Form FTB 3582Payment Voucher for Individual E Filed Returns Form FTB 3582Payment Voucher for Individual E Filed Returns 2022-2026

What is the California Form 3582 Payment Voucher?

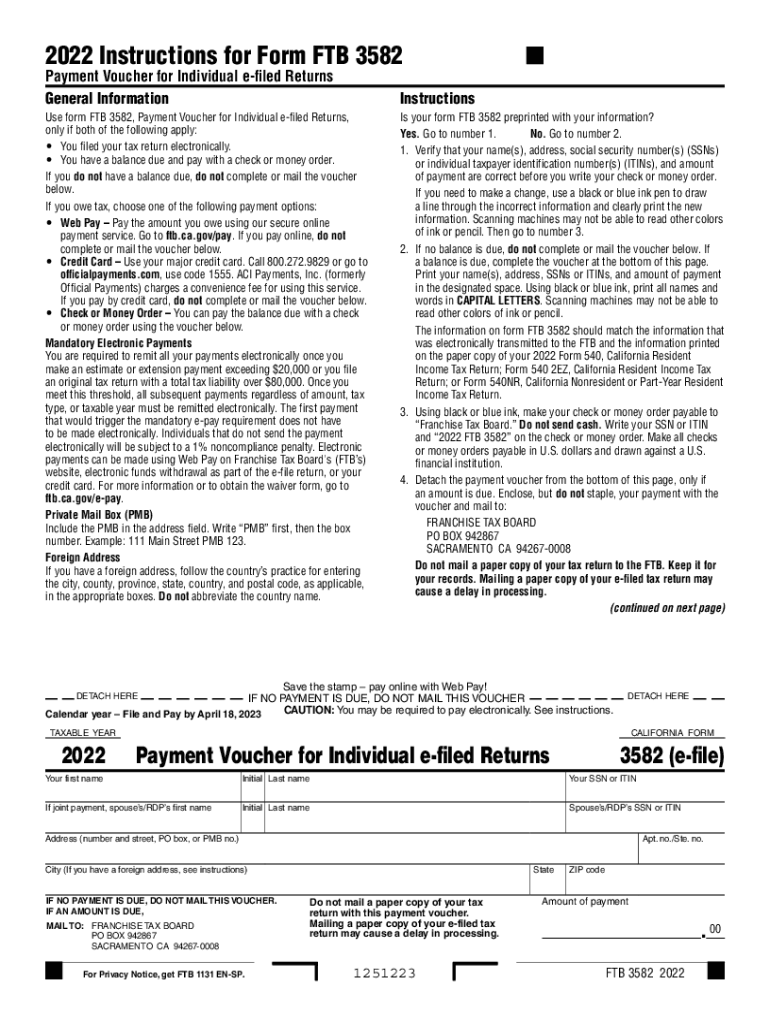

The California Form 3582, also known as the payment voucher for individual e-filed returns, is a document used by taxpayers to submit payments for their state income tax liabilities. This form is particularly relevant for individuals who e-file their tax returns and need to make a payment to the California Franchise Tax Board (FTB). By using Form 3582, taxpayers can ensure that their payments are properly credited to their accounts, facilitating a smoother tax process.

How to Obtain the California Form 3582

To obtain the California Form 3582, taxpayers can visit the official website of the California Franchise Tax Board. The form is typically available in a downloadable PDF format, allowing users to print it for completion. Additionally, taxpayers may find the form at various tax preparation offices or through certified tax professionals who can assist with the filing process.

Steps to Complete the California Form 3582

Completing the California Form 3582 involves a few straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the amount you are paying and ensure it matches the payment due from your e-filed return.

- Review the form for accuracy, ensuring all required fields are filled out correctly.

- Sign and date the form to validate your payment.

Once completed, the form can be submitted either by mail or electronically, depending on the payment method chosen.

Legal Use of the California Form 3582

The California Form 3582 serves as a legally recognized document for submitting tax payments. It is essential for ensuring that payments are processed correctly by the FTB. When filled out accurately and submitted on time, the form helps taxpayers avoid penalties and interest associated with late payments. It is crucial to retain a copy of the completed form for personal records, as it may be needed for future reference or in case of discrepancies.

Filing Deadlines for the California Form 3582

Taxpayers should be aware of the filing deadlines associated with the California Form 3582. Typically, payments are due on the same date as the state income tax return, which is usually April 15 for most individuals. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to check the California Franchise Tax Board’s website for any updates or changes to these deadlines.

Penalties for Non-Compliance with the California Form 3582

Failure to submit the California Form 3582 or making late payments can result in penalties and interest charges imposed by the FTB. These penalties can accumulate quickly, increasing the total amount owed. Taxpayers are encouraged to file and pay on time to avoid these additional costs. Understanding the consequences of non-compliance can help individuals prioritize their tax obligations and maintain good standing with the state tax authority.

Quick guide on how to complete 2022 form ftb 3582payment voucher for individual e filed returns 2022 form ftb 3582payment voucher for individual e filed

Effortlessly Prepare Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns on Any Device

The use of online document management has surged among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any delays. Manage Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns effortlessly

- Find Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form ftb 3582payment voucher for individual e filed returns 2022 form ftb 3582payment voucher for individual e filed

Create this form in 5 minutes!

How to create an eSignature for the 2022 form ftb 3582payment voucher for individual e filed returns 2022 form ftb 3582payment voucher for individual e filed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franchise tax board payment voucher 2020?

The franchise tax board payment voucher 2020 is a document that taxpayers in California use to submit their tax payments along with their income tax returns. This voucher simplifies the payment process and ensures that your payments are correctly allocated for the tax year 2020.

-

How can airSlate SignNow help with the franchise tax board payment voucher 2020?

airSlate SignNow provides an easy-to-use platform that allows you to electronically sign and send your franchise tax board payment voucher 2020. This feature can streamline your tax filing process, ensuring that everything is completed quickly and efficiently without the hassle of paper forms.

-

Is there a cost associated with using airSlate SignNow for the franchise tax board payment voucher 2020?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. By using our platform for the franchise tax board payment voucher 2020, you can potentially save time and reduce costs associated with traditional paper signing methods.

-

What features does airSlate SignNow offer that benefit the franchise tax board payment voucher 2020?

airSlate SignNow offers several features that are beneficial for the franchise tax board payment voucher 2020, including easy document uploads, customizable templates, and seamless eSignature capabilities. These features enhance the overall efficiency and user experience, promoting faster transaction completion.

-

Can I integrate airSlate SignNow with other software for processing the franchise tax board payment voucher 2020?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage your franchise tax board payment voucher 2020 alongside other financial and document management tools. This capability helps streamline operations and enhances productivity.

-

Are electronic signatures on the franchise tax board payment voucher 2020 legally binding?

Yes, electronic signatures on the franchise tax board payment voucher 2020 are legally binding in accordance with the E-Sign Act and UETA. airSlate SignNow ensures compliance with all legal standards, providing you peace of mind when signing important tax documents.

-

How secure is my information when using airSlate SignNow for the franchise tax board payment voucher 2020?

Security is a top priority at airSlate SignNow. When using the platform for the franchise tax board payment voucher 2020, your information is protected with robust encryption and security protocols to ensure the confidentiality and integrity of your sensitive data.

Get more for Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns

- Notice of assignment to living trust south dakota form

- Revocation of living trust south dakota form

- Letter to lienholder to notify of trust south dakota form

- South dakota timber sale contract south dakota form

- South dakota forest products timber sale contract south dakota form

- South dakota easement form

- Assumption agreement of mortgage and release of original mortgagors south dakota form

- Small estate heirship affidavit for estates under 50000 south dakota form

Find out other Form FTB 3582Payment Voucher For Individual E filed Returns Form FTB 3582Payment Voucher For Individual E filed Returns

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple