Form 5472 Rev December Information Return of a 25% Foreign Owned U S Corporation or a Foreign Corporation Engaged in a U S Trade 2023-2026

Understanding Form 5472

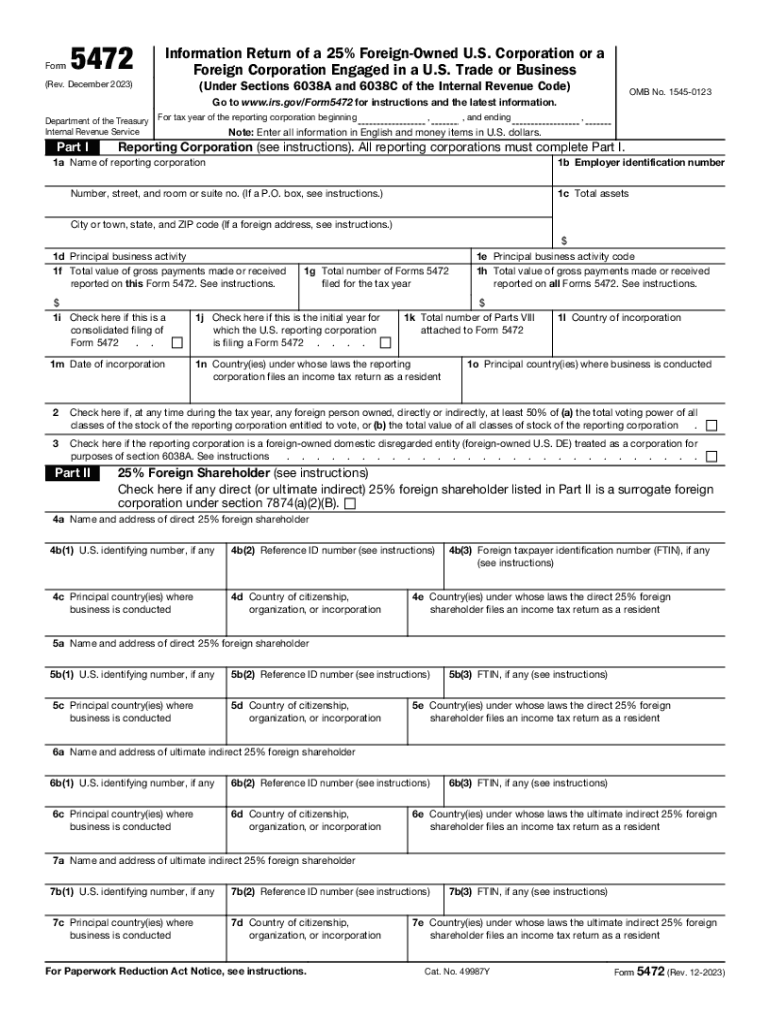

Form 5472 is an information return required under Sections 6038A and 6038C of the Internal Revenue Code. It is specifically designed for reporting information related to a twenty-five percent foreign-owned U.S. corporation or a foreign corporation engaged in a U.S. trade or business. This form helps the IRS monitor foreign ownership and ensure compliance with U.S. tax laws. The information reported includes details about reportable transactions between the reporting corporation and foreign related parties.

Steps to Complete Form 5472

Completing Form 5472 involves several key steps:

- Gather necessary information about the corporation, including its legal name, address, and Employer Identification Number (EIN).

- Identify foreign owners and related parties, including their names, addresses, and ownership percentages.

- Document all reportable transactions that occurred during the tax year, such as sales, purchases, and loans.

- Fill out the form accurately, ensuring all sections are completed, including Part I and Part II.

- Review the form for accuracy before submission to avoid penalties.

Obtaining Form 5472

Form 5472 can be obtained directly from the IRS website. It is available as a PDF file, which can be printed and filled out manually. Additionally, tax software programs often include this form, allowing for easier completion and electronic filing. Ensure you have the most recent version of the form to comply with current IRS requirements.

Filing Deadlines for Form 5472

The deadline for filing Form 5472 aligns with the tax return of the corporation. Generally, this means it is due on the fifteenth day of the fourth month following the end of the corporation's tax year. If the corporation is on a calendar year basis, the form is typically due by April fifteenth. Extensions may be available, but it is crucial to file Form 5472 on time to avoid penalties.

Penalties for Non-Compliance

Failure to file Form 5472 or filing it inaccurately can result in significant penalties. The IRS imposes a penalty of $10,000 for each failure to file the form on time. Additional penalties may apply for incorrect or incomplete information. It is essential to ensure compliance to avoid these financial repercussions.

Key Elements of Form 5472

Form 5472 consists of several important sections:

- Identification of the reporting corporation and its foreign owners.

- Details of reportable transactions, including the nature and amount of each transaction.

- Information about the foreign owners, including their ownership percentage and relationship to the corporation.

- Certification that the information provided is accurate and complete.

IRS Guidelines for Form 5472

The IRS provides detailed guidelines for completing and filing Form 5472. These guidelines include instructions on what constitutes reportable transactions, how to identify related parties, and the necessary documentation to support the information reported. It is advisable to review these guidelines thoroughly to ensure compliance and accuracy when filing the form.

Quick guide on how to complete form 5472 rev december information return of a 25 foreign owned u s corporation or a foreign corporation engaged in a u s trade

Manage Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade on any device with the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

How to modify and electronically sign Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade effortlessly

- Locate Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or mask sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searches, or errors that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5472 rev december information return of a 25 foreign owned u s corporation or a foreign corporation engaged in a u s trade

Create this form in 5 minutes!

How to create an eSignature for the form 5472 rev december information return of a 25 foreign owned u s corporation or a foreign corporation engaged in a u s trade

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 5472 and who needs to file it?

Form 5472 is a document that must be filed by certain foreign entities, including foreign-owned U.S. corporations. It is used to report specific transactions between the foreign entity and related parties. If your business engages in transactions covered by this form, it's essential to comply with IRS requirements to avoid penalties.

-

How can airSlate SignNow help with form 5472?

With airSlate SignNow, you can easily prepare and eSign documents, facilitating the filing process for form 5472. Our platform streamlines your document management and ensures that all necessary signatures are secured quickly. This efficiency allows you to focus on your business while meeting compliance needs.

-

Is there a cost associated with using airSlate SignNow for form 5472?

Yes, airSlate SignNow operates on a subscription model with various pricing plans to suit different business needs. Each plan offers features that can help manage documents related to form 5472 efficiently. You can choose a plan based on your estimated usage and required features.

-

Can I automate the processing of form 5472 with airSlate SignNow?

Absolutely! airSlate SignNow provides automation features that can streamline the creation and signing process for form 5472. By setting up templates and workflows, you can automate repetitive tasks, which saves time and reduces the risk of errors in your filings.

-

What features does airSlate SignNow offer for managing form 5472?

airSlate SignNow offers a variety of features to help manage form 5472, including customizable templates, real-time tracking, and secure cloud storage. These tools allow you to create, send, and sign the form seamlessly, ensuring compliance and improving your workflow efficiency.

-

Are integrations available to make filing form 5472 easier?

Yes, airSlate SignNow integrates with various third-party applications that can facilitate the filing of form 5472. This includes popular accounting software and document management tools that enhance your ability to manage transactions and maintain compliance effectively.

-

What are the benefits of using airSlate SignNow for form 5472?

Using airSlate SignNow for form 5472 provides numerous benefits, such as enhanced efficiency, reduced paperwork, and improved accuracy in your filings. The platform's user-friendly interface simplifies the document creation and signing process, ensuring that you meet IRS deadlines with ease.

Get more for Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure maine form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497310792 form

- Letter from tenant to landlord for failure of landlord to return all prepaid and unearned rent and security recoverable by 497310793 form

- Letter from tenant to landlord for failure of landlord to comply with building codes affecting health and safety or resulting 497310794 form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497310795 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497310796 form

- Letter from landlord to tenant for failure of to dispose all ashes rubbish garbage or other waste in a clean and safe manner in 497310797 form

- Letter from landlord to tenant for failure to keep all plumbing fixtures in the dwelling unit as clean as their condition 497310798 form

Find out other Form 5472 Rev December Information Return Of A 25% Foreign Owned U S Corporation Or A Foreign Corporation Engaged In A U S Trade

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy