Instructions for Form 5472 12Internal Revenue Service 2022

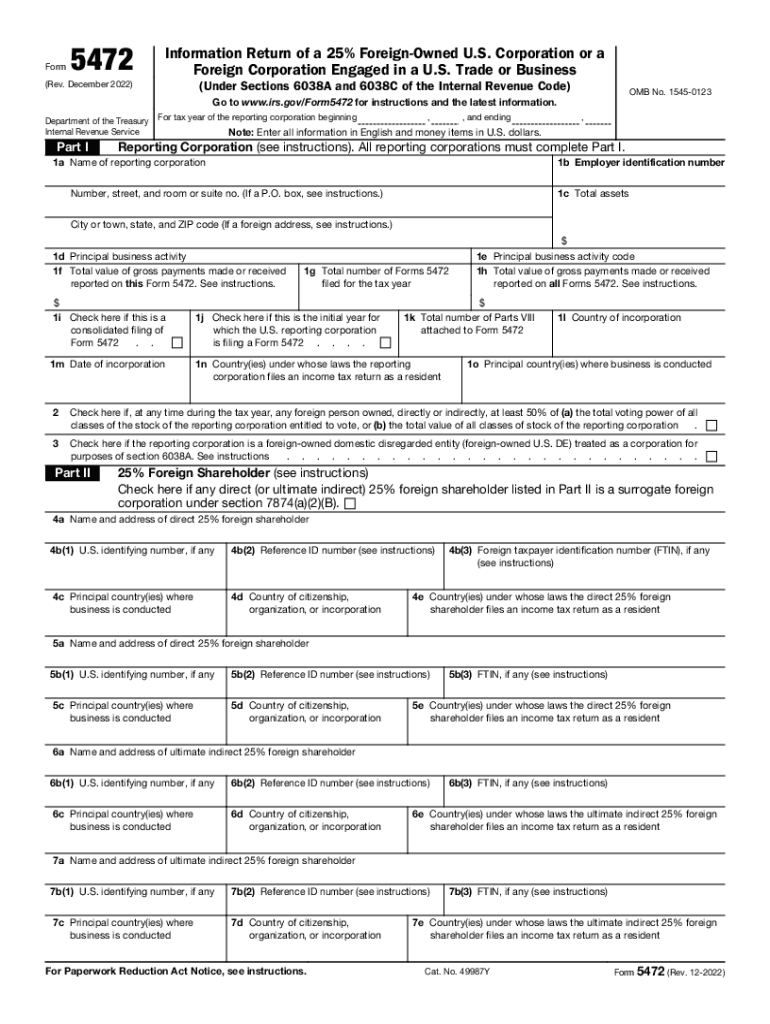

What is Form 5472?

The 5472 form is a crucial document required by the Internal Revenue Service (IRS) for certain foreign-owned U.S. corporations and foreign corporations engaged in a trade or business in the United States. This form is used to provide information about the corporation's transactions with related parties. It helps the IRS monitor compliance with U.S. tax laws and ensures that foreign entities are reporting their income accurately. The form must be filed annually, and failure to do so can result in significant penalties.

Key Elements of Form 5472 Instructions

The instructions for Form 5472 outline essential details that filers must understand to complete the form accurately. Key elements include:

- Filing Requirements: Identifying who is required to file the form based on ownership structure and business activities.

- Information Required: Detailed descriptions of the types of transactions that need to be reported, including sales, purchases, and loans.

- Filing Deadlines: Specific dates by which the form must be submitted to avoid penalties.

- Penalties: Information on the consequences of failing to file or filing inaccurately, which can include fines and additional scrutiny from the IRS.

Steps to Complete Form 5472 Instructions

Completing Form 5472 requires careful attention to detail. Here are the steps to follow:

- Gather Necessary Information: Collect data on your business's transactions with foreign related parties, including financial statements and invoices.

- Fill Out the Form: Complete the form accurately, ensuring all required fields are filled out, including the identification of related parties and the nature of transactions.

- Review for Accuracy: Double-check the information provided to ensure compliance with IRS regulations and avoid potential penalties.

- Submit the Form: File the completed form by the deadline, either electronically or via mail, depending on your business structure.

Filing Deadlines for Form 5472

Filing deadlines for Form 5472 are critical for compliance. Generally, the form is due on the same date as the corporation's income tax return. For most corporations, this means it must be filed by the fifteenth day of the fourth month following the end of the tax year. If the corporation is on a calendar year, the deadline is April 15. Extensions may be available, but it is essential to file the form on time to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 5472 or filing it inaccurately can lead to substantial penalties. The IRS imposes a penalty of $25,000 for each failure to file, and additional penalties may apply for continued non-compliance. It is crucial for businesses to understand these penalties and ensure timely and accurate filing to avoid financial repercussions.

Legal Use of Form 5472 Instructions

The legal use of Form 5472 instructions is vital for ensuring compliance with U.S. tax laws. The form must be filled out in accordance with the IRS guidelines, which dictate the information required and the manner in which it should be reported. Adhering to these instructions not only helps in fulfilling legal obligations but also protects businesses from potential audits and penalties.

Quick guide on how to complete instructions for form 5472 122021internal revenue service

Complete Instructions For Form 5472 12Internal Revenue Service effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents rapidly without any hold-ups. Manage Instructions For Form 5472 12Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Instructions For Form 5472 12Internal Revenue Service with ease

- Find Instructions For Form 5472 12Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important areas of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Instructions For Form 5472 12Internal Revenue Service to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 5472 122021internal revenue service

Create this form in 5 minutes!

People also ask

-

What are the 5472 instructions for completing the form?

The 5472 instructions provide detailed guidance on how to fill out and submit IRS Form 5472. This involves understanding the specific requirements for reporting, the types of information needed about foreign owners and transactions, and ensuring compliance with IRS regulations. Following these instructions is crucial for avoiding penalties and ensuring your submission is accurate.

-

How does airSlate SignNow help in managing 5472 instructions?

airSlate SignNow simplifies the process of managing 5472 instructions by allowing users to securely eSign and send documents electronically. With its user-friendly interface, you can easily share these critical forms with stakeholders and track their statuses in real time. This streamlines the entire documentation process, ensuring everyone is on the same page regarding the 5472 instructions.

-

Are there any specific features in airSlate SignNow related to 5472 instructions?

Yes, airSlate SignNow offers features specifically designed for handling forms like the 5472 instructions. This includes customizable templates that reflect the necessary fields of the 5472 form, automated reminders for renewal dates, and audit trails for compliance tracking. These features enhance efficiency and accuracy in managing your documentation.

-

What is the pricing structure of airSlate SignNow for processing 5472 instructions?

airSlate SignNow provides a flexible pricing structure designed to cater to various business needs, including those who require assistance with 5472 instructions. You can choose from different plans based on the volume of documents you need to manage, ensuring cost-effectiveness. A free trial is also available to help you evaluate its features before committing to a plan.

-

What benefits does airSlate SignNow offer for users dealing with 5472 instructions?

Using airSlate SignNow for your 5472 instructions offers several benefits, including increased efficiency, enhanced document security, and reduced turnaround times. It enables businesses to maintain compliance effortlessly and provides an intuitive interface for both senders and signers. This ensures that the entire eSigning process, including complex forms like the 5472, is straightforward.

-

Can airSlate SignNow integrate with other tools for managing 5472 instructions?

Absolutely! airSlate SignNow supports integration with various platforms, enabling seamless handling of 5472 instructions alongside your existing business tools. This includes popular applications like CRMs, document storage solutions, and accounting software, streamlining your workflow and data management. Such integrations ensure that all relevant information is easily accessible.

-

How can businesses ensure compliance with 5472 instructions through airSlate SignNow?

Businesses can ensure compliance with 5472 instructions using airSlate SignNow's robust tracking and documentation features. The platform provides an audit trail for all signed documents, allowing you to review the completion status and time of submission. Additionally, you can set up automatic reminders for key deadlines related to 5472 instructions to avoid penalties.

Get more for Instructions For Form 5472 12Internal Revenue Service

Find out other Instructions For Form 5472 12Internal Revenue Service

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free