Irs 1065 Partnership Return 2017-2026

What is the IRS 1065 Partnership Return?

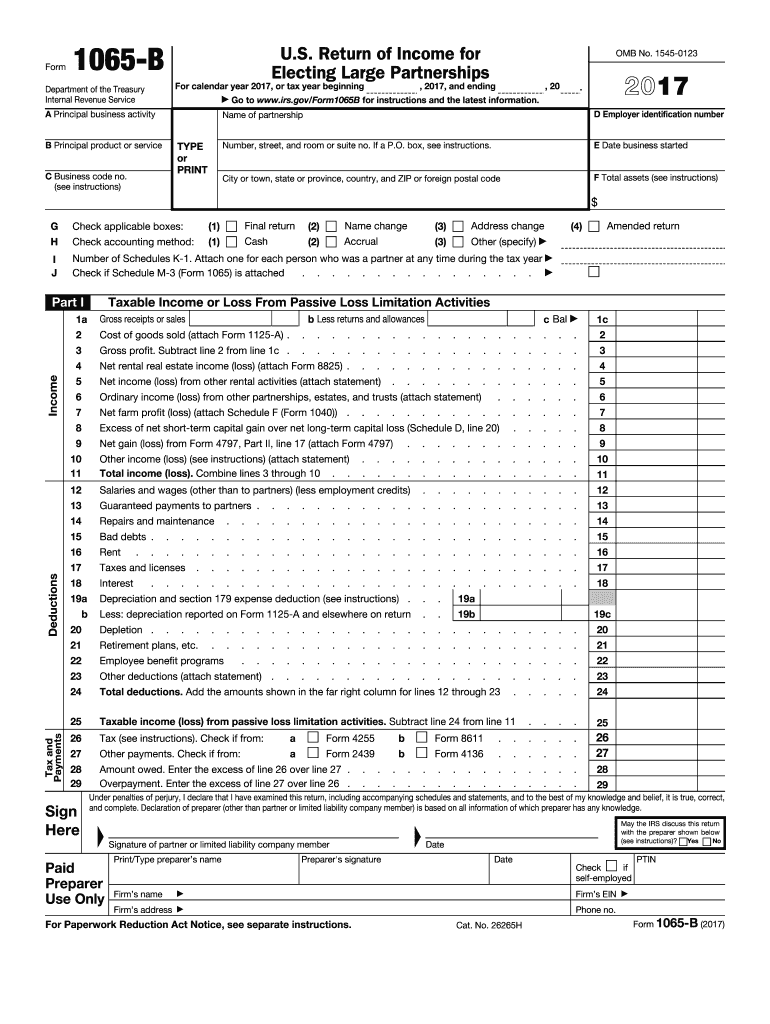

The IRS 1065 Partnership Return is a tax form used by partnerships to report income, deductions, gains, and losses from their operations. Unlike individual tax returns, this form does not calculate tax owed but instead provides a comprehensive overview of the partnership's financial activities for the year. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits, allowing them to report this information on their personal tax returns.

Steps to Complete the IRS 1065 Partnership Return

Completing the IRS 1065 Partnership Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including income statements, expense reports, and prior year tax returns. Next, fill out the main form, detailing the partnership's income and deductions. Ensure that each partner's information is accurately represented on the Schedule K-1 forms. After completing the forms, review them for any errors or omissions before submitting them to the IRS by the designated deadline.

Legal Use of the IRS 1065 Partnership Return

The IRS 1065 Partnership Return is legally required for partnerships operating in the United States. Filing this form ensures compliance with federal tax laws and provides transparency regarding the partnership's financial activities. It is essential for partnerships to maintain accurate records and submit this form annually to avoid penalties and ensure that each partner's tax obligations are properly reported.

Filing Deadlines / Important Dates

The IRS 1065 Partnership Return must be filed annually, with the deadline typically set for March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Partnerships can request a six-month extension to file, but this does not extend the time to pay any taxes owed. It is crucial for partnerships to adhere to these deadlines to avoid late filing penalties and interest charges.

Required Documents

When preparing the IRS 1065 Partnership Return, several documents are essential for accurate completion. These include:

- Financial statements, including income and balance sheets.

- Records of all income and expenses incurred during the tax year.

- Prior year tax returns for reference.

- Partner information, including Social Security numbers and ownership percentages.

Having these documents readily available will streamline the process of completing the return and ensure compliance with IRS requirements.

Form Submission Methods

The IRS 1065 Partnership Return can be submitted through various methods, including electronic filing and traditional paper submission. Electronic filing is often recommended for its speed and efficiency, allowing for quicker processing and confirmation of receipt. Partnerships may also choose to mail their completed forms to the appropriate IRS address, ensuring that they use certified mail or another trackable method to confirm delivery.

Penalties for Non-Compliance

Failing to file the IRS 1065 Partnership Return on time can result in significant penalties. The IRS imposes a penalty for each month the return is late, which can accumulate quickly. Additionally, partners may face issues with their individual tax returns if the partnership does not file properly. It is essential for partnerships to remain compliant with filing requirements to avoid these financial repercussions.

Quick guide on how to complete irs 1065 partnership return

Effortlessly Handle Irs 1065 Partnership Return on Any Device

The management of online documents has surged in popularity among businesses and individuals alike. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Irs 1065 Partnership Return from any device using the airSlate SignNow applications for Android or iOS, and simplify any document-centric task today.

The simplest method to modify and eSign Irs 1065 Partnership Return effortlessly

- Obtain Irs 1065 Partnership Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Edit and eSign Irs 1065 Partnership Return to ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1065 partnership return

Create this form in 5 minutes!

How to create an eSignature for the irs 1065 partnership return

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the b income partnership form?

The b income partnership form is a document used by businesses to report their income from partnerships. It ensures accurate tax reporting and compliance with tax regulations. By using the b income partnership form, businesses can simplify their financial reporting process.

-

How can airSlate SignNow help with the b income partnership form?

airSlate SignNow streamlines the process of completing and eSigning your b income partnership form. Our platform provides templates and easy collaboration features to ensure your partners can review and sign documents effortlessly. Plus, you'll have a secure digital record of all transactions.

-

Is there a cost associated with using airSlate SignNow for the b income partnership form?

Yes, airSlate SignNow offers affordable pricing plans tailored to businesses' needs, including sections specifically for managing documents like the b income partnership form. Pricing varies based on features and the number of users, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for the b income partnership form?

airSlate SignNow includes features like templates for the b income partnership form, eSigning, and document tracking. These tools make it easy to manage your partnership agreements digitally, ensuring all parties can review and sign without any hassle.

-

Can I integrate airSlate SignNow with other software for processing the b income partnership form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage the b income partnership form within your existing workflows. Our API allows you to connect with accounting and management tools for a more streamlined experience.

-

What are the benefits of using airSlate SignNow for the b income partnership form?

Using airSlate SignNow for the b income partnership form maximizes efficiency and minimizes errors. You'll benefit from faster processing times, the ability to collect eSignatures securely, and a digital audit trail. These advantages save time and reduce stress associated with paperwork.

-

Is it safe to eSign the b income partnership form with airSlate SignNow?

Yes, airSlate SignNow employs industry-standard security measures to ensure your b income partnership form remains protected. With encryption and secure cloud storage, you can confidently send and receive documents without worrying about data bsignNowes.

Get more for Irs 1065 Partnership Return

- Title 63 public health and safety 2010 oklahoma code form

- Application form high commission for pakistan london phclondon

- Pakistan visa indian form

- Get the free government of pakistan ministry of interior form

- Pdf automatically generated pdf from existing images hm idrees h form

- Opal refund form 557876839

- Wwwfinancegovpkbudgetnsamlcftregulations2020extraordinary published by authority islamabad thursday form

- Bmatradecomdownloadssub accountopeningformsub account opening form for individuals

Find out other Irs 1065 Partnership Return

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online