Instructions Tax Form 2017

What is the Instructions Tax Form

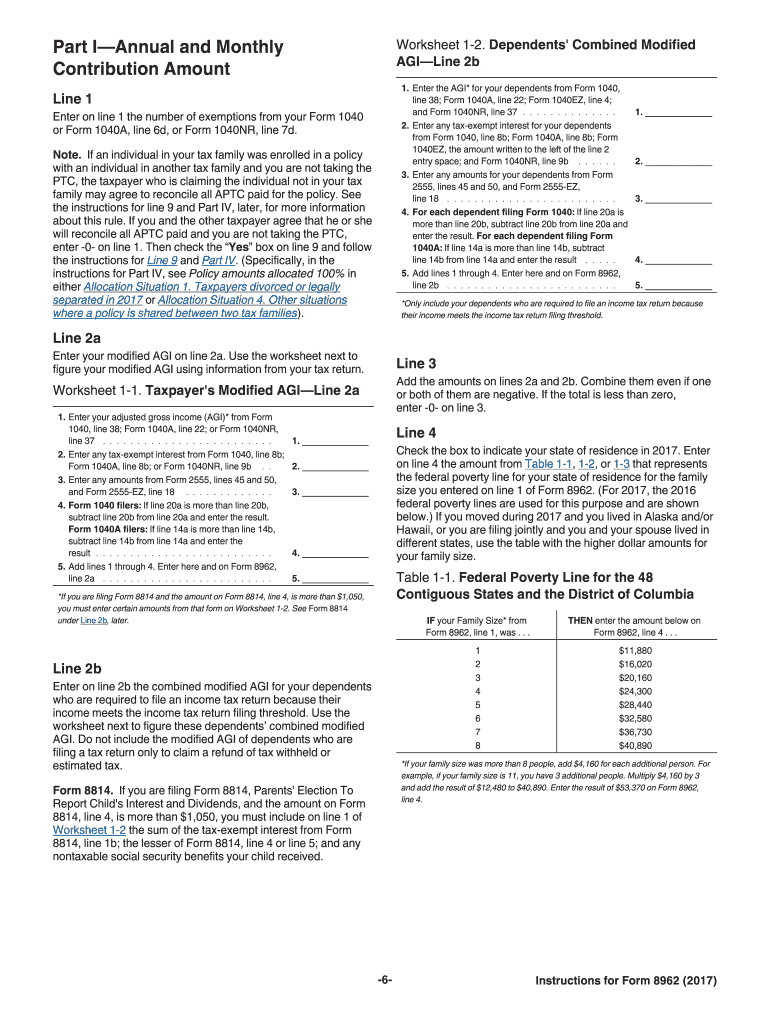

The Instructions Tax Form serves as a guide for taxpayers in the United States, detailing how to properly fill out various tax forms. It provides essential information about eligibility, required documentation, and the filing process. This form is crucial for ensuring compliance with IRS regulations and helps taxpayers understand their obligations when reporting income, claiming deductions, or requesting credits.

How to use the Instructions Tax Form

Using the Instructions Tax Form involves following a systematic approach to ensure accurate completion. Taxpayers should first identify the specific tax form they need to complete, as the Instructions Tax Form will correspond to that particular document. Next, users should read through the instructions carefully, noting any specific requirements or deadlines. It is advisable to gather all necessary documents, such as W-2s or 1099s, before beginning the form. Finally, taxpayers can fill out the form, ensuring that all information is accurate and complete before submission.

Steps to complete the Instructions Tax Form

Completing the Instructions Tax Form involves several key steps:

- Identify the correct tax form you need to complete.

- Review the instructions provided for that form carefully.

- Gather all necessary documents, including income statements and previous tax returns.

- Fill out the form with accurate information, following the guidelines provided.

- Double-check all entries for accuracy and completeness.

- Submit the form by the appropriate deadline, either electronically or by mail.

Legal use of the Instructions Tax Form

The Instructions Tax Form is legally recognized as a valid document under U.S. tax law. It provides taxpayers with the necessary guidance to ensure compliance with IRS regulations. Using this form correctly can help avoid penalties and ensure that all tax obligations are met. It is important to follow the guidelines precisely, as failure to do so may result in errors that could lead to audits or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for tax forms can vary based on the type of form and the taxpayer's situation. Generally, individual tax returns are due on April fifteenth each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions available for filing, as well as deadlines for estimated tax payments, which typically occur quarterly. Staying informed about these dates is crucial to avoid late fees and penalties.

Required Documents

To complete the Instructions Tax Form accurately, several documents are typically required. These may include:

- W-2 forms from employers, reporting annual wages.

- 1099 forms for other income sources, such as freelance work or investments.

- Previous year’s tax return for reference.

- Receipts for deductible expenses, if applicable.

- Social Security numbers for all dependents.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting their Instructions Tax Form. The most common methods include:

- Online submission through the IRS e-file system or authorized tax software.

- Mailing a paper form to the designated IRS address based on the taxpayer's location.

- In-person submission at local IRS offices, though this method may require an appointment.

Quick guide on how to complete 2017 instructions tax form

Complete Instructions Tax Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Instructions Tax Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Instructions Tax Form effortlessly

- Locate Instructions Tax Form and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your selected device. Edit and eSign Instructions Tax Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 instructions tax form

Create this form in 5 minutes!

How to create an eSignature for the 2017 instructions tax form

How to create an eSignature for the 2017 Instructions Tax Form online

How to make an electronic signature for your 2017 Instructions Tax Form in Google Chrome

How to create an electronic signature for signing the 2017 Instructions Tax Form in Gmail

How to generate an eSignature for the 2017 Instructions Tax Form straight from your smartphone

How to create an electronic signature for the 2017 Instructions Tax Form on iOS devices

How to generate an electronic signature for the 2017 Instructions Tax Form on Android

People also ask

-

What are the Instructions Tax Form available with airSlate SignNow?

With airSlate SignNow, users can easily access and fill out various Instructions Tax Forms, including W-2 and 1099 forms. Our platform provides a streamlined process for completing these forms digitally, ensuring accuracy and efficiency. You can find detailed templates and guides for each tax form on our website.

-

How can airSlate SignNow help me complete my Instructions Tax Form?

airSlate SignNow simplifies the process of completing your Instructions Tax Form by providing an intuitive interface where you can fill out necessary fields electronically. You can also include digital signatures and securely share the forms with others. This reduces the risk of errors and speeds up the filing process.

-

Is there a cost associated with using airSlate SignNow for Instructions Tax Form?

Yes, airSlate SignNow offers flexible pricing plans designed to meet the needs of different users, including individuals and businesses. The plans start at an affordable monthly fee, allowing you to access all features related to Instructions Tax Form and other document signing needs. There is also a free trial available for new users to explore our services.

-

Can I integrate airSlate SignNow with other applications for Instructions Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and Salesforce. This allows you to easily manage your Instructions Tax Form alongside your other documents and workflows, enhancing productivity and collaboration.

-

What security measures does airSlate SignNow implement for Instructions Tax Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Instructions Tax Form. Our platform uses advanced encryption protocols and secure access controls to ensure that your data remains confidential and protected from unauthorized access.

-

How do I get started with airSlate SignNow for Instructions Tax Form?

Getting started with airSlate SignNow is simple! Just visit our website, sign up for an account, and choose a suitable pricing plan. You can then access various templates for Instructions Tax Form and begin filling them out right away.

-

What features does airSlate SignNow offer for managing Instructions Tax Form?

airSlate SignNow provides a range of features for managing Instructions Tax Form, including template creation, automated workflows, and real-time tracking of document status. These features help streamline the process and ensure that all participants are informed about the progress of the forms.

Get more for Instructions Tax Form

Find out other Instructions Tax Form

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online