Form 1065 B Internal Revenue Service Irs 2013

What is the Form 1065 B Internal Revenue Service IRS

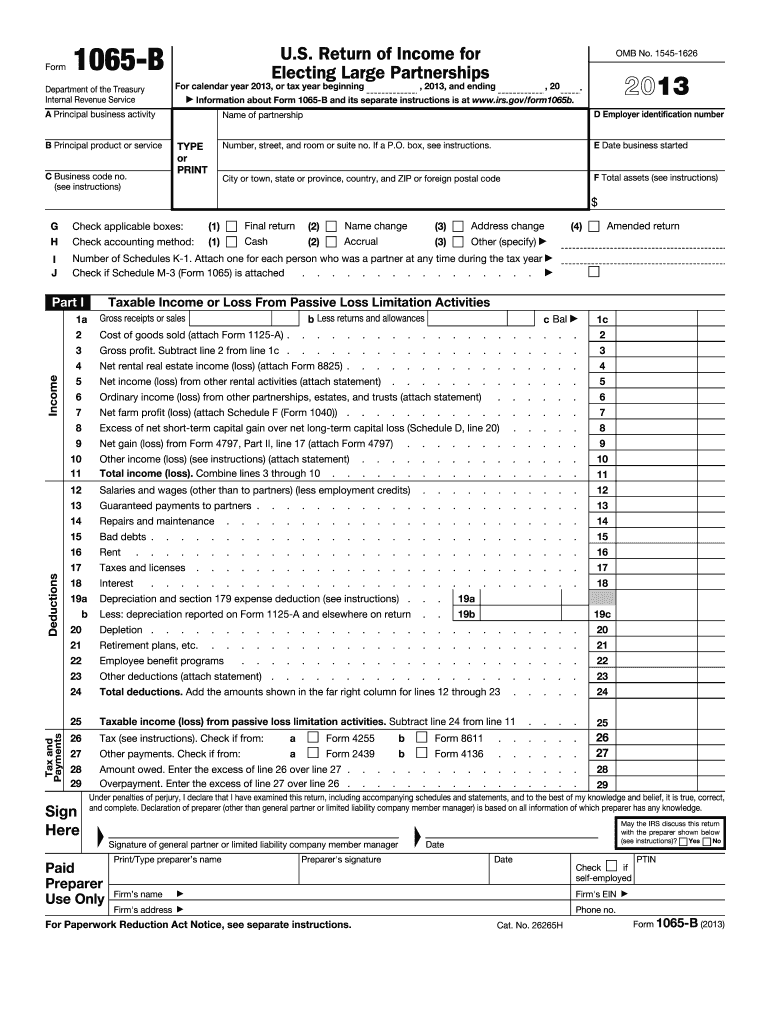

The Form 1065 B is a tax document used by partnerships to report income, deductions, gains, and losses to the Internal Revenue Service (IRS). This form is essential for partnerships that elect to be treated as a business entity for tax purposes. It provides a comprehensive overview of the partnership's financial activities and ensures compliance with federal tax regulations. The form also includes information about each partner's share of the partnership's income or loss, which is crucial for individual tax filings.

How to use the Form 1065 B Internal Revenue Service IRS

Using the Form 1065 B involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation regarding the partnership's operations. Next, complete the form by entering the required information about the partnership and its partners. Each partner's share of income, deductions, and credits must be calculated and reported accurately. Finally, file the completed form with the IRS by the designated deadline, ensuring that all partners receive a copy for their records.

Steps to complete the Form 1065 B Internal Revenue Service IRS

Completing the Form 1065 B requires careful attention to detail. Follow these steps:

- Gather financial records, including income, expenses, and partner information.

- Fill out the basic information section, including the partnership name, address, and Employer Identification Number (EIN).

- Report the partnership's income, deductions, and other financial details in the appropriate sections.

- Calculate each partner's distributive share of income, deductions, and credits.

- Review the form for accuracy and completeness before submission.

- File the form electronically or by mail, ensuring it is submitted by the deadline.

Legal use of the Form 1065 B Internal Revenue Service IRS

The Form 1065 B serves as a legally binding document for partnerships. It must be filled out accurately to comply with IRS regulations. The information provided on the form is used to determine the tax obligations of the partnership and its partners. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. Therefore, it is crucial to ensure that all information is correct and that the form is submitted on time.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 1065 B. Generally, the form is due on the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this typically falls on March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is essential for partnerships to be aware of these deadlines to avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 1065 B can be submitted through various methods, providing flexibility for partnerships. It can be filed electronically using IRS-approved software, which often streamlines the process and ensures compliance with submission requirements. Alternatively, partnerships can mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not available, so it is crucial to choose a method that aligns with the partnership's needs and capabilities.

Quick guide on how to complete form 1065 b internal revenue service irs

Complete Form 1065 B Internal Revenue Service Irs effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed files, allowing you to obtain the necessary format and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your paperwork promptly without delays. Handle Form 1065 B Internal Revenue Service Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form 1065 B Internal Revenue Service Irs with ease

- Find Form 1065 B Internal Revenue Service Irs and click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Highlight pertinent sections of your files or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature via the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and hit the Done button to store your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, laborious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your requirements for document management in just a few clicks from any device of your choice. Modify and eSign Form 1065 B Internal Revenue Service Irs and ensure excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1065 b internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b internal revenue service irs

How to create an electronic signature for your PDF document in the online mode

How to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

How to create an electronic signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What is Form 1065 B from the Internal Revenue Service (IRS)?

Form 1065 B is a tax form used by partnerships to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically for electing large partnerships. It's essential for the accurate reporting of partnership income to ensure compliance with IRS regulations.

-

How can airSlate SignNow assist with Form 1065 B submissions?

airSlate SignNow offers users an efficient platform to send, receive, and eSign documents, including Form 1065 B submissions. Our easy-to-use interface allows for quick collaboration and ensures that all parties can securely sign the document electronically, reducing time and paperwork.

-

What are the pricing options for airSlate SignNow when dealing with IRS forms?

airSlate SignNow provides several pricing plans tailored to different business needs, including options suitable for those frequently dealing with IRS forms like Form 1065 B. You can select a plan that best fits your budget while still benefiting from efficient document eSigning and management.

-

Can I integrate airSlate SignNow with my accounting software for Form 1065 B management?

Yes, airSlate SignNow easily integrates with various accounting software and applications, making it simple to manage your Form 1065 B documents. This streamlining helps ensure all your tax documentation and eSigns are in one place, improving efficiency when dealing with the Internal Revenue Service (IRS).

-

What are the benefits of using airSlate SignNow for Form 1065 B?

Using airSlate SignNow for Form 1065 B provides numerous benefits, including faster turnaround times for document signing and secure storage of important tax files. With features designed to enhance workflow, you can minimize the hassle of processing tax forms while ensuring compliance with IRS regulations.

-

Is airSlate SignNow secure for sending Form 1065 B to the IRS?

Absolutely, airSlate SignNow uses robust encryption and secure storage to protect your documents, including Form 1065 B submissions. We prioritize your data security, so you can confidently send your tax forms to the Internal Revenue Service (IRS) without worrying about bsignNowes or unauthorized access.

-

How does electronic signing of Form 1065 B with airSlate SignNow work?

Electronic signing of Form 1065 B using airSlate SignNow is simple. After uploading your document, you can invite others to eSign it quickly through a secure link. Once all parties have eSigned, you will receive a complete, legally binding document ready for submission to the IRS.

Get more for Form 1065 B Internal Revenue Service Irs

Find out other Form 1065 B Internal Revenue Service Irs

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form