California Form 3582 Instructions ESmart Tax 2020

Overview of California Form 3582

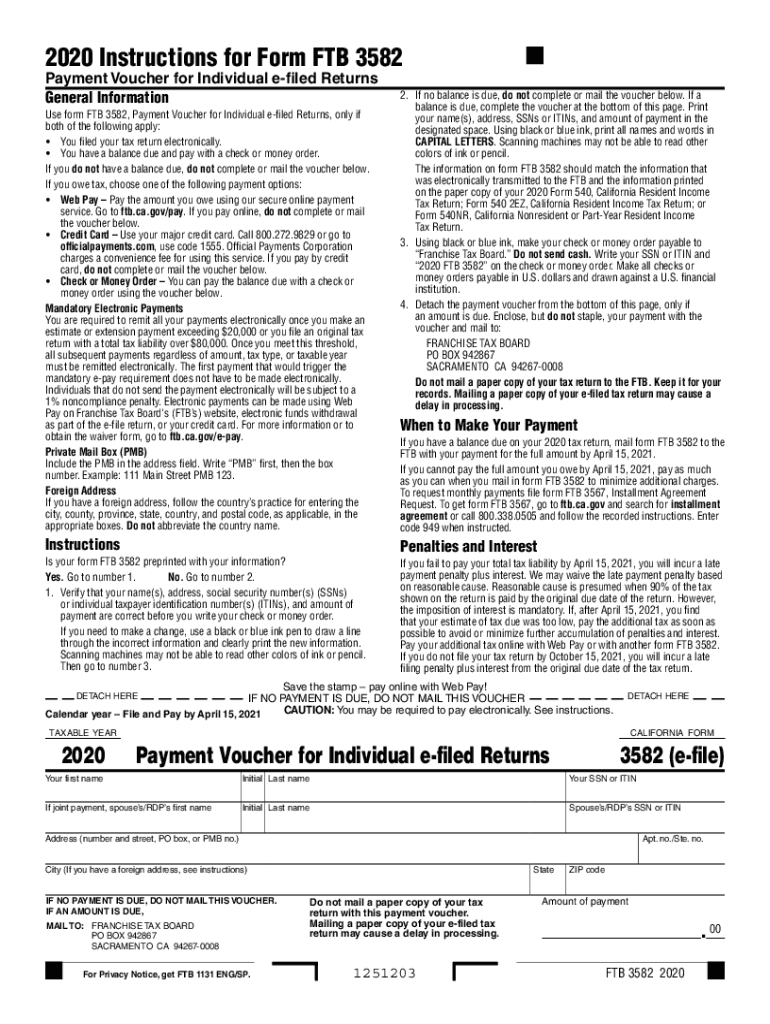

The California Form 3582, also known as the California payment voucher, is a crucial document used by taxpayers to remit payments for their state tax obligations. This form is specifically designed for individuals and businesses that need to make estimated tax payments or settle any outstanding tax liabilities with the California Franchise Tax Board (FTB). Understanding the purpose and requirements of Form 3582 is essential for ensuring compliance with state tax regulations.

Steps to Complete California Form 3582

Completing the California Form 3582 involves several clear steps. First, gather all necessary financial information, including your total income and any deductions applicable to your situation. Next, accurately calculate your estimated tax liability for the year. Once you have this information, fill out the form by entering your personal details, payment amount, and any relevant tax identification numbers. After reviewing the information for accuracy, you can submit the form either electronically or via mail, depending on your preference.

Legal Use of California Form 3582

The legal validity of the California Form 3582 hinges on proper completion and submission. When filled out correctly, this form serves as an official record of your tax payment, which can be crucial in case of audits or disputes with the FTB. It is important to ensure that all information is accurate and that you adhere to submission deadlines to avoid penalties. Utilizing a reliable e-signature solution can further enhance the legal standing of your submission.

Filing Deadlines for California Form 3582

Timely submission of the California Form 3582 is essential to avoid late fees and penalties. The deadlines for filing this form typically align with the state’s tax payment schedule. For individuals and businesses making estimated payments, the due dates are generally quarterly. It is advisable to check the California Franchise Tax Board's official resources for the most current deadlines to ensure compliance.

Form Submission Methods

California Form 3582 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file the form online through the FTB’s electronic filing system, which offers a quick and efficient way to submit payments. Alternatively, the form can be mailed directly to the FTB or delivered in person at designated offices. Each method has its own processing times and requirements, so it is important to select the one that best fits your needs.

Key Elements of California Form 3582

Understanding the key elements of California Form 3582 is critical for accurate completion. The form typically includes sections for taxpayer identification information, payment amount, and details regarding the tax period for which the payment is being made. Additionally, there may be fields for specific codes related to the type of payment being submitted. Familiarizing yourself with these sections can streamline the process and reduce the likelihood of errors.

Penalties for Non-Compliance

Failure to comply with the requirements associated with California Form 3582 can result in significant penalties. These may include late payment fees, interest on unpaid amounts, and potential legal action from the FTB. It is crucial to adhere to filing deadlines and ensure that all information provided is accurate to avoid these consequences. Regularly reviewing your tax obligations can help maintain compliance and prevent unnecessary penalties.

Quick guide on how to complete california form 3582 instructions esmart tax

Complete California Form 3582 Instructions ESmart Tax seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage California Form 3582 Instructions ESmart Tax on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign California Form 3582 Instructions ESmart Tax with ease

- Obtain California Form 3582 Instructions ESmart Tax and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Mark relevant sections of your documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Modify and eSign California Form 3582 Instructions ESmart Tax and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3582 instructions esmart tax

Create this form in 5 minutes!

How to create an eSignature for the california form 3582 instructions esmart tax

The way to make an e-signature for a PDF file in the online mode

The way to make an e-signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an e-signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is Form 3582 and how is it used?

Form 3582 is a crucial document used for specific regulatory compliance. Businesses can utilize airSlate SignNow to efficiently complete and eSign Form 3582, ensuring adherence to deadlines and accuracy in submissions.

-

How does airSlate SignNow simplify the process of completing Form 3582?

airSlate SignNow offers an intuitive interface that streamlines the completion of Form 3582. Users can easily fill out the required fields, add signatures, and submit the form electronically, saving time and reducing paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 3582?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. These plans are cost-effective and designed to ensure that customers can manage their Form 3582 processes without breaking the bank.

-

What are the key features of airSlate SignNow for handling Form 3582?

Key features include eSignature capabilities, document storage, and automated workflows. With airSlate SignNow, businesses can manage Form 3582 efficiently while enhancing document security and tracking.

-

Can I integrate airSlate SignNow with other applications for Form 3582?

Absolutely! airSlate SignNow offers seamless integration with various applications, allowing users to link their Form 3582 process with existing workflows. This helps improve productivity and ensures that all document-related tasks are interconnected.

-

What benefits does airSlate SignNow provide for managing Form 3582?

airSlate SignNow provides numerous benefits, including reduced processing times and improved accuracy. By utilizing airSlate SignNow for Form 3582, businesses can ensure compliance while enhancing their overall operational efficiency.

-

Is it secure to use airSlate SignNow for sending Form 3582?

Yes, airSlate SignNow employs advanced security measures to protect your data. When using airSlate SignNow for Form 3582, you can be assured that your information is safe and compliant with industry standards.

Get more for California Form 3582 Instructions ESmart Tax

- District of columbia application for allowance of appeal from the small claims and conciliation branch of the civil division form

- District of columbia notices resolutions simple stock ledger and certificate form

- Dc disclosure form

- Dc note form

- District of columbia instructions for completing petition for small estate affidavit form

- District of columbia statement of claim pursuant to scr pdip 307 form

- Prenuptial form

- Delaware delaware bylaws for corporation form

Find out other California Form 3582 Instructions ESmart Tax

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile