Form 6765 2023-2026

What is the Form 6765

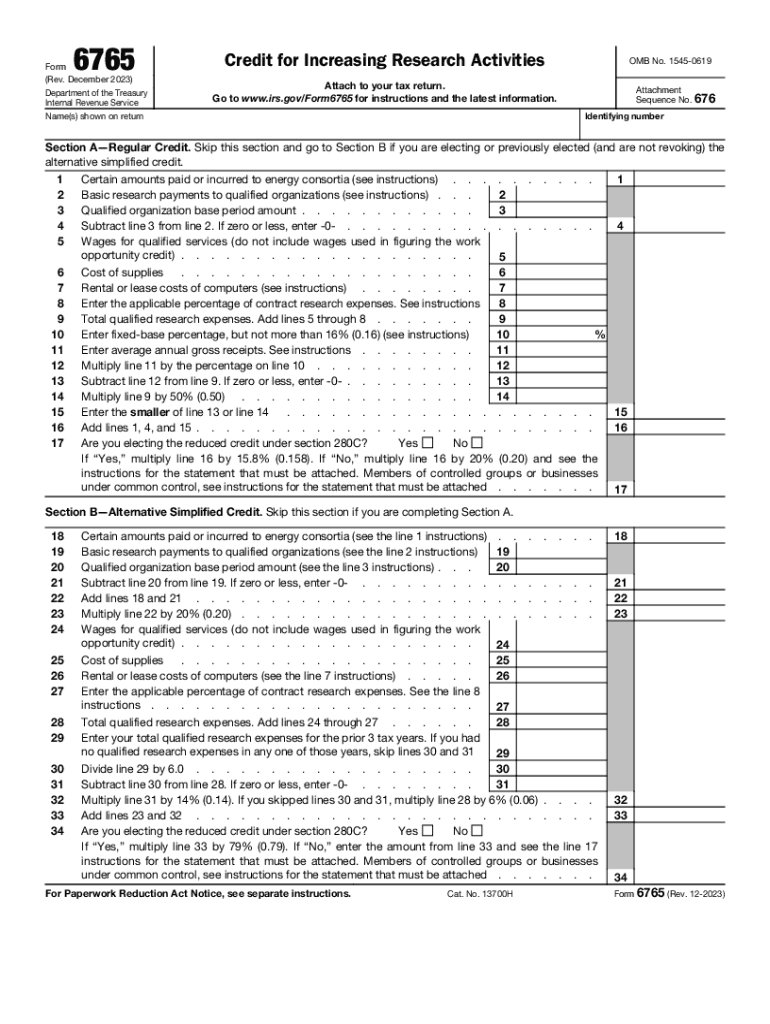

The Form 6765, officially known as the Credit for Increasing Research Activities, is a tax form used by businesses in the United States to claim the Research and Development (R&D) tax credit. This credit is designed to incentivize companies to invest in innovation by allowing them to reduce their tax liability based on qualified research expenses. The form captures essential information about the taxpayer, the nature of the research activities, and the associated costs that qualify for the credit.

How to use the Form 6765

To effectively use the Form 6765, businesses must first determine their eligibility for the R&D tax credit. This involves identifying qualified research activities, which may include developing new products, processes, or software. Once eligibility is established, businesses should accurately fill out the form, detailing their research expenses and the specific projects undertaken. It is crucial to maintain thorough documentation of all related costs, as this information supports the claim and may be required during an audit.

Steps to complete the Form 6765

Completing the Form 6765 involves several key steps:

- Gather all relevant documentation, including payroll records, invoices, and project descriptions.

- Identify and categorize qualified research expenses, such as wages, supplies, and contract research costs.

- Fill out the form, ensuring that all sections are completed accurately, including the calculation of the credit amount.

- Review the form for accuracy and completeness before submission.

- File the form with the IRS along with your tax return, ensuring it is submitted by the applicable deadline.

Eligibility Criteria

Eligibility for claiming the R&D tax credit using Form 6765 is based on specific criteria set by the IRS. Businesses must demonstrate that their research activities meet the four-part test, which includes:

- The purpose of the research must be to create or improve a product, process, or software.

- The research must involve a process of experimentation, including developing or refining prototypes.

- The research must be technological in nature, relying on physical or biological sciences, engineering, or computer science.

- The activities must be intended to eliminate uncertainty regarding the development or improvement of a business component.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 6765. These guidelines include detailed instructions on what constitutes qualified research expenses, how to calculate the credit, and the necessary documentation required to support the claim. It is important for businesses to familiarize themselves with these guidelines to ensure compliance and maximize their potential tax benefits. The IRS also updates these guidelines periodically, so staying informed about any changes is essential for accurate filing.

Filing Deadlines / Important Dates

Filing deadlines for Form 6765 align with the tax return deadlines for businesses. Generally, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For partnerships and sole proprietorships, the deadline is typically the fifteenth day of the third month after the end of the tax year. It is crucial to file Form 6765 by these deadlines to ensure eligibility for the R&D tax credit and avoid any penalties for late submission.

Quick guide on how to complete form 6765 702464764

Effortlessly Prepare Form 6765 on Any Device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and digitally sign your documents swiftly without delays. Manage Form 6765 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Digitally Sign Form 6765 Without Effort

- Search for Form 6765 and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal standing as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 6765 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6765 702464764

Create this form in 5 minutes!

How to create an eSignature for the form 6765 702464764

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it assist with research?

airSlate SignNow is a powerful eSignature solution that enables businesses to manage documents efficiently. For researchers, it simplifies the process of signing off on approvals and agreements, allowing for faster project progression. With easy-to-use features, it helps streamline research workflows and enhances collaboration.

-

How does airSlate SignNow pricing work for research institutions?

airSlate SignNow offers flexible pricing plans that cater to a variety of research institutions and budgets. You can choose a plan based on the number of users and the features you need for your research projects. This cost-effective solution ensures that teams can access the tools necessary for efficient document management.

-

What features make airSlate SignNow ideal for research teams?

AirSlate SignNow comes equipped with features that are particularly beneficial for research teams, such as customizable templates and automated reminders. These tools make it easier to keep track of document workflows and ensure timely signatures, which is essential for maintaining the pace of research activities. Additionally, the platform offers secure storage for all signed documents.

-

Can airSlate SignNow integrate with other research tools?

Yes, airSlate SignNow offers integrations with various research tools, enhancing your workflow. It seamlessly connects with platforms like Google Drive, Salesforce, and others, helping researchers manage their documents alongside their favorite tools. This integration capability allows teams to focus on their research without juggling multiple applications.

-

What security measures does airSlate SignNow have for research documents?

AirSlate SignNow prioritizes the security of your research documents through advanced encryption and secure access protocols. It ensures that sensitive data is protected, which is crucial for compliance in research environments. With robust security measures, researchers can confidently manage their documents without fear of data bsignNowes.

-

How can airSlate SignNow benefit collaborative research efforts?

Collaborative research efforts greatly benefit from airSlate SignNow's user-friendly features. The ability to send documents for eSignature and track their status in real time enhances communication among team members. This ensures all collaborators are on the same page, which is vital for successful research outcomes.

-

What are the advantages of using eSignatures for research agreements?

Using eSignatures for research agreements via airSlate SignNow offers numerous advantages, including speed and accessibility. Researchers can obtain necessary approvals quickly, reducing delays in their projects. Additionally, eSignatures provide a legally binding way to finalize agreements, ensuring research compliance.

Get more for Form 6765

Find out other Form 6765

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed