Www Irs Govinstructionsi5472Instructions for Form 5472 12Internal Revenue Service 2021

What is Form 5472?

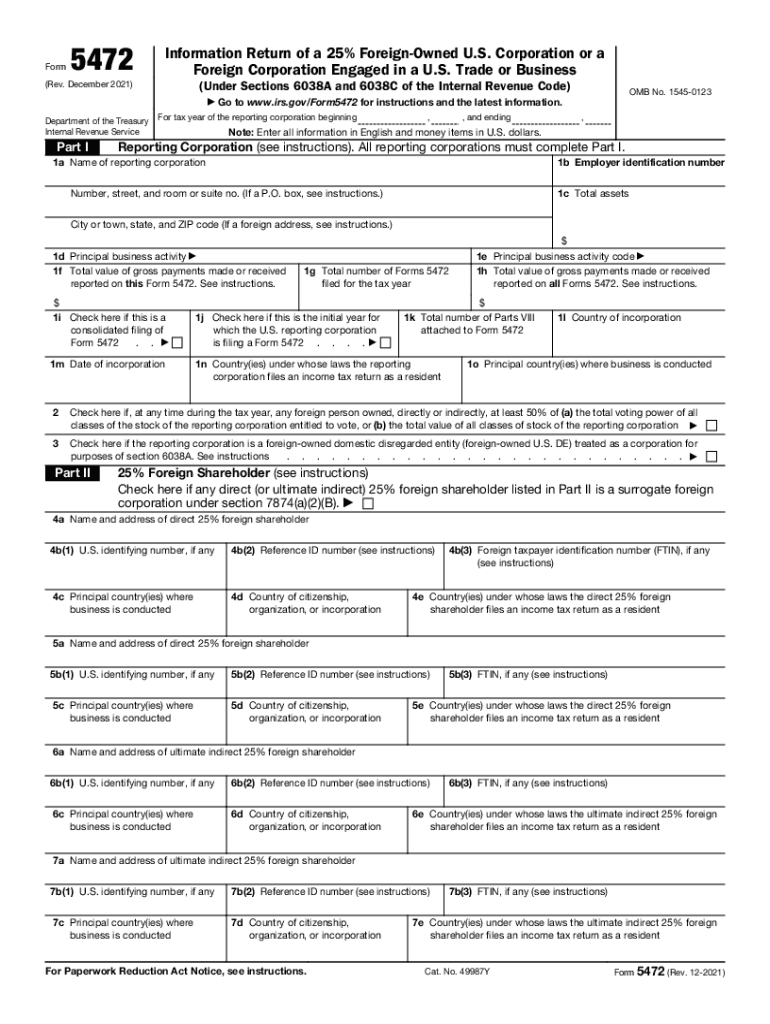

Form 5472 is a document required by the Internal Revenue Service (IRS) for certain foreign-owned U.S. corporations and domestic disregarded entities. This form is used to report transactions between the reporting corporation and related parties. The information collected helps the IRS track potential tax liabilities and ensure compliance with U.S. tax laws. It is crucial for businesses to understand their obligations regarding this form to avoid penalties.

Steps to Complete Form 5472

Completing Form 5472 involves several key steps:

- Identify whether your business qualifies as a reporting corporation or a domestic disregarded entity.

- Gather necessary information, including details about the foreign owner and any related parties involved in reportable transactions.

- Fill out the form accurately, ensuring all transactions are reported as required by the IRS.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines for Form 5472

The filing deadline for Form 5472 typically aligns with the due date of the corporation's income tax return. For most corporations, this is the fifteenth day of the fourth month following the end of the tax year. It is essential to file the form on time to avoid penalties. If the deadline falls on a weekend or holiday, the due date is extended to the next business day.

Penalties for Non-Compliance

Failure to file Form 5472 or filing it incorrectly can result in significant penalties. The IRS imposes a penalty of $25,000 for each failure to file the form timely or accurately. Additionally, if the non-compliance continues for more than 90 days after the IRS notifies the taxpayer, further penalties may apply. Understanding these consequences emphasizes the importance of diligent compliance with reporting requirements.

Required Documents for Form 5472

To complete Form 5472, several documents and pieces of information are necessary:

- Identification details of the reporting corporation, including its Employer Identification Number (EIN).

- Information about the foreign owner, including their name, address, and tax identification number.

- Details of all reportable transactions between the reporting corporation and related parties.

Legal Use of Form 5472

Form 5472 must be filed in accordance with IRS regulations to ensure it is legally valid. This includes providing accurate information and adhering to deadlines. The form serves as a critical tool for the IRS to monitor compliance with U.S. tax laws, particularly concerning foreign ownership and related party transactions. Ensuring legal compliance when filling out this form is vital for businesses to avoid potential legal issues.

Quick guide on how to complete wwwirsgovinstructionsi5472instructions for form 5472 122021internal revenue service

Effortlessly Prepare Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service on Any Device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Handle Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

Efficiently Edit and eSign Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service with Ease

- Obtain Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service and then click Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details, then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors requiring new printouts. airSlate SignNow meets your document management needs with just a few clicks from any preferred device. Revise and eSign Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovinstructionsi5472instructions for form 5472 122021internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovinstructionsi5472instructions for form 5472 122021internal revenue service

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to generate an e-signature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

How to generate an e-signature for a PDF file on Android devices

People also ask

-

What are the form 5472 instructions for filing?

The form 5472 instructions outline the requirements for reporting certain transactions between a reporting corporation and a foreign or domestic related party. It's crucial to understand these guidelines to ensure compliance with IRS regulations. Following the form 5472 instructions carefully can help prevent costly penalties.

-

How can airSlate SignNow assist with form 5472 instructions?

airSlate SignNow streamlines the eSigning and document management process, making it easier to implement form 5472 instructions. By using our platform, you can securely send, sign, and store your form 5472 documents electronically, ensuring that your filings are submitted efficiently and accurately.

-

What features of airSlate SignNow are beneficial for managing form 5472 instructions?

AirSlate SignNow offers features like customizable templates, automated workflows, and real-time tracking, which are essential for managing form 5472 instructions. These features enhance organization and reduce the chances of errors while preparing your tax documents. Additionally, our platform is user-friendly, making complex processes simpler.

-

Is there a cost associated with following form 5472 instructions on airSlate SignNow?

Yes, while airSlate SignNow offers a cost-effective solution, pricing depends on the features you select to best meet your needs. Subscribing to our platform provides valuable functionalities that can save time and resources when following form 5472 instructions. Check our pricing page for detailed options.

-

Can airSlate SignNow integrate with other software for form 5472 instructions?

Absolutely! airSlate SignNow provides integrations with various accounting and software tools to ease the process of complying with form 5472 instructions. These integrations help to sync and manage your data, allowing for smooth document workflows and ensuring the accuracy of your information.

-

Are there benefits to using airSlate SignNow for electronic signatures on form 5472?

Using airSlate SignNow for electronic signatures on form 5472 eliminates the need for paper-based documentation, thus enhancing efficiency and compliance. Our platform offers secure, legally binding eSignatures that aid in meeting the form 5472 instructions requirements quickly. This streamlining can signNowly reduce processing time.

-

How does airSlate SignNow ensure the security of documents related to form 5472 instructions?

AirSlate SignNow prioritizes the security of your documents related to form 5472 instructions by implementing industry-standard encryption and authentication protocols. This ensures that sensitive tax information remains confidential and protected from unauthorized access. Our commitment to security helps build trust with users handling crucial documents.

Get more for Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service

- New state resident package district of columbia form

- Commercial property sales package district of columbia form

- General partnership package district of columbia form

- Contract for deed package district of columbia form

- Power of attorney forms package district of columbia

- Revised uniform anatomical gift act donation district of columbia

- Employment hiring process package district of columbia form

- Dc donor form

Find out other Www irs govinstructionsi5472Instructions For Form 5472 12Internal Revenue Service

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast