Form 14157 2014

What is the Form 14157

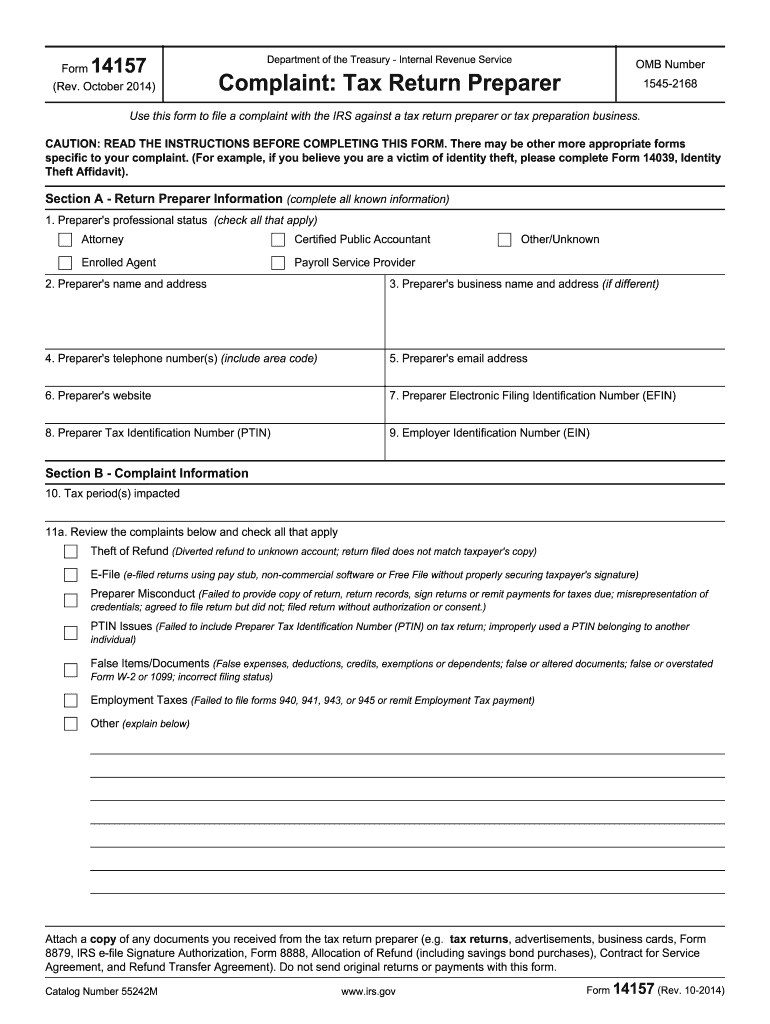

The Form 14157 is a critical document used by taxpayers to report suspected misconduct by tax professionals. This form is particularly relevant for individuals who believe that their tax preparer has engaged in unethical or illegal practices. By submitting this form to the Internal Revenue Service (IRS), taxpayers can initiate an investigation into the actions of their tax preparer, which may include issues such as fraud or negligence. Understanding the purpose and implications of the Form 14157 is essential for maintaining the integrity of the tax preparation process.

How to use the Form 14157

Using the Form 14157 involves a straightforward process aimed at reporting concerns regarding tax preparers. To begin, individuals should carefully fill out the form, providing detailed information about the tax preparer in question, including their name, address, and the specific issues encountered. It is important to include any relevant documentation that supports the claims being made. Once completed, the form should be submitted to the IRS, ensuring that all required information is accurate to facilitate a thorough investigation.

Steps to complete the Form 14157

Completing the Form 14157 requires attention to detail. Follow these steps for successful submission:

- Gather all necessary information about the tax preparer, including their name, address, and any identification numbers.

- Clearly outline the specific misconduct or concerns you have regarding their services.

- Attach any supporting documents that may help substantiate your claims.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS, ensuring that it is sent to the correct address as indicated in the form instructions.

Legal use of the Form 14157

The legal use of the Form 14157 is governed by IRS regulations that allow taxpayers to report misconduct without fear of retaliation. This form serves as a formal mechanism for individuals to voice their concerns about tax preparers who may be violating tax laws or ethical standards. It is essential for users to ensure that their claims are based on factual information to avoid potential legal repercussions. The IRS takes these reports seriously and investigates claims to uphold the integrity of the tax preparation industry.

Key elements of the Form 14157

Several key elements must be included in the Form 14157 to ensure it is effective:

- Tax Preparer Information: Accurate details about the tax preparer, including their name and contact information.

- Nature of the Complaint: A clear description of the misconduct, including specific examples and dates.

- Supporting Documentation: Any relevant documents that substantiate the claims made in the form.

- Taxpayer Information: The taxpayer's contact information for follow-up purposes.

Form Submission Methods

The Form 14157 can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Mail: Send the completed form to the designated IRS address provided in the form instructions.

- Online Submission: In some cases, taxpayers may be able to submit the form electronically through the IRS website, depending on the current regulations.

- In-Person: Taxpayers can also visit local IRS offices to submit the form directly to an IRS representative.

Quick guide on how to complete form 14157 2014

Complete Form 14157 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 14157 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to amend and eSign Form 14157 with ease

- Obtain Form 14157 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive data using tools that airSlate SignNow specifically supplies for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 14157 and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 14157 2014

Create this form in 5 minutes!

How to create an eSignature for the form 14157 2014

How to make an eSignature for the Form 14157 2014 in the online mode

How to make an electronic signature for your Form 14157 2014 in Chrome

How to generate an electronic signature for signing the Form 14157 2014 in Gmail

How to generate an eSignature for the Form 14157 2014 from your mobile device

How to create an eSignature for the Form 14157 2014 on iOS

How to generate an eSignature for the Form 14157 2014 on Android

People also ask

-

What is Form 14157 and how can airSlate SignNow help with it?

Form 14157 is a crucial document used for reporting tax-related issues to the IRS. With airSlate SignNow, you can easily fill out, sign, and submit Form 14157 electronically, ensuring a seamless and efficient process that saves you time and reduces errors.

-

Is there a cost associated with using airSlate SignNow for Form 14157?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to tools that simplify the signing and processing of documents like Form 14157, making it a cost-effective solution for managing your paperwork.

-

What features does airSlate SignNow offer for managing Form 14157?

airSlate SignNow includes a range of features designed to streamline the handling of Form 14157. These features include customizable templates, real-time tracking of document status, and secure cloud storage, ensuring that you can manage your forms efficiently and effectively.

-

Can I integrate airSlate SignNow with other software while using Form 14157?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage Form 14157 alongside your existing tools. This integration enhances workflow efficiency and helps keep all your important documents organized.

-

What are the benefits of using airSlate SignNow for Form 14157?

Using airSlate SignNow for Form 14157 provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform's user-friendly interface makes it simple to navigate, ensuring that you can focus on your business rather than paperwork.

-

How secure is airSlate SignNow when handling Form 14157?

Security is a top priority for airSlate SignNow. When you use our platform to manage Form 14157, you benefit from advanced encryption and compliance with data protection regulations, ensuring that your sensitive information remains safe and secure.

-

Can multiple users collaborate on Form 14157 using airSlate SignNow?

Yes, airSlate SignNow allows for multiple users to collaborate on Form 14157. This feature enables teams to work together in real-time, making it easier to collect signatures and share information efficiently, regardless of team members' locations.

Get more for Form 14157

Find out other Form 14157

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy