Form 1065 B Irs 2016

What is the Form 1065 B Irs

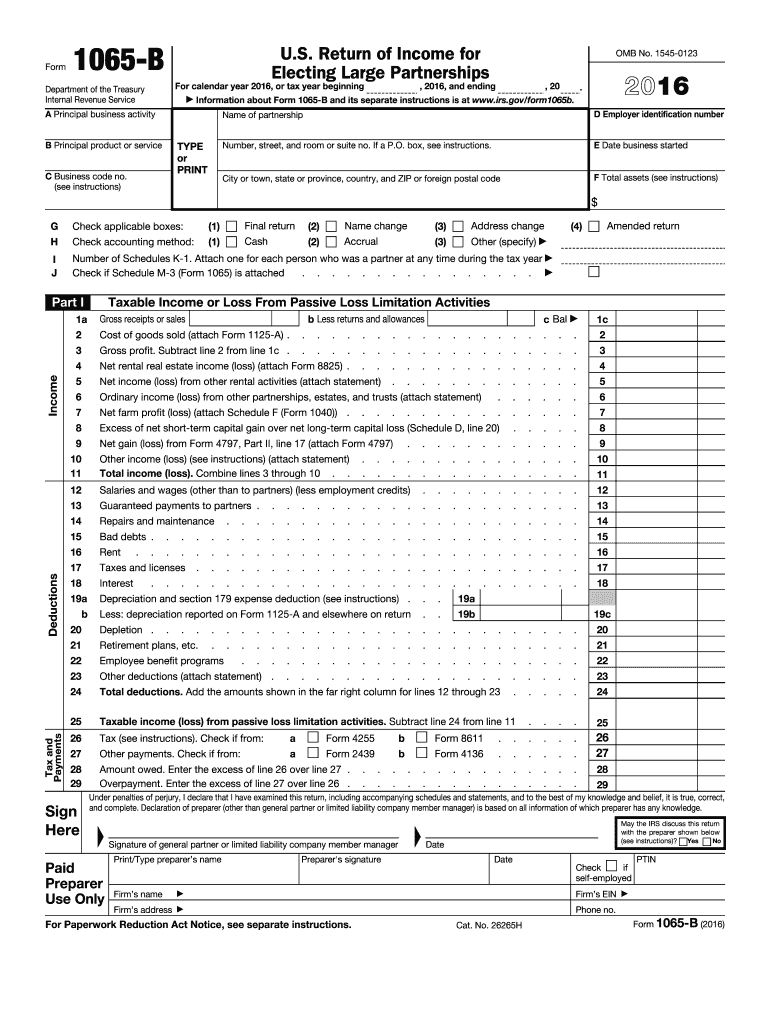

The Form 1065 B Irs is a tax return form used by partnerships to report income, deductions, gains, and losses from their operations. This form is specifically designed for certain types of partnerships that elect to be treated as "small partnerships" under IRS guidelines. It allows these entities to report their financial activities to the Internal Revenue Service (IRS) while providing transparency to partners regarding their share of income and losses. The form is essential for compliance with federal tax regulations and is a key document in the partnership tax filing process.

How to use the Form 1065 B Irs

Using the Form 1065 B Irs involves several steps that ensure accurate reporting of partnership income and deductions. First, partnerships must gather all necessary financial information, including income statements and expense records. Next, the form requires detailed entries regarding the partnership's income, deductions, and credits. Each partner's share of the partnership's income and losses must also be calculated and reported. After completing the form, it should be filed with the IRS by the designated deadline, typically March 15 for calendar-year partnerships. Partners will receive a Schedule K-1, which details their share of the partnership's income, deductions, and credits for their personal tax returns.

Steps to complete the Form 1065 B Irs

Completing the Form 1065 B Irs requires careful attention to detail. Here are the steps involved:

- Gather all financial documents, including income and expense records.

- Fill out the basic information section, including the partnership name, address, and Employer Identification Number (EIN).

- Report total income by entering gross receipts or sales, along with other income sources.

- Detail deductible expenses, including salaries, rent, and other operational costs.

- Calculate the partnership's taxable income by subtracting total deductions from total income.

- Complete Schedule K, which summarizes each partner's share of income, deductions, and credits.

- Review the form for accuracy and ensure all required signatures are included.

- File the completed form with the IRS by the deadline.

Legal use of the Form 1065 B Irs

The legal use of the Form 1065 B Irs is critical for compliance with federal tax laws. Partnerships must file this form annually to report their financial activities accurately. Failure to file or inaccuracies in reporting can lead to penalties and interest charges from the IRS. Additionally, the form serves as a legal document that provides evidence of the partnership's income and expenses, which can be important in case of audits or disputes. By using the form correctly, partnerships can maintain their legal standing and ensure that all partners are informed of their tax obligations.

Filing Deadlines / Important Dates

Partnerships must adhere to specific deadlines when filing the Form 1065 B Irs. The standard filing deadline for partnerships is March 15 for calendar-year filers. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension to file, but this does not extend the deadline for paying any taxes owed. It is crucial for partnerships to keep track of these dates to avoid penalties and ensure timely compliance with IRS regulations.

Required Documents

To complete the Form 1065 B Irs accurately, partnerships need to gather several key documents:

- Financial statements, including profit and loss statements.

- Records of all income sources, such as sales and investment income.

- Documentation of deductible expenses, including receipts and invoices.

- Partner agreements that outline the distribution of profits and losses.

- Previous years' tax returns for reference.

Quick guide on how to complete 2016 form 1065 b irs

Finish Form 1065 B Irs effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 1065 B Irs on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Form 1065 B Irs easily

- Obtain Form 1065 B Irs and click Get Form to kick things off.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with functions that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1065 B Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1065 b irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1065 b irs

How to create an electronic signature for your 2016 Form 1065 B Irs online

How to create an eSignature for your 2016 Form 1065 B Irs in Google Chrome

How to generate an electronic signature for putting it on the 2016 Form 1065 B Irs in Gmail

How to generate an electronic signature for the 2016 Form 1065 B Irs straight from your smartphone

How to create an electronic signature for the 2016 Form 1065 B Irs on iOS devices

How to generate an electronic signature for the 2016 Form 1065 B Irs on Android

People also ask

-

What is Form 1065 B IRS and who needs to file it?

Form 1065 B IRS is a tax return form used by certain partnerships to report income, deductions, and credits to the IRS. This form is specifically for electing large partnerships that have made an election under IRS regulations. If your business falls under this classification, you are required to file Form 1065 B IRS annually.

-

How can airSlate SignNow help with filing Form 1065 B IRS?

airSlate SignNow streamlines the process of filing Form 1065 B IRS by allowing you to easily eSign and send documents securely. Our platform ensures that your tax forms are handled efficiently, reducing the time spent on paperwork. Additionally, you can store and manage your signed documents all in one place.

-

What features does airSlate SignNow offer for managing Form 1065 B IRS documents?

With airSlate SignNow, you get features designed to simplify the management of Form 1065 B IRS documents, such as customizable templates, cloud storage, and real-time tracking of document status. Our intuitive interface allows you to quickly navigate through the eSigning process, ensuring compliance and accuracy when filing.

-

Is there a cost associated with using airSlate SignNow for Form 1065 B IRS?

Yes, there is a cost associated with using airSlate SignNow, but we offer flexible pricing plans to suit different business needs. Our solutions are cost-effective, especially when you consider the time and resources saved by automating the eSigning process for Form 1065 B IRS and other documents. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 1065 B IRS?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, enhancing your ability to manage Form 1065 B IRS and other documents. Whether you use accounting software or project management tools, our integrations will help streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for Form 1065 B IRS?

Using airSlate SignNow for Form 1065 B IRS offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. Our platform is designed to simplify the eSigning process, ensuring compliance with IRS requirements while also providing a user-friendly experience.

-

How secure is airSlate SignNow for handling Form 1065 B IRS documents?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and compliance measures to protect your Form 1065 B IRS documents from unauthorized access. You can trust that your sensitive information is safe with us while you streamline your document signing process.

Get more for Form 1065 B Irs

Find out other Form 1065 B Irs

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form