Form 5472 Instructions 2011

What is the Form 5472 Instructions

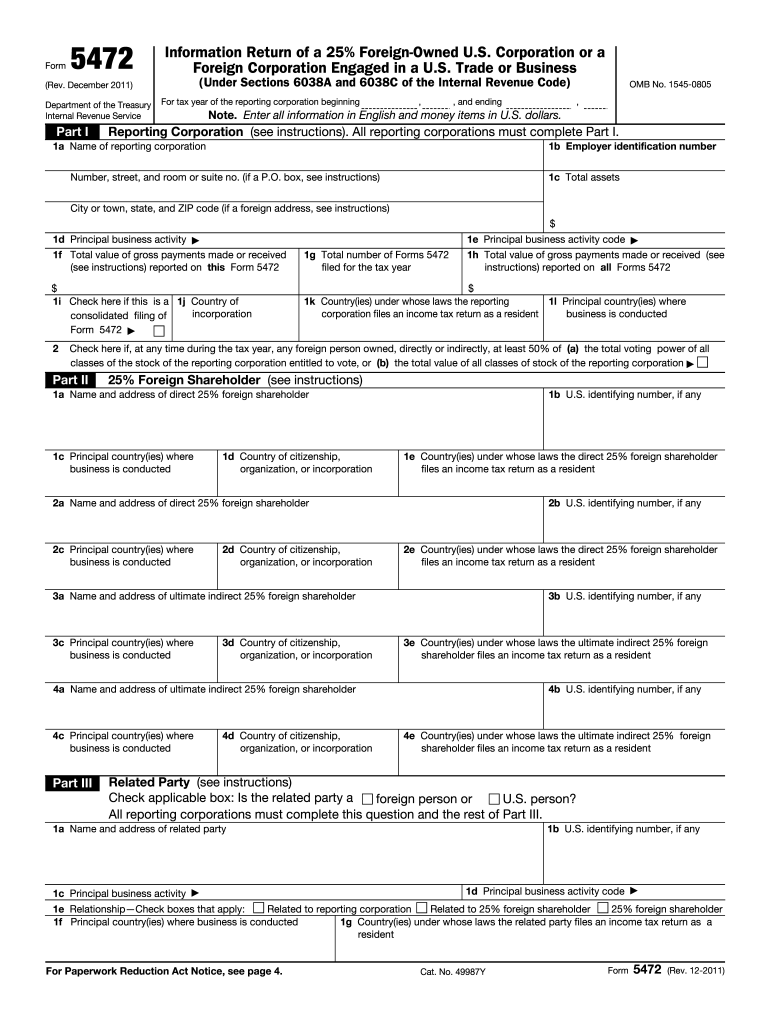

The Form 5472 Instructions provide detailed guidance for U.S. taxpayers who are required to report certain transactions with foreign-related parties. This form is primarily used by foreign corporations engaged in a trade or business in the United States and U.S. corporations that are 25% foreign-owned. The instructions outline the necessary information to complete the form accurately, ensuring compliance with IRS regulations.

Steps to complete the Form 5472 Instructions

Completing the Form 5472 involves several key steps:

- Gather required information about the reporting corporation and its foreign owners.

- Identify and document all reportable transactions with foreign-related parties.

- Fill out the form accurately, ensuring all sections are completed as per the guidelines.

- Review the completed form for accuracy and compliance with IRS requirements.

- Submit the form along with the tax return by the specified deadline.

Legal use of the Form 5472 Instructions

The Form 5472 Instructions are legally binding as they provide the framework for compliance with U.S. tax laws regarding foreign transactions. Proper adherence to these instructions ensures that businesses meet their reporting obligations, thereby avoiding potential penalties for non-compliance. Understanding the legal implications of the form is crucial for maintaining good standing with the IRS.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with Form 5472. Generally, the form must be filed by the due date of the corporation's income tax return, including extensions. For most corporations, this date is the fifteenth day of the fourth month following the end of the tax year. Missing this deadline can result in significant penalties, making timely submission critical.

Required Documents

To complete the Form 5472, several documents are necessary:

- Financial statements of the reporting corporation.

- Records of transactions with foreign-related parties.

- Ownership structure documents to verify foreign ownership.

- Any prior year Form 5472 submissions for reference.

Penalties for Non-Compliance

Failure to file Form 5472 or filing it inaccurately can lead to severe penalties. The IRS imposes a penalty of $10,000 for each failure to file or for each failure to provide complete and accurate information. Additionally, continued non-compliance may result in further legal action or increased scrutiny from tax authorities.

Quick guide on how to complete form 5472 instructions 2011 100028368

Effortlessly prepare Form 5472 Instructions on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 5472 Instructions on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and electronically sign Form 5472 Instructions with ease

- Locate Form 5472 Instructions and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, by email, SMS, or invite link, or download it to your computer.

Simplify the hassle of lost or misplaced files, tedious form searches, or mistakes requiring the reprinting of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form 5472 Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5472 instructions 2011 100028368

Create this form in 5 minutes!

How to create an eSignature for the form 5472 instructions 2011 100028368

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are Form 5472 Instructions?

Form 5472 Instructions provide detailed guidelines on how to complete and file the Form 5472, which is required for certain foreign-owned U.S. corporations. This form helps ensure compliance with U.S. tax laws, particularly regarding transactions with foreign related parties.

-

How can airSlate SignNow help with Form 5472 Instructions?

airSlate SignNow can streamline the process of preparing and signing documents related to Form 5472 Instructions by providing an easy-to-use electronic signing platform. Businesses can efficiently collect signatures and manage documents, ensuring compliance without unnecessary delays.

-

Are there any costs associated with using airSlate SignNow for Form 5472 Instructions?

Yes, airSlate SignNow offers cost-effective pricing plans suited for businesses of all sizes. Customers can choose from different subscription options that best fit their needs while ensuring they have access to tools required for managing Form 5472 Instructions.

-

What features does airSlate SignNow offer for managing Form 5472 Instructions?

AirSlate SignNow offers several features tailored for handling Form 5472 Instructions, including document templates, customizable workflows, and secure cloud storage. These capabilities allow users to efficiently prepare, send, and sign essential documents with ease.

-

Can airSlate SignNow integrate with other software for Form 5472 Instructions?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications and accounting software. This ensures that users can efficiently manage their Form 5472 Instructions in conjunction with their existing business tools.

-

What are the benefits of using airSlate SignNow for eSigning Form 5472 Instructions?

Using airSlate SignNow for eSigning Form 5472 Instructions enhances efficiency and security in document management. Businesses can enjoy faster turnaround times, reduced paper waste, and improved tracking of signed documents, facilitating better compliance.

-

Is it easy to get started with airSlate SignNow for Form 5472 Instructions?

Yes, getting started with airSlate SignNow for Form 5472 Instructions is simple and user-friendly. With just a few steps, you can create an account, upload your documents, and start sending them for eSignature right away.

Get more for Form 5472 Instructions

- Obtaining a power of attorney through irs e services form

- Policies and principles of healthcare engineering form

- By an individual not resident in the uk form

- Instructions for form 8802 082020internal revenue service

- Fillable online 1 enter the credit for wisconsin real and form

- Non residents relief under double taxation agreements non residents relief under double taxation agreements form

- New jersey forms application for a license to operate a new show

- Vo6020 form

Find out other Form 5472 Instructions

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy