1095 B Form 2015

What is the 1095 B Form

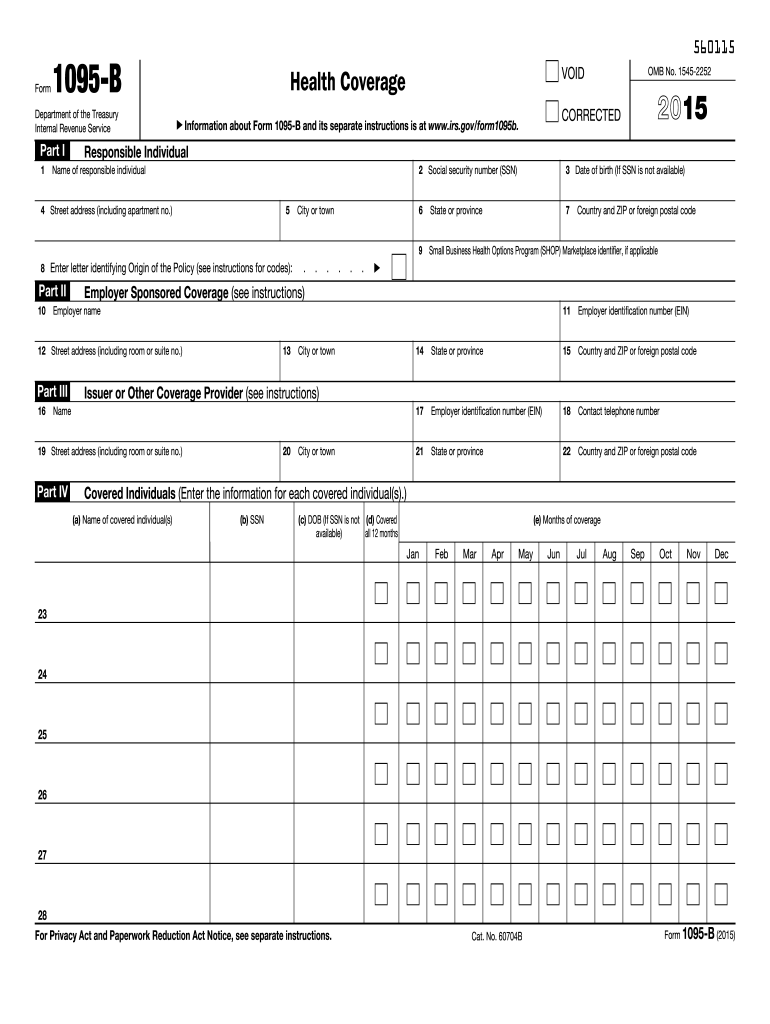

The 1095 B Form is a tax document that provides information about individuals who are covered by minimum essential health coverage. This form is essential for taxpayers to demonstrate compliance with the Affordable Care Act (ACA) requirements. It is issued by health insurance providers, government programs, and employers that provide health coverage. The 1095 B Form includes details such as the name of the insured, the coverage period, and the type of coverage provided. Understanding this form is crucial for ensuring that you meet your tax obligations and avoid potential penalties.

How to obtain the 1095 B Form

To obtain the 1095 B Form, individuals typically receive it from their health insurance provider or employer. Most providers are required to send this form by January 31 of the year following the coverage year. If you do not receive your form, you can contact your insurance provider directly to request a copy. Additionally, many insurance companies offer online access to tax documents, allowing you to download the form directly from their website. It is important to keep this form for your records and to use it when filing your taxes.

Steps to complete the 1095 B Form

Completing the 1095 B Form involves several straightforward steps. First, ensure you have all necessary information, including your personal details and the coverage information from your insurance provider. Next, accurately fill in the required fields, such as the name of the insured, policy number, and coverage dates. It is essential to double-check all entries for accuracy to avoid issues during tax filing. Once completed, keep a copy for your records and submit it as required by your tax filing process.

Legal use of the 1095 B Form

The legal use of the 1095 B Form is primarily related to tax compliance under the Affordable Care Act. This form serves as proof of health coverage, which is necessary for taxpayers to avoid penalties for not having minimum essential coverage. The IRS requires this documentation to verify that individuals meet the health insurance mandate. It is important to retain the 1095 B Form along with other tax documents, as it may be requested during an audit or review by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1095 B Form align with the overall tax filing schedule. The form must be distributed to individuals by January 31 of the year following the coverage year. When filing your taxes, you should include the information from the 1095 B Form with your tax return by the standard tax deadline, which is typically April 15. It is crucial to be aware of these dates to ensure compliance and avoid any potential penalties related to health coverage reporting.

Who Issues the Form

The 1095 B Form is issued by various entities, including health insurance providers, government-sponsored programs like Medicaid and Medicare, and employers that offer health insurance coverage. Each issuer is responsible for providing accurate information about the coverage they offer. If you are unsure who should issue your 1095 B Form, review your health insurance policy or contact your employer's human resources department for clarification.

Quick guide on how to complete 1095 b 2015 form

Effortlessly Prepare 1095 B Form on Any Device

The management of documents online has become increasingly favored by both companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed forms, allowing you to access the necessary documents and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delay. Manage 1095 B Form on any platform with the airSlate SignNow apps available for Android or iOS, and streamline any document-related process today.

How to Modify and Electronically Sign 1095 B Form with Ease

- Locate 1095 B Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1095 B Form and ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1095 b 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1095 b 2015 form

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is a 1095 B Form?

The 1095 B Form is an IRS tax form used to report health coverage that meets the Affordable Care Act requirements. It provides information about individuals who were covered by minimum essential health coverage throughout the year. Understanding how to properly handle the 1095 B Form can help ensure compliance with federal regulations.

-

How can airSlate SignNow help with the 1095 B Form?

AirSlate SignNow simplifies the process of preparing and sending the 1095 B Form, offering an easy-to-use platform to manage documents securely. With its electronic signature functionality, users can quickly eSign the 1095 B Form, reducing processing time and enhancing efficiency. Our solution streamlines compliance and record-keeping for businesses.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, allowing you to choose a plan that fits your budget. The cost-effective solutions provide access to essential features needed for managing the 1095 B Form, including eSigning and document management. You can explore our pricing page for detailed information on features included in each plan.

-

What features can I use for the 1095 B Form in airSlate SignNow?

AirSlate SignNow provides a range of features for managing the 1095 B Form, including customizable templates, reminders, and secure storage. The platform allows users to create, send, and eSign documents effortlessly while maintaining compliance with IRS regulations. These features are designed to enhance productivity and simplify document management.

-

Are there integrations available for airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Salesforce, and Microsoft Office. These integrations enable users to manage the 1095 B Form efficiently, pulling data directly from other platforms. This connectivity streamlines workflows and enhances overall productivity.

-

How does airSlate SignNow ensure the security of my 1095 B Form?

AirSlate SignNow prioritizes data security, employing advanced encryption methods to protect your documents, including the 1095 B Form. To further safeguard information, we adhere to strict compliance standards and offer features like password protection and audit trails. This ensures that your sensitive information remains safe while processing and eSigning.

-

Can multiple users collaborate on the 1095 B Form with airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate on the 1095 B Form in real time. Users can comment, edit, and eSign documents collectively, enhancing teamwork and ensuring that all parties can seamlessly contribute to the form's completion without any hassle.

Get more for 1095 B Form

- Search results for bill of sale for vehicle sale localtous form

- Notice of resignation of registered agent state forms

- 20 printable vehicle maintenance record forms and templates

- Pdf cosmetology salon license application instructions tdlr texasgov form

- Iht402 claim to transfer unused nil band rate form to capture client information relating to unused nil rate band

- Registration of a limited liability company llc with the california secretary of state sos will obligate an llc form

- Free guide to dissolve a virginia limited liability company form

- Illinois llc act state of termination form

Find out other 1095 B Form

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe