Voucher E Form 2016

What is the Voucher E Form

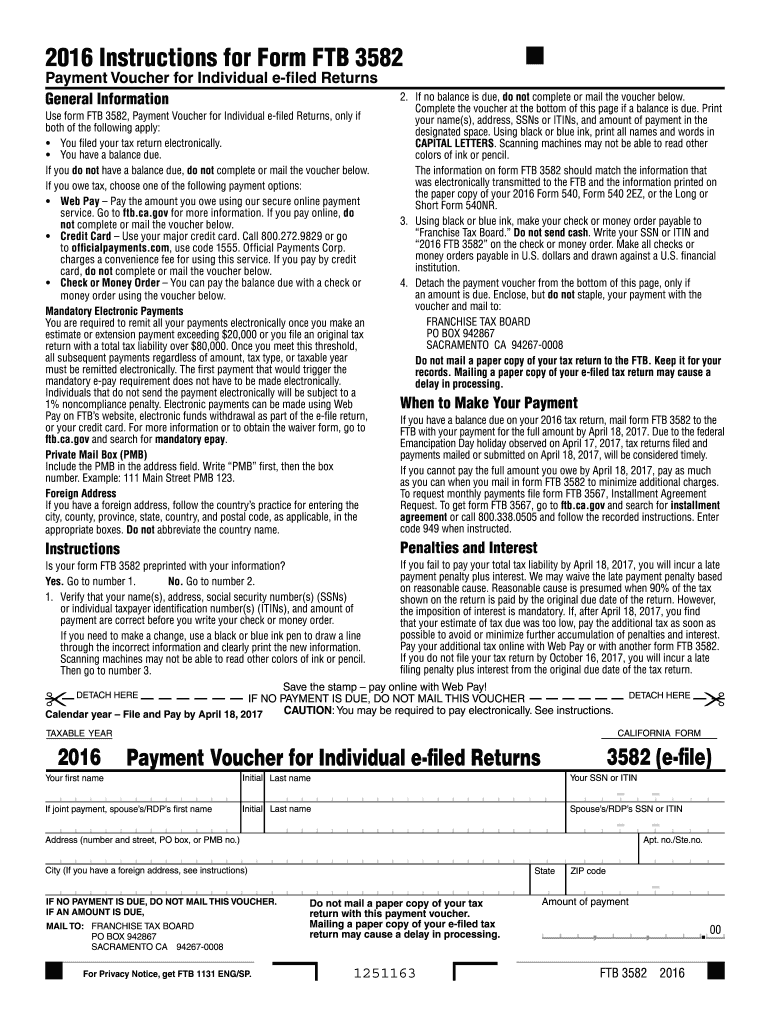

The Voucher E Form is a specific document used primarily for tax purposes in the United States. It serves as a payment voucher for individuals or businesses making estimated tax payments. This form helps taxpayers ensure that their payments are correctly applied to their tax accounts, thus avoiding potential penalties or interest for underpayment. The Voucher E Form is particularly useful for self-employed individuals, freelancers, and those with income not subject to withholding.

How to use the Voucher E Form

Using the Voucher E Form involves several straightforward steps. First, download the form from a reliable source or obtain it from the IRS website. Next, fill in your personal information, including your name, address, and Social Security number. Indicate the tax year for which you are making the payment and the amount you wish to pay. Finally, submit the completed form along with your payment to the appropriate IRS address based on your location. Ensure that you keep a copy for your records.

Steps to complete the Voucher E Form

Completing the Voucher E Form requires careful attention to detail. Follow these steps for accurate submission:

- Download the latest version of the Voucher E Form from the IRS website.

- Enter your personal information, including your name and Social Security number.

- Specify the tax year for which the payment is intended.

- Fill in the payment amount you wish to submit.

- Review the form for accuracy, ensuring all fields are completed.

- Mail the form along with your payment to the designated IRS address.

Legal use of the Voucher E Form

The Voucher E Form is legally recognized as a valid method for submitting tax payments to the IRS. To ensure its legal standing, it is crucial to complete the form accurately and submit it by the specified deadlines. Compliance with IRS regulations is essential to avoid penalties. Additionally, retaining copies of submitted forms and any correspondence with the IRS can provide protection in case of disputes or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Voucher E Form typically align with the estimated tax payment schedule set by the IRS. Generally, estimated tax payments are due four times a year: April 15, June 15, September 15, and January 15 of the following year. It is important to be aware of these dates to avoid late payment penalties. Taxpayers should also check for any changes in deadlines that may occur due to specific circumstances or legislation.

Key elements of the Voucher E Form

Understanding the key elements of the Voucher E Form can facilitate its proper use. Essential components include:

- Taxpayer Information: Name, address, and Social Security number.

- Payment Amount: The total amount being submitted for estimated taxes.

- Tax Year: The specific tax year for which the payment applies.

- Signature: A signature may be required to validate the form.

Quick guide on how to complete voucher e 2016 form

Prepare Voucher E Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents promptly without interruptions. Manage Voucher E Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Voucher E Form without hassle

- Locate Voucher E Form and click on Get Form to commence.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in several clicks from any gadget of your preference. Modify and eSign Voucher E Form and ensure proficient communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct voucher e 2016 form

Create this form in 5 minutes!

How to create an eSignature for the voucher e 2016 form

How to generate an electronic signature for the Voucher E 2016 Form in the online mode

How to create an eSignature for your Voucher E 2016 Form in Chrome

How to create an eSignature for signing the Voucher E 2016 Form in Gmail

How to generate an electronic signature for the Voucher E 2016 Form from your smart phone

How to generate an electronic signature for the Voucher E 2016 Form on iOS

How to make an electronic signature for the Voucher E 2016 Form on Android

People also ask

-

What is a Voucher E Form and how does it work?

A Voucher E Form is a digital document used for the electronic submission of vouchers, streamlining the process for businesses. With airSlate SignNow, you can easily create and manage Voucher E Forms, enabling efficient eSigning and document processing. This automation reduces paperwork and saves time, allowing your team to focus on more critical tasks.

-

How can airSlate SignNow benefit my business with Voucher E Forms?

airSlate SignNow provides a cost-effective solution for managing Voucher E Forms, enhancing workflow efficiency and reducing turnaround times. The platform allows for seamless collaboration and secure signing, ensuring that you can handle vouchers without the hassle of physical paperwork. Additionally, the automation features help minimize errors and streamline your operations.

-

Is there a cost associated with using Voucher E Forms on airSlate SignNow?

Yes, there is a pricing structure associated with using Voucher E Forms on airSlate SignNow. However, the platform offers flexible pricing plans designed to suit various business sizes and needs. Investing in electronic voucher management can lead to signNow cost savings in time and resources over traditional methods.

-

Can Voucher E Forms be customized with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Voucher E Forms according to your specific needs and branding. You can add logos, adjust fields, and incorporate personalized messages, which enhances user experience and promotes brand consistency. Customization ensures that your forms meet your business requirements effectively.

-

Are there integration options available for Voucher E Forms?

Yes, airSlate SignNow provides various integration options for utilizing Voucher E Forms alongside your existing software. You can integrate with popular applications such as CRM systems, payment processors, and cloud storage services. This flexibility helps streamline your workflows, making it easier to manage documents across different platforms.

-

How secure are Voucher E Forms created with airSlate SignNow?

Security is a top priority with airSlate SignNow, especially for Voucher E Forms. The platform employs advanced encryption protocols and secure cloud storage to protect your sensitive information. With role-based permissions and audit trails, you can ensure that your documents are secure and compliant with industry standards.

-

What features does airSlate SignNow offer for managing Voucher E Forms?

airSlate SignNow offers a range of features for managing Voucher E Forms, including templates, workflow automation, and real-time tracking. You can easily send, sign, and manage your documents in one user-friendly interface. Furthermore, features such as reminders and notifications help ensure that your vouchers get the attention they need promptly.

Get more for Voucher E Form

Find out other Voucher E Form

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast