12 995c Form 2010

What is the 12 995c Form

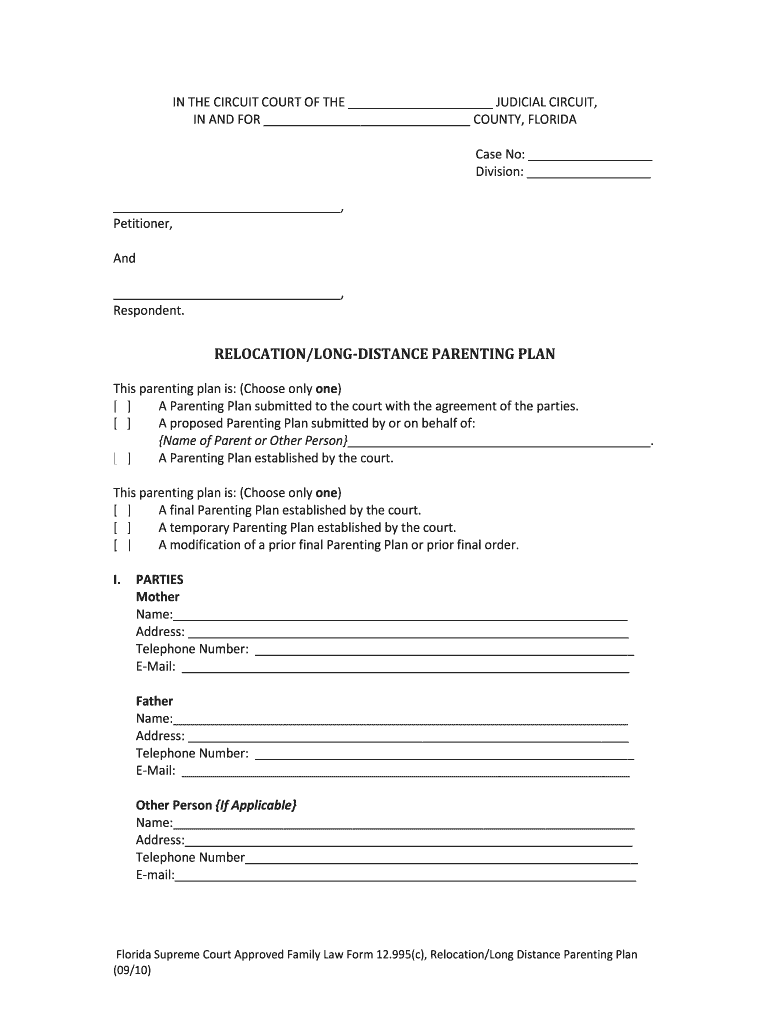

The 12 995c Form is a specific document used primarily for tax purposes within the United States. It serves as a means for individuals or businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance and accurate reporting. The 12 995c Form may be required for various tax-related activities, ensuring that all necessary information is disclosed to the IRS.

How to use the 12 995c Form

Using the 12 995c Form involves several steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out each section of the form, ensuring that all figures are correct. Once completed, review the form for any errors or omissions. Finally, submit the form according to the guidelines provided by the IRS, either electronically or via mail, depending on your preference.

Steps to complete the 12 995c Form

Completing the 12 995c Form requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial records, including income statements and expense reports.

- Begin filling out the form by entering your personal or business information at the top.

- Proceed to input financial data in the designated sections, ensuring accuracy.

- Double-check all entries for correctness and completeness.

- Sign and date the form where required.

- Submit the form according to IRS guidelines.

Legal use of the 12 995c Form

The legal use of the 12 995c Form is governed by IRS regulations. It is essential to ensure that the form is completed accurately and submitted on time to avoid penalties. The information reported must be truthful and reflect the actual financial situation of the individual or business. Misrepresentation or failure to file can lead to legal consequences, including fines or audits by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 12 995c Form are critical to ensure compliance with IRS regulations. Typically, the form must be submitted by a specific date each year, which aligns with the overall tax filing deadline. It is advisable to be aware of any changes to these dates, as they can vary from year to year. Keeping track of these important dates helps avoid late fees and potential penalties.

Who Issues the Form

The 12 995c Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain the form, complete it, and submit it. It is important to refer to the IRS website or official publications for the most current version of the form and any accompanying instructions.

Quick guide on how to complete 12 995c 2010 form

Effortlessly finalize 12 995c Form on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Handle 12 995c Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Editing and eSigning 12 995c Form with ease

- Find 12 995c Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, cumbersome form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Alter and eSign 12 995c Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 12 995c 2010 form

Create this form in 5 minutes!

How to create an eSignature for the 12 995c 2010 form

How to generate an electronic signature for your 12 995c 2010 Form in the online mode

How to generate an electronic signature for the 12 995c 2010 Form in Google Chrome

How to create an electronic signature for putting it on the 12 995c 2010 Form in Gmail

How to make an electronic signature for the 12 995c 2010 Form straight from your mobile device

How to generate an eSignature for the 12 995c 2010 Form on iOS devices

How to create an eSignature for the 12 995c 2010 Form on Android

People also ask

-

What is the 12 995c Form and why do I need it?

The 12 995c Form is a crucial document used for various business transactions. It serves as a formal agreement that can be electronically signed using airSlate SignNow, making the process efficient and secure. Utilizing the 12 995c Form allows businesses to streamline their document management and ensure compliance.

-

How does airSlate SignNow simplify the 12 995c Form signing process?

airSlate SignNow offers an intuitive platform that simplifies the signing process for the 12 995c Form. With features like drag-and-drop signature placement and real-time tracking, users can easily manage and sign documents from any device. This ensures that the 12 995c Form is executed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow with the 12 995c Form?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses using the 12 995c Form. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while offering all the necessary features for effective document management.

-

Can I integrate airSlate SignNow with other software for the 12 995c Form?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing the usability of the 12 995c Form. Whether you use CRM systems or cloud storage services, these integrations allow for a smooth workflow and better document management.

-

What are the key features of airSlate SignNow for managing the 12 995c Form?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure cloud storage, all designed to enhance the management of the 12 995c Form. These features help in reducing errors and saving time, making document signing a hassle-free experience.

-

Is airSlate SignNow secure for signing the 12 995c Form?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and audit trails, to protect the integrity of the 12 995c Form. Your documents are safe, ensuring that sensitive information remains confidential throughout the signing process.

-

How can I track the status of my 12 995c Form with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your 12 995c Form in real time. The platform provides notifications and updates on when the document is viewed, signed, or completed, giving you full visibility throughout the signing process.

Get more for 12 995c Form

Find out other 12 995c Form

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will