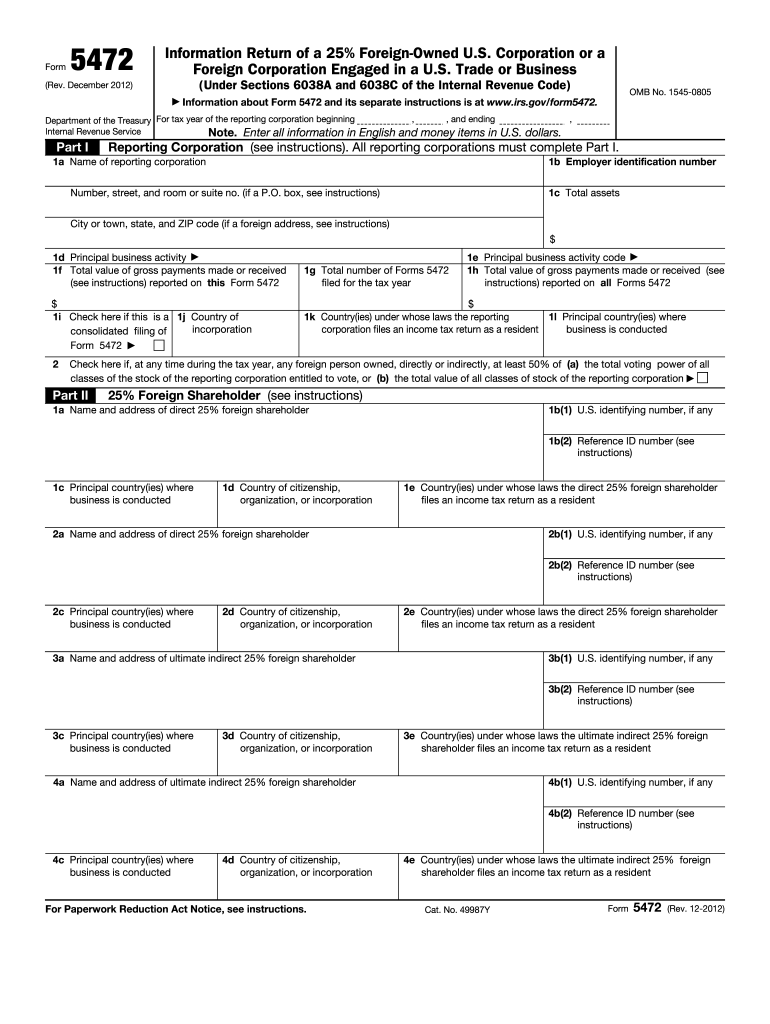

Form 5472 2012

What is the Form 5472

The Form 5472 is a U.S. Internal Revenue Service (IRS) tax form used to report certain transactions between a foreign-owned U.S. corporation and its foreign parent or related parties. It is primarily utilized by foreign corporations that have a substantial ownership interest in a U.S. entity, as well as by U.S. corporations that are 25% or more foreign-owned. The form helps the IRS monitor and assess potential tax liabilities associated with international transactions.

How to use the Form 5472

To effectively use the Form 5472, businesses must first determine if they meet the filing requirements. If a foreign corporation owns at least 25% of a U.S. corporation, the latter must complete the form to disclose specific transactions. This includes sales, purchases, and loans between the foreign parent and the U.S. subsidiary. Accurate reporting is crucial to avoid penalties, and the form must be submitted alongside the U.S. corporation's tax return.

Steps to complete the Form 5472

Completing the Form 5472 involves several key steps:

- Gather necessary information: Collect details about the foreign owner, including their name, address, and country of incorporation.

- Identify reportable transactions: Document all relevant transactions between the U.S. corporation and the foreign parent or related parties.

- Fill out the form: Complete the required sections of the form accurately, ensuring all information is current and correct.

- Review for accuracy: Double-check all entries to avoid mistakes that could lead to penalties.

- Submit the form: File the Form 5472 with the corporation's tax return by the designated deadline.

Legal use of the Form 5472

The legal use of the Form 5472 is governed by IRS regulations. It must be filed by the due date of the U.S. corporation's tax return, including extensions. Failure to file the form or providing inaccurate information can result in significant penalties. The form serves to ensure compliance with U.S. tax laws regarding international transactions and foreign ownership.

Filing Deadlines / Important Dates

The Form 5472 must be filed annually and is due on the same date as the U.S. corporation's tax return, typically on April 15. If the corporation files for an extension, the form is due on the extended deadline. It is essential for businesses to keep track of these dates to avoid late filing penalties, which can be substantial.

Penalties for Non-Compliance

Non-compliance with Form 5472 filing requirements can lead to severe penalties. The IRS imposes a penalty of $25,000 for each failure to file the form on time. Additionally, if the form is filed but contains incorrect or incomplete information, further penalties may apply. Understanding these consequences highlights the importance of accurate and timely filing.

Quick guide on how to complete form 5472 2012

Complete Form 5472 seamlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 5472 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 5472 effortlessly

- Obtain Form 5472 and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Identify important sections of your documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 5472 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5472 2012

Create this form in 5 minutes!

How to create an eSignature for the form 5472 2012

How to generate an eSignature for the Form 5472 2012 online

How to generate an electronic signature for the Form 5472 2012 in Google Chrome

How to generate an electronic signature for signing the Form 5472 2012 in Gmail

How to generate an electronic signature for the Form 5472 2012 right from your mobile device

How to generate an electronic signature for the Form 5472 2012 on iOS

How to generate an electronic signature for the Form 5472 2012 on Android devices

People also ask

-

What is Form 5472 and why is it important?

Form 5472 is an IRS form used to provide information regarding transactions between a reporting corporation and foreign or domestic related parties. It is crucial for compliance with U.S. tax laws, especially for foreign-owned U.S. corporations. Ensuring accurate completion of Form 5472 helps avoid penalties and facilitates smoother audits.

-

How can airSlate SignNow help with Form 5472 documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to Form 5472. With features like templates and real-time collaboration, businesses can streamline their workflow and ensure that all necessary information is accurately captured. This reduces the risk of errors and enhances compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for Form 5472?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution for managing documents like Form 5472. Pricing plans are designed to fit different business needs, ensuring that users get great value for their investment. Additionally, the time saved in document management often offsets the subscription cost.

-

What features does airSlate SignNow offer for managing Form 5472?

airSlate SignNow offers a variety of features specifically tailored for managing Form 5472, including document templates, cloud storage, and secure eSigning capabilities. Users can easily customize their forms and track the status of signatures in real-time, ensuring that all steps in the process are efficiently handled. This enhances overall productivity while maintaining compliance.

-

Can I integrate other applications with airSlate SignNow for Form 5472 processing?

Absolutely! airSlate SignNow supports integrations with various applications and platforms, making it easier to manage Form 5472 and related documentation. Popular integrations include CRM systems, cloud storage services, and accounting software, enhancing the overall workflow and data management for businesses.

-

What security measures does airSlate SignNow implement for Form 5472?

airSlate SignNow takes security seriously, employing advanced encryption protocols to protect all documents, including Form 5472. The platform ensures that sensitive information is kept confidential and secure, providing peace of mind for businesses handling crucial tax-related documents. Regular security audits further enhance the integrity of the platform.

-

How does airSlate SignNow ensure compliance when handling Form 5472?

airSlate SignNow keeps up-to-date with IRS regulations and requirements for Form 5472, ensuring that users are guided throughout the documentation process. The platform provides tips and resources to help users understand compliance issues and avoid common pitfalls. This commitment to compliance helps businesses mitigate risks associated with tax filings.

Get more for Form 5472

- File ca tax form 2010 540nr

- Obtain a writ of garnishment earnings maricopa county justicecourts maricopa form

- Epsdt 90 form

- Dmas 62 form

- Horse purchase contract form

- Abc 140 department of alcoholic beverage control state of abc ca form

- Diabetes management plan northcott form

- Work and income forms 40044944

Find out other Form 5472

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form