Form 1040 2007

What is the Form 1040

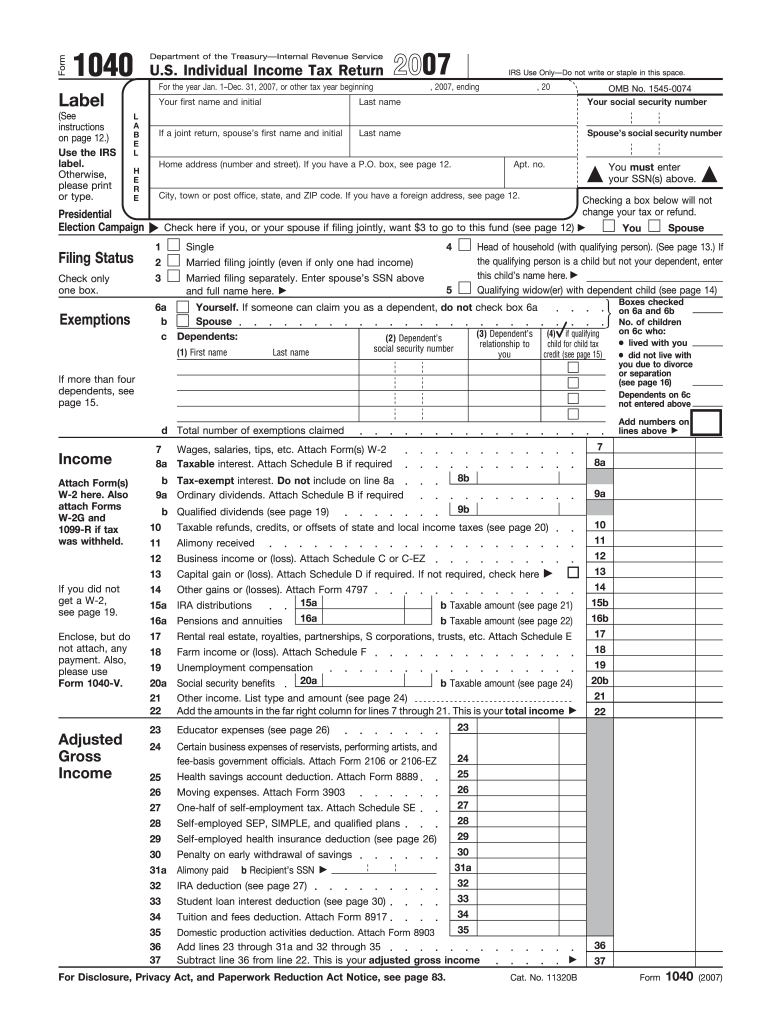

The Form 1040 is the standard individual income tax return form used by U.S. taxpayers to report their annual income and calculate their tax liability. This form is essential for filing federal taxes and is required by the Internal Revenue Service (IRS). It includes various sections where taxpayers can report income from different sources, claim deductions, and apply for tax credits. Understanding the Form 1040 is crucial for ensuring compliance with tax laws and maximizing potential refunds.

How to use the Form 1040

Using the Form 1040 involves several steps that require careful attention to detail. First, gather all necessary financial documents, such as W-2s, 1099s, and records of other income. Next, fill out the form by entering personal information, including your filing status and dependents. Report all income in the appropriate sections and claim any deductions or credits you qualify for. After completing the form, review it thoroughly to ensure accuracy before submitting it to the IRS.

Steps to complete the Form 1040

Completing the Form 1040 requires a systematic approach:

- Gather necessary documents, including income statements and receipts for deductions.

- Choose the correct filing status based on your situation (e.g., single, married filing jointly).

- Enter personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim deductions and credits applicable to your tax situation, such as the standard deduction or itemized deductions.

- Calculate your total tax liability and any refund or amount owed.

- Sign and date the form before submitting it to the IRS.

Required Documents

To complete the Form 1040 accurately, you will need several key documents:

- W-2 forms from employers showing wages and tax withheld.

- 1099 forms for income from freelance work, interest, dividends, or retirement distributions.

- Records of other income, such as rental income or business income.

- Receipts for deductible expenses, including medical costs, mortgage interest, and charitable donations.

- Social Security numbers for yourself, your spouse, and any dependents.

Filing Deadlines / Important Dates

Understanding the deadlines for filing the Form 1040 is essential to avoid penalties:

- The standard deadline for filing your federal tax return is April 15 of each year.

- If April 15 falls on a weekend or holiday, the deadline is extended to the next business day.

- Extensions may be requested, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the Form 1040:

- Online: Taxpayers can e-file their Form 1040 using IRS-approved software, which often provides a streamlined process.

- Mail: Completed forms can be printed and mailed to the appropriate IRS address based on the taxpayer's location and filing status.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices or through tax preparation services.

Quick guide on how to complete 2007 form 1040

Uncover the most efficient method to complete and endorse your Form 1040

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow presents a superior approach to complete and endorse your Form 1040 and related forms for public services. Our intelligent eSignature solution equips you with all the tools necessary to manage documents swiftly and comply with official standards - robust PDF editing, managing, securing, signing, and sharing functionalities are all accessible within a user-friendly interface.

Only a few steps are required to finish filling out and endorsing your Form 1040:

- Upload the editable template to the editor using the Get Form button.

- Verify what information you need to provide in your Form 1040.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize the important parts or Deny fields that are no longer relevant.

- Click on Sign to create a legally binding eSignature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 1040 in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our system also offers versatile form sharing. There’s no necessity to print out your forms when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 1040

FAQs

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do you fill out line 5 on a 1040EZ tax form?

I suspect the question is related to knowing whether someone can claim you as a dependent, because otherwise line 5 itself is pretty clear.General answer: if you are under 19, or a full-time student under the age of 24, your parents can probably claim you as a dependent. If you are living with someone to whom you are not married and who is providing you with more than half of your support, that person can probably claim you as a dependent. If you are married and filing jointly, your spouse needs to answer the same questions.Note that whether those individuals actually do claim you as a dependent doesn't matter; the question is whether they can. It is not a choice.

-

How can I fill up my own 1040 tax forms?

The 1040 Instructions will provide step-by-step instructions on how to prepare the 1040. IRS Publication 17 is also an important resource to use while preparing your 1040 return. You can prepare it online through the IRS website or through a software program. You can also prepare it by hand and mail it in, or you can see a professional tax preparer to assist you with preparing and filing your return.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

How do I understand the 1040 U.S. tax form in terms of an equation instead of a ton of boxes to fill in and instructions to read?

First the 1040 is an exercise in sets:Gross Income - A collection and summation of all your income types.Adjustments - A collection of deductions the tax law allow you to deduct before signNowing AGI. (AGI is used as a threshold for another set of deductions).ExemptionsDeductions - A collection of allowed deductions.Taxes - A Collection of Different collected along with Income TaxesCredits - A collection of allowed reductions in tax owed.Net Tax Owed or Refundable - Hopefully Self Explanatory.Now the formulas:[math]Gross Income - Adjustments = Adjusted Gross Income (AGI)[/math][math]AGI - Exemptions - Deductions = Taxable Income[/math][math]Tax Function (Taxable Income ) = Income Tax[/math][math]Taxes - Credits = Net Tax Owed or Refundable[/math]Please Note each set of lines is meant as a means to make collecting and summing the subsidiary information easier.It would probably be much easier to figure out if everyone wanted to pay more taxes instead of less.

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

Does the IRS require filling in the "cents" fields on form 1040?

No, you are not required to show the cents, however, you should round up or down any cent amount.Computations:The following information may be useful in making the return easier to complete. Rounding off dollars: You can round off cents to whole dollars on your return and schedules. If you do round to whole dollars, you must round all amounts. To round, drop amounts under 50 cents and increase amounts from 50 to 99 cents to the next dollar.For example, $1.39 becomes $1 and $2.50 becomes $3. If you have to add two or more amounts to figure the amount to enter on a line, include cents when adding the amounts and round off only the total.Equal amounts: If you are asked to enter the smaller or larger of two equal amounts, enter that amount.Negative amounts: If you file a paper return and you need to enter a negative amount, put the amount in parentheses rather than using a minus sign. To combine positive and negative amounts, add all the positive amounts together and then subtract the negative amounts.You may find this and additional information on this website: https://www.irs.gov/pub/irs-pdf/... Page 12I hope this information is helpful.

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 1040

How to create an electronic signature for your 2007 Form 1040 online

How to make an eSignature for your 2007 Form 1040 in Google Chrome

How to make an eSignature for signing the 2007 Form 1040 in Gmail

How to create an electronic signature for the 2007 Form 1040 straight from your smartphone

How to make an eSignature for the 2007 Form 1040 on iOS

How to make an electronic signature for the 2007 Form 1040 on Android OS

People also ask

-

What is Form 1040 and how does it relate to eSigning documents?

Form 1040 is the standard IRS form used by individuals to file their annual income tax returns. With airSlate SignNow, you can easily eSign your Form 1040, ensuring that your tax documents are signed quickly and securely. This simplifies the tax filing process, allowing you to focus on other financial matters.

-

Can I use airSlate SignNow to fill out and eSign my Form 1040?

Yes, airSlate SignNow allows you to fill out and eSign your Form 1040 seamlessly. Our platform provides a user-friendly interface that makes it easy to complete your tax information and add your electronic signature. This eliminates the need for printing or mailing, saving you time.

-

What are the pricing options for using airSlate SignNow with Form 1040?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial for new users. Depending on your usage, you can choose from monthly or annual subscriptions that include features specifically designed for managing documents like Form 1040. Check our pricing page for detailed options.

-

What features does airSlate SignNow offer for managing Form 1040 and other tax documents?

airSlate SignNow provides robust features for managing Form 1040, including customizable templates, real-time collaboration, and secure cloud storage. Additionally, our platform supports automated workflows to streamline the process of sending and eSigning tax documents. This enhances efficiency and accuracy in your tax filing.

-

How does airSlate SignNow ensure the security of my Form 1040?

Security is a top priority at airSlate SignNow. We implement advanced encryption and follow industry best practices to protect your Form 1040 and any sensitive information contained within it. Our platform is compliant with regulations to ensure that your data is safe during the eSigning process.

-

Can airSlate SignNow integrate with accounting software for filing Form 1040?

Yes, airSlate SignNow can integrate with various accounting software solutions, making it easier to manage your Form 1040 and other tax documents. This integration allows for a streamlined workflow, enabling you to pull in financial data directly into your tax forms and simplifying the eSigning process.

-

What are the benefits of using airSlate SignNow for Form 1040 compared to traditional methods?

Using airSlate SignNow for your Form 1040 offers numerous benefits over traditional methods, such as faster processing times and reduced paperwork. You can eSign your tax documents from anywhere, on any device, which enhances convenience. Additionally, our platform minimizes errors and ensures compliance with tax regulations.

Get more for Form 1040

- Correctional services learnership 2020 application form

- Transnet jobs form

- Vehicle licence renewal post office 2001 form

- Coid registration form 2020 pdf

- Non academic merit form stellenbosch university

- Sadtu membership form

- Standard bank proof of residence form download

- Signaling status with luxury goods the role of brand prominence pdf form

Find out other Form 1040

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors