1095 B Form 2016

What is the 1095 B Form

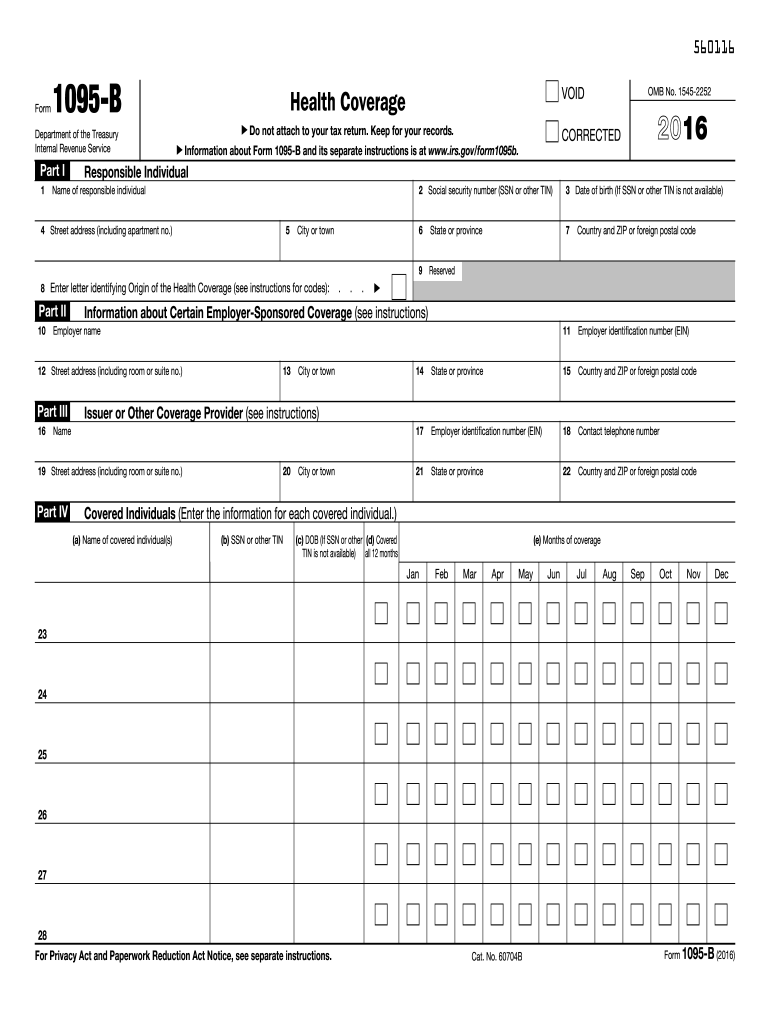

The 1095 B Form is a tax document utilized in the United States to report health coverage information. It is specifically designed for individuals who have minimum essential coverage, which meets the Affordable Care Act requirements. This form is issued by health insurance providers, including employers who provide health insurance to their employees. The 1095 B Form contains vital information such as the name of the insured, the months of coverage, and the provider's details. Understanding this form is crucial for taxpayers to ensure compliance with health coverage mandates.

How to use the 1095 B Form

The 1095 B Form serves as proof of health insurance coverage when filing your federal tax return. Taxpayers should receive this form from their insurance providers by early March each year. It is essential to keep this document for your records, as it may be required when completing your tax return. When filling out your tax return, you will need to indicate whether you had health coverage for the entire year or specific months, using the information provided on the form. This helps the IRS verify compliance with the individual mandate.

Steps to complete the 1095 B Form

Completing the 1095 B Form involves several straightforward steps:

- Obtain the form from your health insurance provider.

- Review the form for accuracy, ensuring all personal information is correct.

- Check the months of coverage to confirm that they align with your health insurance plan.

- Keep a copy of the completed form for your records and for filing purposes.

It is important to ensure that the information is accurate, as discrepancies may lead to issues with the IRS.

Legal use of the 1095 B Form

The 1095 B Form is legally required under the Affordable Care Act. It serves as documentation that individuals have maintained minimum essential health coverage throughout the year. This form is essential for compliance with federal tax laws. Failure to provide accurate information on this form can result in penalties, including fines for non-compliance with health coverage requirements. It is advisable to consult a tax professional if you have questions about the legal implications of the 1095 B Form.

Who Issues the Form

The 1095 B Form is issued by various entities, primarily health insurance providers. This includes private health insurance companies, government programs like Medicaid and Medicare, and employers who offer self-insured health plans. Each entity is responsible for providing accurate information regarding the coverage they offer. It is essential for recipients to ensure they receive this form annually to fulfill their tax obligations.

Filing Deadlines / Important Dates

For the 1095 B Form, the filing deadlines are aligned with the tax filing season. Insurance providers must send out the forms to individuals by January 31 of each year. Taxpayers should receive their forms by early March to allow sufficient time for review and inclusion in their tax returns. It is important to keep track of these dates to ensure compliance and avoid potential penalties.

Quick guide on how to complete 1095 b 2016 form

Complete 1095 B Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and seamlessly. Handle 1095 B Form on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based operations today.

How to modify and eSign 1095 B Form with ease

- Find 1095 B Form and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight essential sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your alterations.

- Choose your preferred method of delivering your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, and the hassle of printing new document copies due to errors. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Edit and eSign 1095 B Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1095 b 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1095 b 2016 form

How to make an eSignature for your 1095 B 2016 Form online

How to generate an eSignature for the 1095 B 2016 Form in Chrome

How to generate an electronic signature for signing the 1095 B 2016 Form in Gmail

How to create an eSignature for the 1095 B 2016 Form right from your mobile device

How to generate an eSignature for the 1095 B 2016 Form on iOS devices

How to generate an electronic signature for the 1095 B 2016 Form on Android OS

People also ask

-

What is a 1095 B Form?

The 1095 B Form is a tax document that provides information about an individual's health coverage. It is required by the IRS to confirm whether minimum essential health coverage was maintained during the tax year. Understanding the 1095 B Form is crucial for individuals to ensure compliance with health insurance mandates.

-

How can airSlate SignNow help with the 1095 B Form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the 1095 B Form efficiently. With its intuitive interface, you can easily manage your forms and track document statuses. This streamlines the process, making it simpler for businesses to handle health coverage confirmations.

-

What are the pricing options for using airSlate SignNow for the 1095 B Form?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of various businesses. With flexible subscription options, you can choose a package that suits your budget while gaining access to features necessary for managing 1095 B Forms. Consider taking advantage of our free trial to explore the potential benefits.

-

Are there any integrations available for managing the 1095 B Form?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM, accounting software, and cloud storage solutions. This enables businesses to generate and track the 1095 B Form alongside their existing workflows. Such integrations enhance productivity and ensure a smooth documentation process.

-

What benefits does eSigning the 1095 B Form provide?

eSigning the 1095 B Form with airSlate SignNow provides enhanced security, speed, and convenience. It eliminates the need for physical signatures, allowing quick turnaround times for processing documents. This ensures timely compliance with IRS requirements and fosters efficient communication between involved parties.

-

Can I customize the 1095 B Form using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the 1095 B Form to fit specific organizational needs. You can add branding elements, tailor fields, and adjust layouts to ensure the document meets your business requirements while still complying with IRS standards.

-

Is airSlate SignNow suitable for small businesses handling the 1095 B Form?

Yes, airSlate SignNow is an excellent solution for small businesses managing the 1095 B Form. Its cost-effective pricing and user-friendly features make it accessible for companies of all sizes. Moreover, the platform facilitates secure and efficient document management, helping small businesses stay compliant without overwhelming their resources.

Get more for 1095 B Form

Find out other 1095 B Form

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template