed for individuals who are not citizens or residents of the United States and who receive income from U.S. sources. It is important to ensure that the individual meets the criteria for claiming tax treaty benefits, as this can affect the withholding tax rate applied to their income.

Quick guide on how to complete w 8ben 2017 form

Discover the simplest method to complete and sign your W 8ben Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your W 8ben Form and associated forms for public services. Our intelligent electronic signature solution equips you with all the necessary tools to handle documents swiftly and in compliance with official standards - powerful PDF editing, management, protection, signing, and sharing resources readily available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your W 8ben Form:

- Introduce the fillable template into the editor using the Get Form button.

- Review the information you need to include in your W 8ben Form.

- Move through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Edit the content with Text boxes or Images from the top menu.

- Emphasize what is essential or Conceal areas that are no longer relevant.

- Select Sign to generate a legally recognized electronic signature using any method you prefer.

- Insert the Date beside your signature and finalize your task with the Done button.

Store your completed W 8ben Form in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also supports versatile file sharing. There’s no need to print your templates when you need to submit them to the appropriate public office - you can do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Try it today!

Create this form in 5 minutes or less

Find and fill out the correct w 8ben 2017 form

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

Create this form in 5 minutes!

How to create an eSignature for the w 8ben 2017 form

How to generate an eSignature for the W 8ben 2017 Form in the online mode

How to generate an electronic signature for your W 8ben 2017 Form in Google Chrome

How to create an electronic signature for signing the W 8ben 2017 Form in Gmail

How to make an eSignature for the W 8ben 2017 Form from your smart phone

How to generate an electronic signature for the W 8ben 2017 Form on iOS devices

How to create an electronic signature for the W 8ben 2017 Form on Android devices

People also ask

-

What is the W 8ben Form and why do I need it?

The W 8ben Form is a tax document used by foreign individuals and entities to signNow their non-U.S. status and claim tax treaty benefits. Completing the W 8ben Form is essential for avoiding unnecessary withholding taxes on U.S. source income. Using airSlate SignNow, you can easily fill out and eSign the W 8ben Form, streamlining your tax compliance process.

-

How can airSlate SignNow help me with my W 8ben Form?

airSlate SignNow allows you to create, fill, and eSign your W 8ben Form quickly and securely. Our platform provides templates and intuitive editing tools to simplify the completion of the W 8ben Form, ensuring that you have the correct information and signatures in place. This efficiency saves time and reduces errors in your tax documentation.

-

Is there a cost associated with using airSlate SignNow for the W 8ben Form?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs, including features for managing documents like the W 8ben Form. You can choose a plan that suits your budget and volume of document processing. Additionally, we provide a free trial so you can explore our features before committing.

-

What features does airSlate SignNow offer for managing W 8ben Forms?

airSlate SignNow provides a range of features for managing your W 8ben Forms, including customizable templates, secure eSigning, and real-time tracking of document status. These features enhance collaboration and ensure that all parties involved in the signing process can easily access and complete the W 8ben Form.

-

Can I integrate airSlate SignNow with other software for my W 8ben Form processing?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRMs and cloud storage services, to enhance your workflow for processing the W 8ben Form. This integration allows you to automatically populate the W 8ben Form with relevant data, making the process more efficient and reducing manual entry.

-

How secure is my information when using the W 8ben Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to manage your W 8ben Form, your data is protected with advanced encryption and compliance with industry standards. You can confidently eSign and store your W 8ben Form knowing that your sensitive information is safe.

-

What if I need help filling out the W 8ben Form?

If you need assistance with filling out your W 8ben Form, airSlate SignNow offers comprehensive support resources, including tutorials and customer service. Our team is available to answer any questions you may have about the W 8ben Form and guide you through the process. We aim to ensure that you have a smooth experience.

Get more for W 8ben Form

- Credit reference letter pdf purchasing the ohio state university purchasing osu form

- Lincoln elementary independent pe santa monica form

- Agency agreement renewal andor amendment north carolina ncrealtors form

- Example nc lease agreement the bayshore company form

- Addendum housing form

- Certificate of origin and free sale to from the florida form

- Veterans affair attendant affidavitpdffillercom form

- Bcal 3731 2012 2019 form

Find out other W 8ben Form

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement