Tax Preparer Complaint Form 14157 2018-2026

What is the Tax Preparer Complaint Form 14157

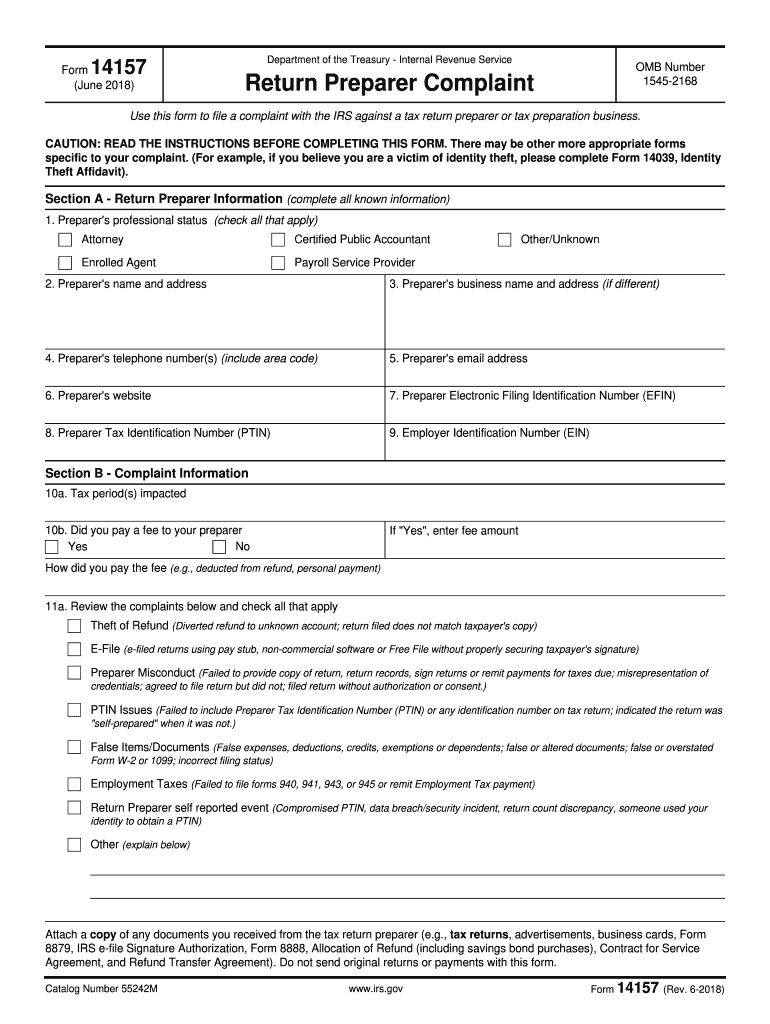

The Tax Preparer Complaint Form 14157 is a document used by taxpayers to report misconduct or unethical practices by tax preparers. This form is essential for individuals who believe their tax preparer has acted improperly, such as providing false information, charging excessive fees, or failing to file returns accurately. By submitting this form, taxpayers can initiate an investigation into the preparer's actions, helping to maintain the integrity of the tax preparation profession.

How to use the Tax Preparer Complaint Form 14157

To use the Tax Preparer Complaint Form 14157, taxpayers should first gather all relevant information regarding the tax preparer and the issues encountered. This includes the preparer's name, address, and any documentation supporting the complaint. Once the form is completed, it should be submitted to the appropriate IRS office. It is advisable to keep a copy of the completed form for personal records. This process ensures that the IRS can take appropriate action based on the complaint.

Steps to complete the Tax Preparer Complaint Form 14157

Completing the Tax Preparer Complaint Form 14157 involves several key steps:

- Gather necessary information about the tax preparer, including their name, address, and any relevant tax documents.

- Clearly describe the nature of the complaint, including specific actions or behaviors that are concerning.

- Fill out the form accurately, ensuring all sections are completed to avoid delays in processing.

- Review the completed form for accuracy before submitting.

- Submit the form to the IRS office specified in the instructions, either online, by mail, or in person.

Key elements of the Tax Preparer Complaint Form 14157

The Tax Preparer Complaint Form 14157 includes several key elements that are critical for a successful submission:

- Taxpayer Information: This section requires the taxpayer's name, address, and contact information.

- Preparer Information: Details about the tax preparer, including their name, address, and any identifying numbers.

- Complaint Details: A comprehensive description of the issue, including dates and specific actions that prompted the complaint.

- Signature: The taxpayer must sign the form to verify the accuracy of the information provided.

Legal use of the Tax Preparer Complaint Form 14157

The legal use of the Tax Preparer Complaint Form 14157 is crucial for ensuring that complaints are handled appropriately. This form is recognized by the IRS as a formal method for reporting misconduct. Taxpayers should ensure that their complaints are based on factual information and that they are not filing frivolous claims. Proper use of this form can lead to investigations that protect the rights of taxpayers and uphold the standards of tax preparation.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Tax Preparer Complaint Form 14157:

- Online Submission: If available, submitting the form electronically can expedite the process.

- Mail: The completed form can be sent via postal service to the designated IRS office.

- In-Person: Taxpayers may also choose to deliver the form directly to an IRS office for immediate processing.

Quick guide on how to complete form 14157 2018 2019

Uncover the easiest method to complete and endorse your Tax Preparer Complaint Form 14157

Are you still spending time preparing your official documents on paper instead of doing it digitally? airSlate SignNow offers a superior approach to finish and endorse your Tax Preparer Complaint Form 14157 and associated forms for public services. Our intelligent eSignature solution delivers all the resources you need to handle documents swiftly and in accordance with official standards - robust PDF editing, managing, securing, endorsing, and sharing tools all available within a user-friendly interface.

There are just a few steps needed to complete your Tax Preparer Complaint Form 14157:

- Upload the editable template to the editor using the Get Form button.

- Review what information is necessary for your Tax Preparer Complaint Form 14157.

- Navigate through the fields using the Next option to ensure you don’t overlook anything.

- Utilize Text, Check, and Cross features to fill in the fields with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is truly important or Obscure fields that are no longer relevant.

- Click on Sign to create a legally enforceable eSignature using any method you prefer.

- Add the Date next to your signature and finalize your task with the Done button.

Store your finalized Tax Preparer Complaint Form 14157 in the Documents folder within your profile, download it, or export it to your chosen cloud storage. Our solution also provides flexible form sharing. There’s no need to print your templates when you must submit them to the appropriate public office - do it by utilizing email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 14157 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the form 14157 2018 2019

How to make an eSignature for the Form 14157 2018 2019 online

How to create an electronic signature for the Form 14157 2018 2019 in Chrome

How to make an eSignature for putting it on the Form 14157 2018 2019 in Gmail

How to make an eSignature for the Form 14157 2018 2019 from your smart phone

How to generate an eSignature for the Form 14157 2018 2019 on iOS

How to generate an electronic signature for the Form 14157 2018 2019 on Android OS

People also ask

-

What is the Tax Preparer Complaint Form 14157?

The Tax Preparer Complaint Form 14157 is a document used by taxpayers to report any issues or misconduct related to tax preparers. This form is vital for ensuring that tax professionals adhere to ethical standards and provide accurate services. If you have concerns about a tax preparer's practices, completing the Tax Preparer Complaint Form 14157 is an essential step.

-

How can I use airSlate SignNow to submit the Tax Preparer Complaint Form 14157?

With airSlate SignNow, you can easily eSign and submit the Tax Preparer Complaint Form 14157 electronically. Our user-friendly platform allows you to upload the form, add your signature, and send it directly to the appropriate authorities without any hassle. This streamlines the process, ensuring your complaint is filed quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the Tax Preparer Complaint Form 14157?

airSlate SignNow offers a cost-effective solution for managing documents, including the Tax Preparer Complaint Form 14157. We provide various pricing plans that cater to different needs, ensuring that you can submit your complaint without breaking the bank. Check our website for the latest pricing options and choose the plan that suits you best.

-

What features does airSlate SignNow offer for managing the Tax Preparer Complaint Form 14157?

airSlate SignNow provides a range of features to assist with the Tax Preparer Complaint Form 14157, including secure eSigning, document storage, and real-time tracking. These features not only simplify the submission process but also enhance your ability to manage important documents efficiently. You can access your forms anytime, ensuring you stay organized.

-

Can I track the status of my Tax Preparer Complaint Form 14157 submission with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Tax Preparer Complaint Form 14157 submission. You will receive notifications when your form is viewed and signed, giving you peace of mind that your complaint is being processed. This transparency helps keep you informed throughout the submission process.

-

Does airSlate SignNow integrate with other tools for submitting the Tax Preparer Complaint Form 14157?

Absolutely! airSlate SignNow integrates seamlessly with various tools and applications, making it easier to submit the Tax Preparer Complaint Form 14157. Whether you use cloud storage services or project management tools, our integrations ensure that all your documentation needs are met efficiently.

-

What are the benefits of using airSlate SignNow for the Tax Preparer Complaint Form 14157?

Using airSlate SignNow for the Tax Preparer Complaint Form 14157 offers numerous benefits, including enhanced security, ease of use, and quick submission. Our platform is designed to make the process straightforward, allowing you to focus on addressing your concerns rather than getting bogged down in paperwork. Plus, you can complete everything from anywhere, at any time.

Get more for Tax Preparer Complaint Form 14157

- Informed consent form and medical emergency abortion form adph

- Administrative policies and procedures 1643 subject tngov tn form

- Exhibit out of state party affidavit texaslawhelporg texaslawhelp form

- Rp6 form medical council of new zealand mcnz org

- Amsa 419 form

- Iowa statewide universal practitioner credentialing application form

- Aa attendance form

- Temadd orders form

Find out other Tax Preparer Complaint Form 14157

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors