Form 6765 Rev December Credit for Increasing Research Activities 2020

What is the Form 6765 Rev December Credit For Increasing Research Activities

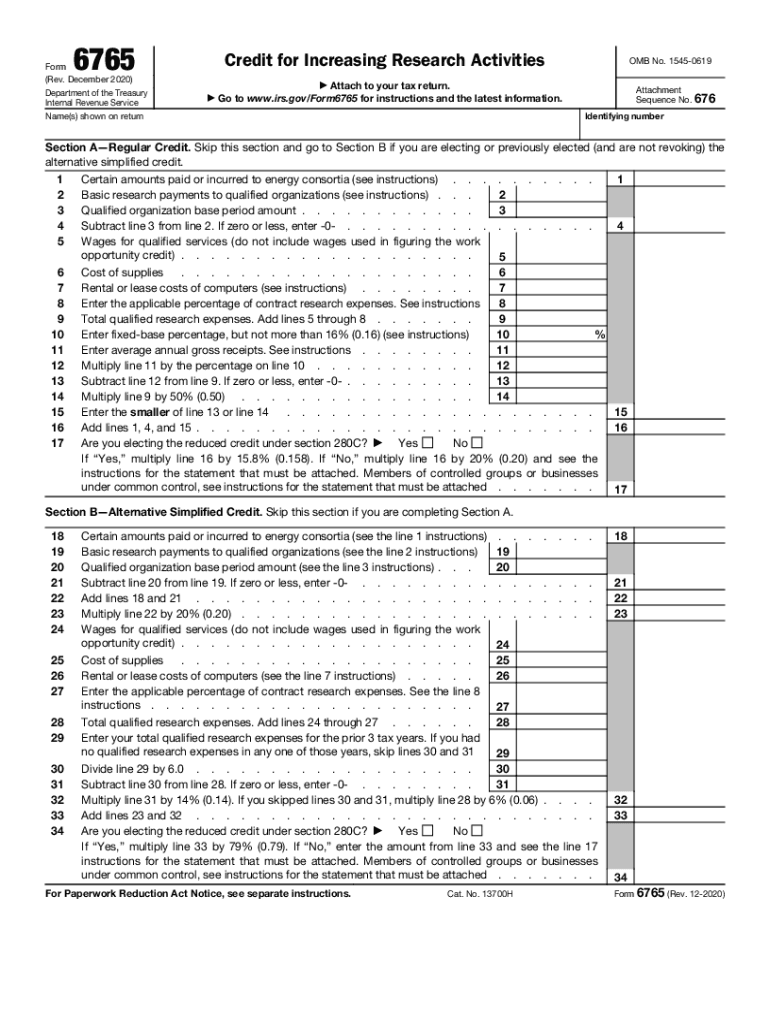

The Form 6765, officially known as the Credit for Increasing Research Activities, is a tax form used by businesses to claim a federal tax credit for qualified research expenses. This form is essential for companies engaging in research and development (R&D) activities aimed at improving products, processes, or software. The credit is designed to incentivize innovation and technological advancement within the United States, allowing eligible businesses to reduce their tax burden significantly.

How to use the Form 6765 Rev December Credit For Increasing Research Activities

To utilize Form 6765 effectively, businesses must first identify their qualifying research activities and expenses. This includes wages paid to employees involved in R&D, costs associated with supplies, and contract research expenses. Once the relevant information is gathered, businesses fill out the form, detailing their research activities and the associated costs. The completed form is then submitted with the business's tax return to claim the credit.

Steps to complete the Form 6765 Rev December Credit For Increasing Research Activities

Completing Form 6765 involves several key steps:

- Gather documentation of all qualified research expenses, including payroll records and invoices.

- Fill out the form, providing detailed descriptions of the research activities and expenses.

- Calculate the credit amount based on the eligible expenses.

- Review the form for accuracy and completeness.

- Submit the form along with your federal tax return.

Eligibility Criteria

To qualify for the tax credit using Form 6765, businesses must meet specific eligibility criteria. These include:

- Engaging in qualified research activities that aim to develop or improve products, processes, or software.

- Incurring eligible expenses, such as wages for R&D personnel and costs for materials used in research.

- Maintaining proper documentation to substantiate the research activities and expenses claimed.

IRS Guidelines

The IRS provides detailed guidelines regarding the use of Form 6765. These guidelines outline the types of activities that qualify for the research credit, the necessary documentation, and the calculation methods for the credit amount. It is crucial for businesses to adhere to these guidelines to ensure compliance and maximize their potential tax benefits.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with Form 6765. Typically, the form should be submitted with the annual tax return, which is due on April 15 for most businesses. However, extensions may apply, so it is important to check the IRS guidelines for specific dates and any changes that may occur annually.

Quick guide on how to complete form 6765 rev december 2020 credit for increasing research activities

Prepare Form 6765 Rev December Credit For Increasing Research Activities effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 6765 Rev December Credit For Increasing Research Activities on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 6765 Rev December Credit For Increasing Research Activities with ease

- Find Form 6765 Rev December Credit For Increasing Research Activities and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark essential sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to share your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 6765 Rev December Credit For Increasing Research Activities to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 6765 rev december 2020 credit for increasing research activities

Create this form in 5 minutes!

How to create an eSignature for the form 6765 rev december 2020 credit for increasing research activities

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

How can airSlate SignNow improve my research process?

airSlate SignNow streamlines document management, allowing you to focus on your research without the administrative burden. With features like templates and automated workflows, you can quickly send and receive documents, ensuring that your research activities are not interrupted. This efficiency enables you to dedicate more time to core research tasks.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a range of pricing plans to fit various research needs and budgets. You can choose from monthly or annual subscriptions, with tiered pricing that unlocks additional features as your research demands grow. This flexibility ensures that you can find a plan that suits your specific research organization.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial that allows users to explore its features before committing to a plan. This trial period enables you to assess how airSlate SignNow can enhance your research and document signing processes. Take advantage of the trial to determine if it meets your research requirements.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various applications that are crucial for your research, such as Google Drive, Slack, and CRM systems. These integrations ensure that your research workflow remains uninterrupted while using multiple tools. You can easily manage documents associated with your research without switching platforms.

-

How secure is my research data with airSlate SignNow?

Your research data is protected with advanced security features provided by airSlate SignNow, including data encryption and secure access controls. These measures ensure that sensitive research information is safeguarded against unauthorized access. With airSlate SignNow, you can confidently manage and eSign documents related to your research.

-

Can airSlate SignNow help with compliance in research documentation?

Absolutely, airSlate SignNow assists in maintaining compliance by providing features tailored for research documentation. Its audit trails and secure storage options help you track all changes and interactions with your documents. This level of oversight is essential for research projects that require adherence to strict regulatory standards.

-

What are the primary benefits of using airSlate SignNow for research?

The primary benefits of airSlate SignNow for research include time-saving document workflows, cost-effectiveness, and improved collaboration. With easy document sending and signing capabilities, you can focus on conducting your research rather than managing paperwork. This can signNowly enhance the overall efficiency of your research activities.

Get more for Form 6765 Rev December Credit For Increasing Research Activities

Find out other Form 6765 Rev December Credit For Increasing Research Activities

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free