Form 6765 Internal Revenue Service 2012

What is the Form 6765 Internal Revenue Service

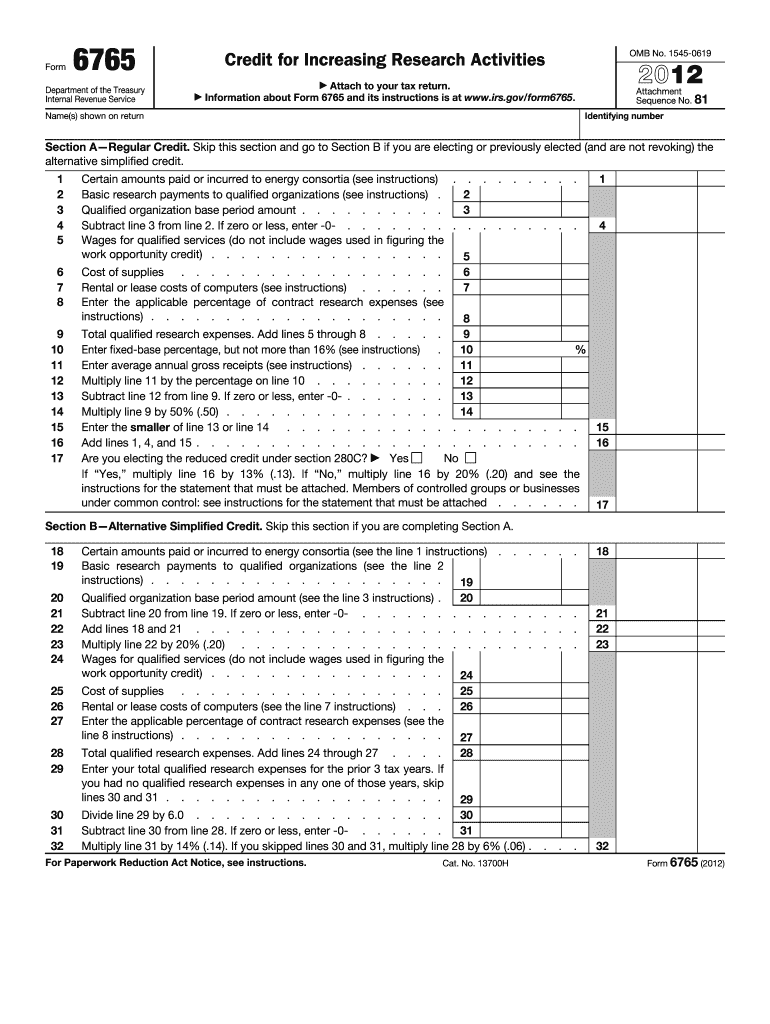

The Form 6765, officially known as the Credit for Increasing Research Activities, is a tax form used by businesses to claim a tax credit for qualified research expenses. This form is essential for companies engaged in research and development (R&D) within the United States, allowing them to reduce their tax liability based on eligible expenditures. The IRS provides this form to incentivize innovation and technological advancement by offering financial relief to businesses investing in R&D activities.

How to use the Form 6765 Internal Revenue Service

Using the Form 6765 involves several steps to ensure compliance and accuracy. Businesses must first determine their eligibility for the research credit, which includes assessing qualified research activities and expenditures. Once eligibility is confirmed, the form must be filled out with precise details regarding the research activities and associated costs. After completing the form, it should be submitted along with the business's tax return to the IRS. It is advisable to keep detailed records of all research activities and expenses to support the claim if audited.

Steps to complete the Form 6765 Internal Revenue Service

Completing the Form 6765 requires careful attention to detail. The following steps outline the process:

- Gather documentation: Collect all records of research activities and expenses, including payroll records, materials costs, and contractor expenses.

- Determine eligibility: Ensure that the research activities meet the IRS criteria for qualified research.

- Fill out the form: Provide accurate information in the designated sections, including the amount of qualified research expenses and the credit being claimed.

- Review and verify: Double-check all entries for accuracy and completeness before submission.

- Submit with tax return: Include the completed Form 6765 with your annual tax return to the IRS.

Legal use of the Form 6765 Internal Revenue Service

The legal use of Form 6765 is governed by IRS regulations that outline the requirements for claiming the research credit. To ensure compliance, businesses must adhere to the definitions of qualified research and maintain thorough documentation of all related expenses. Misuse of the form or inaccurate reporting can lead to penalties, so it is crucial to understand the legal implications and requirements associated with the form.

Filing Deadlines / Important Dates

Filing deadlines for Form 6765 align with the general tax filing deadlines for businesses. Typically, corporations must file their returns by the fifteenth day of the fourth month following the end of their tax year. For partnerships and sole proprietorships, the deadline is usually the fifteenth day of the third month after the end of the tax year. It is important for businesses to be aware of these deadlines to ensure timely submission and avoid penalties.

Eligibility Criteria

To qualify for the research credit claimed on Form 6765, businesses must meet specific eligibility criteria set by the IRS. These include:

- The research must involve a process of experimentation aimed at discovering information that is technological in nature.

- The activities must be intended to develop or improve a product, process, or software.

- Expenses must be incurred for qualified research activities conducted within the United States.

Understanding these criteria is essential for businesses to accurately assess their eligibility for the credit.

Quick guide on how to complete form 6765 internal revenue service

Effortlessly Prepare Form 6765 Internal Revenue Service on Any Device

Digital document management has gained prominence among businesses and individuals. It offers an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all necessary tools to generate, modify, and eSign your documents swiftly without any hold-ups. Manage Form 6765 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Alter and eSign Form 6765 Internal Revenue Service with Ease

- Locate Form 6765 Internal Revenue Service and then click Get Form to begin.

- Take advantage of the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Adjust and eSign Form 6765 Internal Revenue Service to ensure clear communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6765 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 6765 internal revenue service

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is Form 6765 from the Internal Revenue Service?

Form 6765 is a form required by the Internal Revenue Service to claim the Research and Development (R&D) tax credit. This form helps businesses offset their R&D expenses. Understanding how to fill it out correctly is crucial for maximizing your tax benefits.

-

How can airSlate SignNow assist with submitting Form 6765 to the Internal Revenue Service?

airSlate SignNow makes it easy to send and eSign Form 6765 for submission to the Internal Revenue Service. Our platform is designed for ease of use, allowing you to complete and securely send documents without the hassle of physical paperwork.

-

What are the pricing options for using airSlate SignNow to handle Form 6765 Internal Revenue Service submissions?

airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a small business or a large corporation looking to manage Form 6765 submissions effectively, our competitive pricing ensures you receive value for your investment.

-

Can I integrate airSlate SignNow with other tools to manage Form 6765 submissions more efficiently?

Yes, airSlate SignNow offers integrations with a range of tools to streamline your workflow, including document management and accounting software. By integrating these tools, you can manage your Form 6765 submissions alongside other important business processes.

-

What features does airSlate SignNow provide for handling sensitive documents like Form 6765 Internal Revenue Service?

airSlate SignNow prioritizes security with features like secure cloud storage, advanced encryption, and audit trails. These features ensure that your Form 6765 submissions are protected and compliant with data privacy regulations.

-

Is it easy to collaborate with my team on Form 6765 Internal Revenue Service using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration on Form 6765 by enabling multiple team members to review, comment, and eSign documents efficiently. This enhances productivity and ensures that everyone is on the same page before submitting to the Internal Revenue Service.

-

What are the benefits of using airSlate SignNow for eSigning Form 6765 Internal Revenue Service?

Using airSlate SignNow for eSigning Form 6765 offers numerous benefits, including faster processing times, improved accuracy, and reduced paperwork. Our platform simplifies the eSigning process, allowing you to focus on your business rather than administrative tasks.

Get more for Form 6765 Internal Revenue Service

- Trade license renewal form

- Il486 1730 form

- Tmsm 30 form

- Payment plan contract city of indianapolis indygov form

- Paycheck protection program loan application mid penn bank form

- Form sra addendum to business organization and justia

- Certificate of formation mississippi

- Professional solicitors in kentucky kentucky attorney general form

Find out other Form 6765 Internal Revenue Service

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will