Form 6765 2015

What is the Form 6765

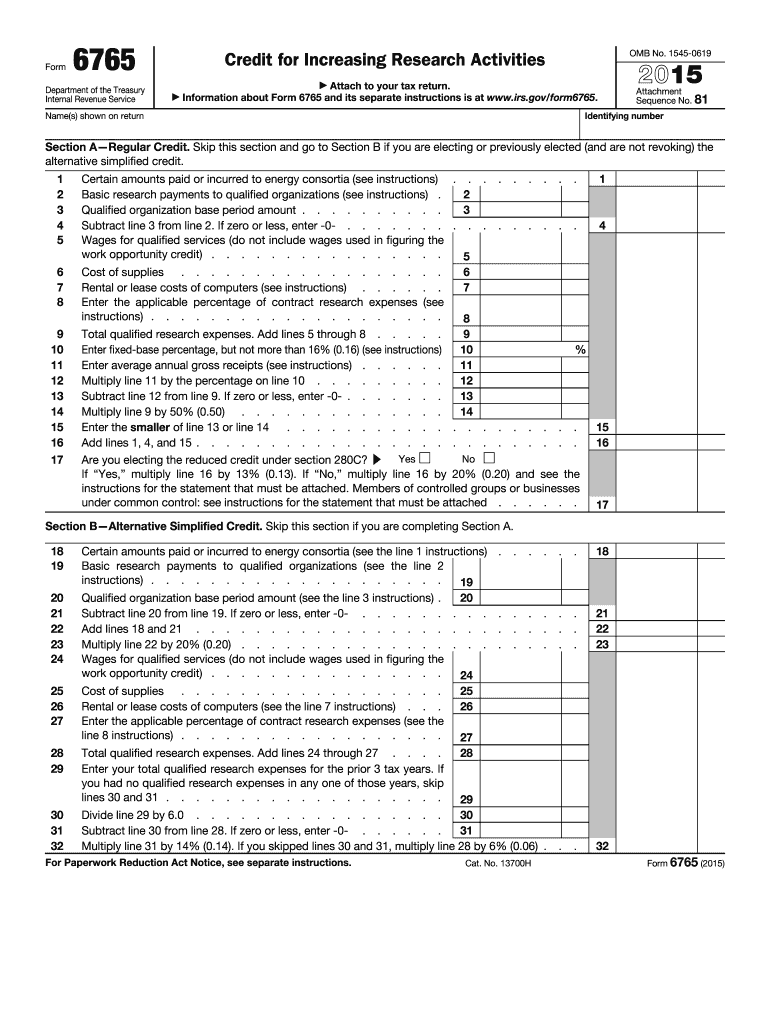

The Form 6765, officially known as the "Credit for Increasing Research Activities," is a tax form used by businesses to claim a tax credit for qualified research expenses. This form is primarily utilized by corporations and partnerships engaged in research and development activities aimed at improving products, processes, or software. The credit is designed to incentivize innovation and technological advancement within the United States.

How to use the Form 6765

Using the Form 6765 involves several key steps. First, businesses must determine their eligibility by assessing their research activities and associated expenses. Next, they should complete the form accurately, providing detailed information about the qualified research activities and costs incurred. Once completed, the form is submitted with the business's tax return. It is essential to retain documentation supporting the research claims, as this may be required in case of an audit.

Steps to complete the Form 6765

Completing the Form 6765 requires careful attention to detail. Follow these steps:

- Gather documentation of all qualified research expenses.

- Fill out the form, including sections on business information and research activities.

- Calculate the credit amount based on the qualified expenses.

- Review the form for accuracy and completeness.

- Attach the form to your tax return and submit it by the filing deadline.

Legal use of the Form 6765

The legal use of the Form 6765 is governed by IRS regulations. To ensure compliance, businesses must adhere to the guidelines set forth by the IRS regarding what constitutes qualified research activities. This includes maintaining accurate records of research expenses and ensuring that the activities meet the necessary criteria for claiming the credit. Failure to comply with these regulations can lead to penalties or disallowance of the credit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6765 align with the overall tax return deadlines for businesses. Typically, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their fiscal year. For partnerships and sole proprietorships, the deadline is the fifteenth day of the third month after the end of the tax year. It is crucial to be aware of these dates to ensure timely submission and avoid penalties.

Eligibility Criteria

To qualify for the tax credit claimed on the Form 6765, businesses must meet specific eligibility criteria. These include:

- Engaging in qualified research activities as defined by the IRS.

- Incurring eligible expenses related to research, such as wages, supplies, and contract research.

- Operating as a corporation, partnership, or sole proprietorship.

Form Submission Methods (Online / Mail / In-Person)

The Form 6765 can be submitted in various ways depending on the filing method chosen by the business. For electronic filers, the form can be submitted online through approved tax software that supports e-filing. For those opting to file by mail, the completed form should be sent to the appropriate IRS address based on the business's location and tax status. In-person submissions are generally not available for this form.

Quick guide on how to complete 2015 form 6765

Complete Form 6765 effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 6765 from any device using airSlate SignNow Android or iOS applications and improve any document-related workflow today.

The easiest way to adjust and eSign Form 6765 without hassle

- Locate Form 6765 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choice. Alter and eSign Form 6765 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 6765

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 6765

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is Form 6765 and how is it used?

Form 6765, also known as the Credit for Increasing Research Activities, is used by businesses to claim tax credits for qualified research expenses. By filing this form, companies can potentially reduce their tax liability, making it beneficial for those engaged in innovative activities.

-

How can airSlate SignNow help with the completion of Form 6765?

airSlate SignNow simplifies the process of completing Form 6765 by allowing businesses to easily fill out, sign, and send the document electronically. This streamlines the submission process, ensuring that the form is completed accurately and efficiently.

-

Is airSlate SignNow cost-effective for managing Form 6765 submissions?

Yes, airSlate SignNow offers a cost-effective solution for managing Form 6765 submissions. With competitive pricing plans, businesses can utilize its features to save time and resources while ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for handling Form 6765?

airSlate SignNow provides a range of features for handling Form 6765, including customizable templates, eSignature capabilities, and document tracking. These tools enhance the user experience, making it easier to manage important tax documents.

-

Can airSlate SignNow integrate with other software for processing Form 6765?

Absolutely! airSlate SignNow seamlessly integrates with various business applications, allowing users to connect their workflow systems for processing Form 6765. These integrations help streamline the data collection and submission process.

-

What are the benefits of using airSlate SignNow for Form 6765?

Using airSlate SignNow for Form 6765 offers numerous benefits, such as enhanced security, reduced processing time, and improved accuracy. Businesses can ensure their submissions are timely and compliant, reducing the risk of errors.

-

Is airSlate SignNow suitable for small businesses filing Form 6765?

Yes, airSlate SignNow is ideal for small businesses looking to file Form 6765 efficiently. Its user-friendly interface and affordable pricing make it accessible for companies of all sizes to manage their tax documentation.

Get more for Form 6765

Find out other Form 6765

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe