Make a Complaint About a Tax Return PreparerInternal Revenue 2013

What is the Make A Complaint About A Tax Return Preparer

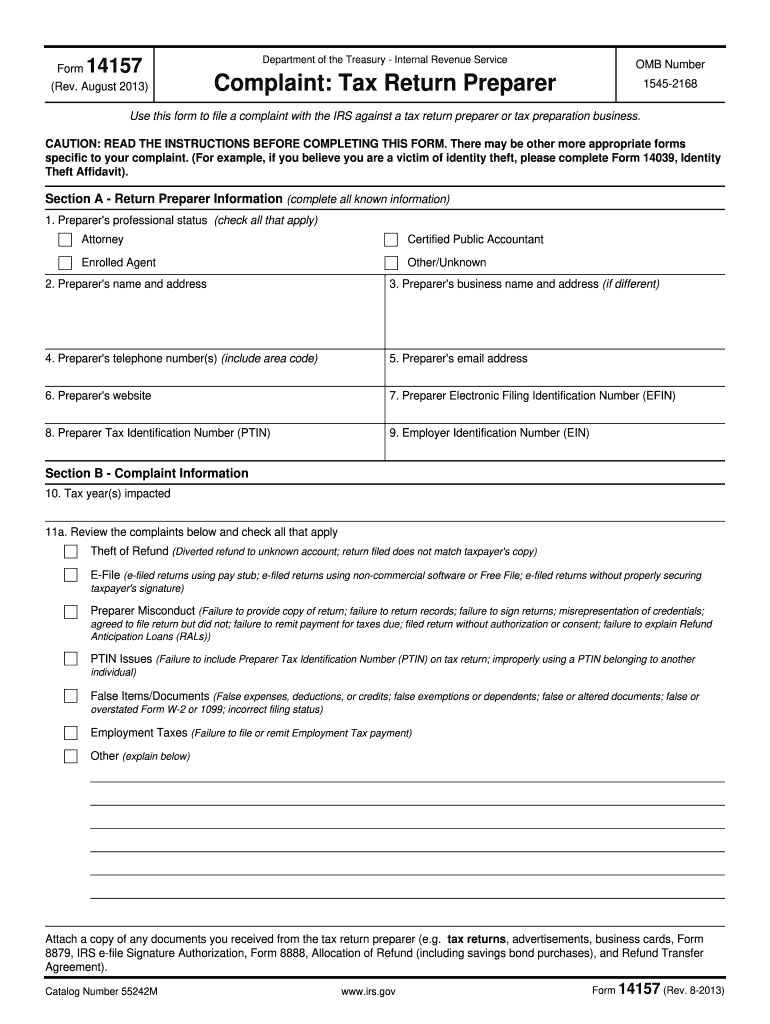

The form to make a complaint about a tax return preparer is a formal document that allows taxpayers to report unethical or illegal behavior by tax professionals. This form is essential for maintaining the integrity of tax preparation services and ensuring that tax preparers adhere to ethical standards. Complaints can be made regarding issues such as fraud, misrepresentation, or failure to comply with IRS regulations. It is important for taxpayers to understand their rights and the processes in place to protect them from dishonest practices.

How to Use the Make A Complaint About A Tax Return Preparer

Using the form to make a complaint about a tax return preparer involves several steps. First, gather all relevant information about the tax preparer, including their name, address, and any specific incidents that prompted the complaint. Next, fill out the form accurately, providing detailed descriptions of the issues encountered. It is crucial to include any supporting documentation that can substantiate your claims. Once completed, the form should be submitted to the appropriate IRS office for review. Keeping a copy of the submitted complaint for your records is also advisable.

Steps to Complete the Make A Complaint About A Tax Return Preparer

Completing the complaint form requires careful attention to detail. Here are the key steps:

- Collect necessary information about the tax return preparer.

- Clearly describe the nature of the complaint, including dates and specific actions taken by the preparer.

- Attach any relevant documents, such as copies of tax returns or correspondence.

- Review the completed form for accuracy and completeness.

- Submit the form to the designated IRS office, either online or by mail.

Legal Use of the Make A Complaint About A Tax Return Preparer

The legal use of the complaint form is governed by IRS regulations that protect taxpayers from fraudulent practices. By filing a complaint, taxpayers are exercising their right to report misconduct, which can lead to investigations and potential disciplinary actions against the tax preparer. It is important to ensure that the complaint is based on factual information and is not frivolous, as false claims can have legal repercussions.

IRS Guidelines

The IRS provides specific guidelines for filing complaints against tax return preparers. These guidelines outline the types of behavior that warrant a complaint, such as failure to sign tax returns, charging excessive fees, or making false statements. Taxpayers should familiarize themselves with these guidelines to ensure that their complaints are valid and actionable. Following the IRS protocols increases the likelihood of a thorough investigation into the reported issues.

Form Submission Methods

There are several methods available for submitting the complaint form to the IRS. Taxpayers can choose to file their complaints online through the IRS website, which may offer a more efficient process. Alternatively, complaints can be submitted via mail, requiring the taxpayer to send the completed form to the appropriate IRS office. In some cases, in-person submissions may also be possible, depending on local IRS office policies. It is essential to check the IRS website for the most current submission options and addresses.

Quick guide on how to complete make a complaint about a tax return preparerinternal revenue

Prepare Make A Complaint About A Tax Return PreparerInternal Revenue effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Make A Complaint About A Tax Return PreparerInternal Revenue on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Make A Complaint About A Tax Return PreparerInternal Revenue with ease

- Locate Make A Complaint About A Tax Return PreparerInternal Revenue and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and eSign Make A Complaint About A Tax Return PreparerInternal Revenue and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct make a complaint about a tax return preparerinternal revenue

Create this form in 5 minutes!

How to create an eSignature for the make a complaint about a tax return preparerinternal revenue

The way to create an electronic signature for your PDF online

The way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What steps should I follow to Make A Complaint About A Tax Return PreparerInternal Revenue?

To Make A Complaint About A Tax Return PreparerInternal Revenue, you should gather documentation supporting your complaint, such as signed forms and tax returns. Then, visit the IRS website or call the IRS to file your complaint. It's important to provide as much detail as possible to ensure a thorough investigation.

-

Are there any fees associated with Making A Complaint About A Tax Return PreparerInternal Revenue?

No, there are no fees required to Make A Complaint About A Tax Return PreparerInternal Revenue. The IRS allows you to file your complaints free of charge to help protect taxpayers from unethical practices. You should be cautious about potential fraudsters who may charge for this service.

-

How can airSlate SignNow help me document my complaint about a tax return preparer?

airSlate SignNow provides a user-friendly platform to easily create and eSign documents necessary for your complaint. You can compile relevant tax documents, sign them electronically, and send them securely. This ensures that your complaint documentation is organized and accessible.

-

What features does airSlate SignNow offer for managing tax-related documents?

airSlate SignNow offers features like document sharing, eSignature capabilities, and customizable templates, making it easier to manage your tax-related documents. You can digitally sign your complaint and any supporting documentation. This streamlines the process and protects your sensitive information.

-

Can I integrate airSlate SignNow with other software to assist with my complaint?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, including accounting and tax software. This makes it easier to manage all your tax documents in one place as you prepare to Make A Complaint About A Tax Return PreparerInternal Revenue. Look for integrations that suit your workflow.

-

What benefits can I expect from using airSlate SignNow for tax complaints?

By using airSlate SignNow for your tax complaint process, you can enjoy time savings, enhanced security, and a simplified user experience. It automates the signing and document management processes, which can facilitate a smoother filing of your complaint. You will also have a secure electronic trail of all your transactions.

-

Is there a customer support team available if I need help with my complaint?

Yes, airSlate SignNow provides robust customer support to assist with any inquiries regarding your use of the platform, especially as you prepare to Make A Complaint About A Tax Return PreparerInternal Revenue. You can signNow out via chat, email, or phone for prompt assistance.

Get more for Make A Complaint About A Tax Return PreparerInternal Revenue

- Indiana claim workers compensation form

- Notice of dishonored check civil keywords bad check bounced check indiana form

- Request for assistance for workers compensation indiana form

- Mutual wills containing last will and testaments for unmarried persons living together with no children indiana form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children indiana form

- Mutual wills or last will and testaments for unmarried persons living together with minor children indiana form

- Non marital cohabitation living together agreement indiana form

- Paternity law and procedure handbook indiana form

Find out other Make A Complaint About A Tax Return PreparerInternal Revenue

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template