Form 1065 B Internal Revenue Service Irs 2015

What is the Form 1065 B Internal Revenue Service IRS

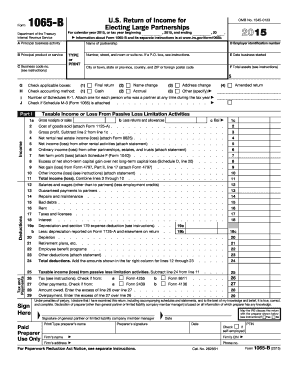

The Form 1065 B is a tax document used by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). This form is specifically designed for certain partnerships that are classified as "electing large partnerships." It allows these entities to report their financial information in a streamlined manner, reflecting their unique tax treatment under U.S. law. The form provides a comprehensive overview of the partnership's financial activities, ensuring compliance with federal tax regulations.

How to use the Form 1065 B Internal Revenue Service IRS

To effectively use the Form 1065 B, partnerships must first determine their eligibility based on size and structure. Once confirmed, the partnership should gather all necessary financial documentation, including income statements and expense reports. The form requires detailed reporting of income, deductions, and other relevant financial data. After completing the form, partnerships must file it with the IRS by the designated deadline, ensuring that all information is accurate and complete to avoid penalties.

Steps to complete the Form 1065 B Internal Revenue Service IRS

Completing the Form 1065 B involves several key steps:

- Gather financial records: Collect all necessary documents, such as income statements, balance sheets, and expense reports.

- Determine eligibility: Confirm that the partnership qualifies as an electing large partnership.

- Fill out the form: Accurately enter all required information, including income, deductions, and partner information.

- Review for accuracy: Double-check all entries to ensure compliance with IRS guidelines.

- File the form: Submit the completed Form 1065 B to the IRS by the due date, either electronically or via mail.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 1065 B. Typically, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. Extensions may be available, but it is crucial to file for an extension before the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 1065 B on time or submitting inaccurate information can result in significant penalties. The IRS imposes fines for late filings, which can accumulate daily until the form is submitted. Additionally, incorrect information may lead to audits or further scrutiny from tax authorities. It is essential for partnerships to maintain accurate records and file timely to mitigate these risks.

Digital vs. Paper Version

Partnerships have the option to file the Form 1065 B either digitally or on paper. Filing electronically is often more efficient, allowing for quicker processing and confirmation of receipt by the IRS. Electronic filing also reduces the risk of errors associated with manual entry. However, some partnerships may prefer the traditional paper filing method. Regardless of the chosen method, it is important to ensure that all information is accurately reported to comply with IRS regulations.

Quick guide on how to complete 2015 form 1065 b internal revenue service irs

Complete Form 1065 B Internal Revenue Service Irs smoothly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Handle Form 1065 B Internal Revenue Service Irs on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and eSign Form 1065 B Internal Revenue Service Irs easily

- Locate Form 1065 B Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Form 1065 B Internal Revenue Service Irs and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 1065 b internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 1065 b internal revenue service irs

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 1065 B from the Internal Revenue Service (IRS)?

Form 1065 B is a tax form used by partnerships to report income, deductions, and other important information to the Internal Revenue Service (IRS). It is essential for ensuring compliance and proper tax treatment for partnership entities. Understanding Form 1065 B is crucial for any business partnership operating in the U.S.

-

How can airSlate SignNow facilitate the completion of Form 1065 B for the IRS?

Using airSlate SignNow, businesses can easily create, send, and eSign their Form 1065 B for the Internal Revenue Service (IRS). The platform provides a straightforward interface to streamline the documentation process, ensuring that tax forms are filled accurately and submitted on time. This efficiency can save time and reduce the risk of errors.

-

What are the benefits of using airSlate SignNow for managing Form 1065 B?

airSlate SignNow offers numerous benefits when managing Form 1065 B for the Internal Revenue Service (IRS). These include enhanced collaboration among partners, secure electronic signature capabilities, and easy tracking of document status. By optimizing the process, businesses can focus on their core operations while ensuring compliance.

-

Does airSlate SignNow provide integrations with accounting software for Form 1065 B?

Yes, airSlate SignNow integrates seamlessly with various accounting software systems, making it easier for businesses to complete and file their Form 1065 B with the IRS. These integrations help streamline data transfer and reduce manual entry, leading to increased accuracy and efficiency. This ensures a smooth process from document creation to submission.

-

What pricing plans does airSlate SignNow offer for businesses needing to file Form 1065 B?

airSlate SignNow provides flexible pricing plans to suit different business needs, making it cost-effective for those needing to file Form 1065 B with the IRS. Plans vary based on features and the number of users, allowing businesses to pick a package that best meets their operational requirements. The competitive pricing ensures that even small businesses can access essential eSigning solutions.

-

Is airSlate SignNow compliant with IRS regulations for Form 1065 B?

Absolutely! airSlate SignNow is designed to comply with all necessary regulations, including those set forth by the Internal Revenue Service (IRS) regarding Form 1065 B. The platform utilizes secure encryption and robust authentication protocols to protect sensitive data and ensure the integrity of the eSigning process.

-

Can I access airSlate SignNow from multiple devices when completing Form 1065 B for the IRS?

Yes, airSlate SignNow is accessible from multiple devices, allowing users to manage their Form 1065 B for the Internal Revenue Service (IRS) anytime and anywhere. Whether using a desktop, tablet, or smartphone, you can easily create, edit, and eSign documents on the go. This flexibility is ideal for busy professionals managing their tax documentation.

Get more for Form 1065 B Internal Revenue Service Irs

- Letter landlord tenant 497303730 form

- Landlord tenant law 497303731 form

- Georgia violation form

- Letter from tenant to landlord about insufficient notice of rent increase georgia form

- Notice rent increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase georgia form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant georgia form

- Letter from tenant to landlord containing notice to landlord to withdraw retaliatory rent increase georgia form

Find out other Form 1065 B Internal Revenue Service Irs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors