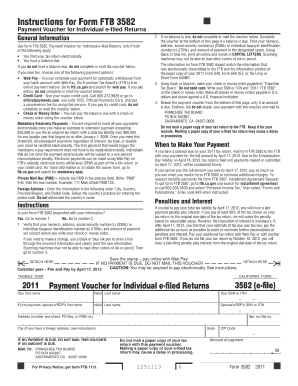

Form 3582 2011

What is the Form 3582

The Form 3582, also known as IRS Form 3582, is a document used primarily for tax-related purposes in the United States. It is often utilized by individuals and businesses to report specific financial information to the Internal Revenue Service (IRS). This form plays a crucial role in ensuring compliance with federal tax regulations and is essential for accurate tax reporting.

How to use the Form 3582

Using the Form 3582 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all fields are completed accurately. It is important to double-check for any errors or omissions before submitting the form to the IRS. Finally, retain a copy of the completed form for your records, as it may be needed for future reference or audits.

Steps to complete the Form 3582

Completing the Form 3582 requires attention to detail and adherence to IRS guidelines. Here are the key steps:

- Obtain the latest version of the form from the IRS website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any deductions accurately in the designated sections.

- Review the form for completeness and accuracy before submission.

- Submit the form electronically or via mail, depending on your preference and IRS guidelines.

Legal use of the Form 3582

The legal use of the Form 3582 is governed by IRS regulations. To ensure the form is legally binding, it must be filled out truthfully and submitted in accordance with the deadlines established by the IRS. Failure to comply with these regulations may result in penalties or fines. It is essential to keep records of the submitted form and any supporting documentation to defend against potential audits or disputes.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3582 can vary based on individual circumstances, such as whether you are filing as an individual or a business entity. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for individuals. Businesses may have different deadlines based on their fiscal year. It is crucial to stay informed about any changes to these dates to avoid late filing penalties.

Required Documents

To complete the Form 3582, several documents are typically required. These may include:

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Previous tax returns, if applicable, for reference.

- Any additional documentation requested by the IRS related to your financial situation.

Form Submission Methods (Online / Mail / In-Person)

The Form 3582 can be submitted through various methods, providing flexibility for users. You can file the form online using the IRS e-filing system, which is often the fastest method. Alternatively, you may choose to mail a paper copy of the form to the appropriate IRS address. In some cases, in-person submission may be available at designated IRS offices, but this option is less common. Always verify the submission method that best suits your needs and complies with IRS requirements.

Quick guide on how to complete form 3582

Effortlessly Prepare Form 3582 on Any Device

The management of online documents has become increasingly favored among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle Form 3582 on any platform with airSlate SignNow apps for Android or iOS and simplify your document-centric tasks today.

How to Modify and Electronically Sign Form 3582 with Ease

- Locate Form 3582 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management requirements with just a few clicks from any device you choose. Modify and electronically sign Form 3582 to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3582

Create this form in 5 minutes!

How to create an eSignature for the form 3582

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is form 3582?

Form 3582 is a specific document used in various business and legal contexts, typically related to electronic signatures. With airSlate SignNow, you can easily create and manage form 3582 to ensure compliance and streamline your workflow.

-

How can I use airSlate SignNow to complete form 3582?

You can use airSlate SignNow to fill out and eSign form 3582 by uploading the document to our platform. Our intuitive interface allows you to add fields and signatures, making the process efficient and error-free.

-

What are the pricing options for using airSlate SignNow for form 3582?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Depending on your needs, you can choose from monthly or annual subscriptions which grant you access to features specifically designed for managing form 3582.

-

Can I integrate airSlate SignNow with other applications for form 3582?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage form 3582 alongside your existing workflows. Popular integrations include Google Drive, Salesforce, and Zapier, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for form 3582?

Using airSlate SignNow for form 3582 simplifies the signing process, reduces turnaround time, and ensures secure document handling. Additionally, our platform offers audit trails to maintain compliance and security.

-

Is it safe to send form 3582 through airSlate SignNow?

Yes, sending form 3582 through airSlate SignNow is safe and secure. Our platform employs advanced encryption and security measures to protect your documents and personal information during transmission.

-

What features does airSlate SignNow offer for managing form 3582?

airSlate SignNow provides numerous features for managing form 3582, including customizable templates, in-person signing options, and automated reminders. These features ensure a smooth and efficient signing experience.

Get more for Form 3582

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable maryland form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration 497310269 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497310270 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement maryland form

- Md tenant landlord 497310272 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants maryland form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises maryland form

- Tenant landlord about 497310275 form

Find out other Form 3582

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word