Form it 601Claim for EZ Wage Tax CreditIT601 Tax Ny

What is the Form IT-601 Claim for EZ Wage Tax Credit?

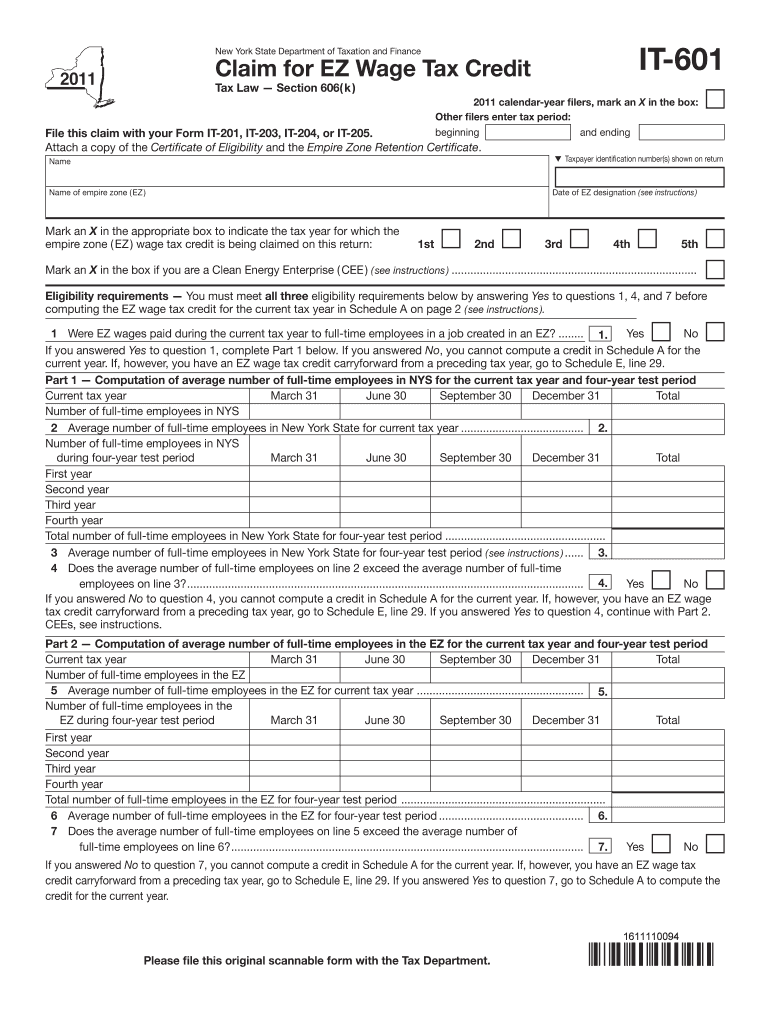

The Form IT-601 is a tax document used by eligible taxpayers in New York to claim the EZ Wage Tax Credit. This credit is designed to provide financial relief to individuals who have earned income and meet specific eligibility criteria. By filing this form, taxpayers can potentially reduce their overall tax liability, making it an important tool for those looking to maximize their tax benefits.

Steps to Complete the Form IT-601 Claim for EZ Wage Tax Credit

Completing the Form IT-601 involves several straightforward steps:

- Gather necessary documentation, including proof of income and any relevant tax information.

- Fill out the personal information section accurately, including your name, address, and Social Security number.

- Provide details regarding your income and any other relevant financial information required for the EZ Wage Tax Credit.

- Review the form for accuracy to ensure all information is correct and complete.

- Sign and date the form to validate your claim.

Eligibility Criteria for the EZ Wage Tax Credit

To qualify for the EZ Wage Tax Credit, taxpayers must meet specific eligibility criteria. Generally, this includes:

- Having earned income during the tax year.

- Meeting the income limits set by the state of New York.

- Filing a New York State tax return.

It is essential to review these criteria carefully to determine if you qualify for the credit before submitting your claim.

How to Obtain the Form IT-601 Claim for EZ Wage Tax Credit

The Form IT-601 can be obtained through various means. Taxpayers can access the form online via the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or public libraries. Ensuring you have the most recent version of the form is crucial for accurate filing.

Filing Deadlines for the Form IT-601

Timely filing of the Form IT-601 is essential to secure your tax credit. The deadline typically aligns with the standard tax filing deadline, which is usually April 15 of each year. However, it is advisable to check for any updates or extensions that may apply to the current tax year to ensure compliance.

Legal Use of the Form IT-601 Claim for EZ Wage Tax Credit

The Form IT-601 is legally recognized as a valid document for claiming the EZ Wage Tax Credit when filled out correctly and submitted on time. Compliance with all relevant tax laws and regulations is necessary to avoid any penalties or issues with the tax authorities. Utilizing a reliable eSignature solution can enhance the legal validity of your submission.

Quick guide on how to complete form it 6012011claim for ez wage tax creditit601 tax ny

Effortlessly prepare Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly option to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The simplest way to edit and eSign Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny without any hassle

- Find Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the form it 6012011claim for ez wage tax creditit601 tax ny

How to generate an eSignature for the Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny in the online mode

How to create an electronic signature for your Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny in Google Chrome

How to create an eSignature for signing the Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny in Gmail

How to create an eSignature for the Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny from your mobile device

How to generate an electronic signature for the Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny on iOS devices

How to make an electronic signature for the Form It 6012011claim For Ez Wage Tax Creditit601 Tax Ny on Android devices

People also ask

-

What is Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny?

Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny is a tax form used by businesses in New York to claim the EZ Wage Tax Credit. This tax credit is designed to incentivize businesses to hire and retain employees, ultimately reducing their tax burden. By using this form, businesses can receive signNow financial benefits, which can be a great advantage during tax season.

-

How can airSlate SignNow help with Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny?

airSlate SignNow simplifies the process of filling out and submitting Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny. Our platform allows you to create, edit, and eSign your tax documents efficiently, ensuring that all necessary information is accurately captured and submitted on time. This can save you valuable time and reduce the likelihood of errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features tailored for tax document management, including templates for Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny, electronic signatures, and secure cloud storage. Our user-friendly interface makes it easy to navigate through your documents, while robust security measures protect sensitive information. You can also track document status to ensure timely submissions.

-

Is airSlate SignNow affordable for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to various needs, ensuring that you can efficiently manage documents like Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny without breaking the bank. This affordability allows you to focus on growing your business while managing your tax obligations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and tax preparation software, making it easy to manage your tax forms, including the Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny. This integration helps streamline your workflow, allowing you to import data directly and ensuring all your documents are in sync.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our digital solution allows you to eSign documents quickly and store them securely, helping you stay organized and compliant with tax regulations. Additionally, you’ll have access to real-time updates on your document status.

-

How secure is airSlate SignNow for storing tax documents?

airSlate SignNow prioritizes the security of your documents, including tax forms such as Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny. We implement advanced encryption protocols, multi-factor authentication, and secure cloud storage to protect your sensitive information. You can trust that your documents are safe and accessible only to authorized users.

Get more for Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny

- Claim for refund of sales and use tax form 7 nebraska

- 600 corporation tax return georgia department of revenue form

- Reason for completing this update must be completed form

- 2020 form 3903 moving expenses

- 2020 instructions for form 8801 instructions for form 8801 credit for prior year minimum taxindividuals estates and trusts

- 5 redeemed nonqualified notices form

- Form 945 a rev december 2020 annual record of federal tax liability

- Form 8869 rev december 2020 qualified subchapter s subsidiary election

Find out other Form IT 601Claim For EZ Wage Tax CreditIT601 Tax Ny

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract