Form 6765 2016

What is the Form 6765

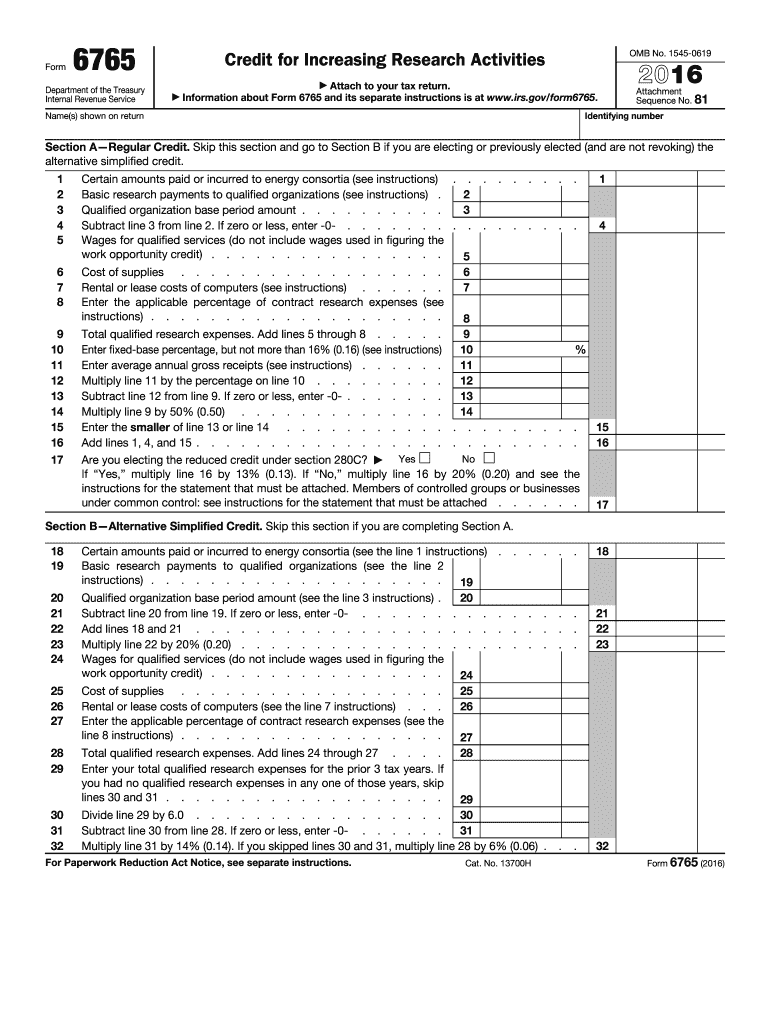

The Form 6765, also known as the Credit for Increasing Research Activities, is a tax form used by businesses to claim a tax credit for qualified research expenses. This form is particularly relevant for companies engaged in research and development activities that aim to improve their products or processes. The credit is designed to encourage innovation and investment in research, providing a financial incentive for businesses to invest in new technologies and methodologies.

How to use the Form 6765

To effectively utilize the Form 6765, businesses must first determine their eligibility for the research credit. This involves identifying qualified research expenses, which may include wages, supplies, and contract research costs. Once eligibility is established, the business can fill out the form by providing the necessary financial details and calculations. It's important to ensure that all information is accurate and complete to avoid delays or issues with the IRS.

Steps to complete the Form 6765

Completing the Form 6765 involves several key steps:

- Gather documentation of all qualified research expenses.

- Fill out the form with accurate financial data, including total expenses and credit calculations.

- Review the form for accuracy and completeness.

- Submit the form with your tax return or file it separately if necessary.

Each step is crucial to ensure that the claim for the research credit is valid and can withstand scrutiny from the IRS.

Legal use of the Form 6765

The legal use of the Form 6765 hinges on compliance with IRS regulations regarding research credits. Businesses must maintain thorough documentation to substantiate their claims. This includes records of research activities, expenses incurred, and any relevant correspondence with tax professionals. Proper legal use also means adhering to deadlines for submission and ensuring that all claims are made in good faith, reflecting genuine research efforts.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 6765, detailing what constitutes qualified research activities and expenses. These guidelines help taxpayers understand the criteria for eligibility and the documentation required to support their claims. Familiarity with these guidelines is essential for businesses to maximize their potential tax credits and avoid penalties associated with incorrect filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6765 align with the general tax return deadlines. Typically, businesses must file their tax returns by April fifteenth of each year, unless an extension is granted. It is crucial to keep track of these dates to ensure timely submission of the form, as late filings may result in the loss of the credit for that tax year.

Quick guide on how to complete form 6765 2016

Effortlessly Prepare Form 6765 on Any Device

The management of documents online has gained immense popularity among both businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage Form 6765 on any device with airSlate SignNow's applications for Android or iOS and enhance any document-related task today.

How to Modify and eSign Form 6765 with Ease

- Locate Form 6765 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Form 6765 and ensure excellent communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6765 2016

Create this form in 5 minutes!

How to create an eSignature for the form 6765 2016

How to make an electronic signature for your Form 6765 2016 in the online mode

How to generate an eSignature for your Form 6765 2016 in Chrome

How to create an electronic signature for signing the Form 6765 2016 in Gmail

How to generate an eSignature for the Form 6765 2016 straight from your smartphone

How to make an electronic signature for the Form 6765 2016 on iOS

How to make an electronic signature for the Form 6765 2016 on Android

People also ask

-

What is Form 6765 and how can airSlate SignNow help with it?

Form 6765 is used to claim the Credit for Increasing Research Activities. airSlate SignNow simplifies the process of completing and submitting Form 6765 by providing an intuitive interface for eSigning and sharing documents, ensuring your submissions are both quick and secure.

-

Is there a cost associated with using airSlate SignNow for Form 6765 submissions?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan allows you to manage documents like Form 6765 efficiently, offering features like unlimited eSignatures, storage, and integrations at an affordable rate.

-

How does airSlate SignNow ensure the security of my Form 6765?

airSlate SignNow prioritizes the security of your documents, including Form 6765, with advanced encryption and compliance with industry standards. This means your sensitive information is protected during the signing process and ensures that your Form 6765 is handled securely.

-

Can I integrate airSlate SignNow with other tools to manage Form 6765?

Absolutely! airSlate SignNow offers seamless integrations with popular tools like Google Drive, Dropbox, and Microsoft Office. This allows you to easily manage and store your Form 6765 alongside other important documents in one centralized location.

-

What features should I look for in an eSignature solution for Form 6765?

When selecting an eSignature solution for Form 6765, look for features like ease of use, customizable templates, and secure signing processes. airSlate SignNow provides all these features, making it a robust choice for managing and submitting your Form 6765.

-

Can I track the status of my Form 6765 once sent for eSignature?

Yes, with airSlate SignNow, you can easily track the status of your Form 6765 after sending it for eSignature. You will receive notifications when your document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is there a mobile app for signing Form 6765 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to sign and manage Form 6765 on the go. This flexibility means you can complete important documents anytime, anywhere, making your workflow more efficient.

Get more for Form 6765

Find out other Form 6765

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation