Instructions for Form 8962 Instructions for Form 8962, Premium Tax Credit PTC 2022-2026

Understanding Form 8962 Instructions

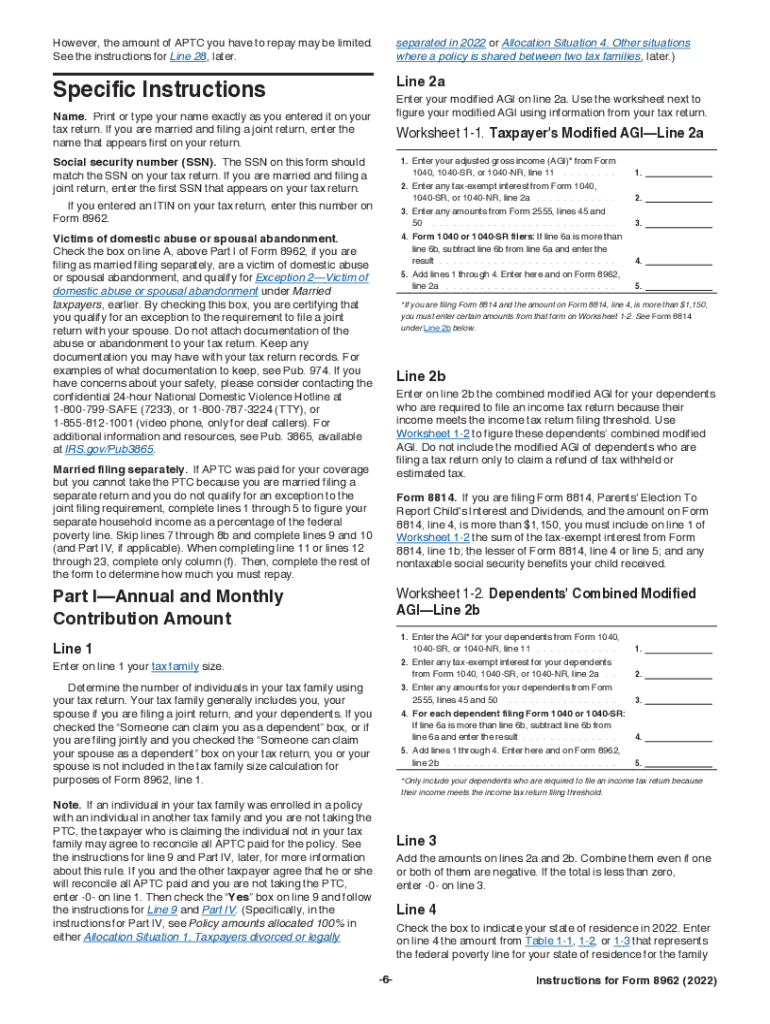

Form 8962, also known as the Premium Tax Credit (PTC) form, is essential for individuals who want to claim the premium tax credit when filing their federal income tax returns. This form helps determine the amount of premium tax credit you are eligible for based on your household income and family size. It is crucial to understand the instructions for Form 8962 to ensure accurate completion and compliance with IRS regulations.

Steps to Complete Form 8962

Completing Form 8962 involves several steps that require careful attention to detail. Here’s a simplified process:

- Gather necessary documents, including your Form 1095-A, which provides information about your health coverage.

- Provide your personal information, including your name, Social Security number, and details about your household.

- Calculate your annual household income and compare it to the federal poverty level to determine eligibility for the premium tax credit.

- Fill out the sections of Form 8962, ensuring all calculations are accurate and consistent with the information from Form 1095-A.

- Review the completed form for any errors before submission.

Required Documents for Form 8962

To accurately complete Form 8962, you will need specific documents. The primary document is Form 1095-A, which is issued by the Health Insurance Marketplace. This form contains crucial information about your health coverage, including the months you were covered and the amount of premium tax credit you received. Additionally, you may need your tax return from the previous year, proof of income, and any other relevant financial documents to support your claims.

IRS Guidelines for Form 8962

The IRS provides detailed guidelines for completing Form 8962. These guidelines include instructions on how to calculate your premium tax credit, how to report changes in your household income, and what to do if you received too much or too little credit. It is important to follow these guidelines closely to avoid any potential issues with your tax return.

Eligibility Criteria for the Premium Tax Credit

To qualify for the premium tax credit, you must meet specific eligibility criteria. These include:

- Having a household income between one and four times the federal poverty level.

- Being enrolled in a qualified health plan through the Health Insurance Marketplace.

- Not being eligible for other types of health coverage, such as Medicare or Medicaid.

Understanding these criteria is essential for accurately completing Form 8962 and ensuring you receive the correct amount of tax credit.

Filing Deadlines for Form 8962

Filing deadlines for Form 8962 align with the general tax filing deadlines. Typically, individual tax returns are due on April 15 of each year. If you need additional time, you may file for an extension, but it is crucial to ensure that Form 8962 is submitted by the deadline to avoid penalties. Keep an eye on any changes to deadlines announced by the IRS, especially in response to special circumstances or emergencies.

Quick guide on how to complete 2022 instructions for form 8962 instructions for form 8962 premium tax credit ptc

Easily Prepare Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC on any device with the airSlate SignNow apps available for Android or iOS and simplify any document-related task today.

How to Edit and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC Effortlessly

- Locate Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 instructions for form 8962 instructions for form 8962 premium tax credit ptc

Create this form in 5 minutes!

People also ask

-

What are the 2020 Form 8962 instructions?

The 2020 Form 8962 instructions provide detailed guidelines on how to calculate the Premium Tax Credit. This form is crucial for taxpayers who received Health Insurance Marketplace coverage. Following these instructions accurately ensures compliance and helps in claiming the tax credits effectively.

-

Where can I find the 2020 Form 8962 instructions?

You can find the 2020 Form 8962 instructions on the IRS official website or through tax preparation software. Additionally, airSlate SignNow offers tools that simplify the signing and submission process for this form. Accessing these resources helps in ensuring you fill out your form accurately.

-

How does airSlate SignNow facilitate the submission of Form 8962?

AirSlate SignNow allows users to easily eSign and send important documents like Form 8962 directly online. By streamlining the process, it reduces paperwork and enhances efficiency. Our platform ensures that you can complete your tax documents without hassle.

-

Are there fees associated with using airSlate SignNow to file Form 8962?

AirSlate SignNow offers a cost-effective solution for eSigning and sending documents, including Form 8962. We provide various pricing plans tailored to different business needs. Sign up for a free trial to explore our features and determine which plan suits your requirements.

-

What features does airSlate SignNow offer for dealing with tax forms like Form 8962?

AirSlate SignNow comes equipped with multiple features such as cloud storage, audit trails, and integrations with various tax software. These features help manage your 2020 Form 8962 instructions efficiently. Enhanced collaboration tools also ensure that all parties can review and sign documents easily.

-

Can I store my completed Form 8962 securely with airSlate SignNow?

Yes, airSlate SignNow provides secure cloud storage for all your completed documents, including the 2020 Form 8962. Our platform employs encryption and stringent security measures to protect your sensitive information. You can access your documents anytime and anywhere securely.

-

What integrations does airSlate SignNow support for filing tax forms?

AirSlate SignNow supports integrations with popular accounting and tax preparation software, making it easier to manage forms like 2020 Form 8962. These integrations help in importing and exporting data seamlessly. This way, you can streamline your entire tax filing process.

Get more for Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- Commercial contractor package ohio form

- Excavation contractor package ohio form

- Renovation contractor package ohio form

- Concrete mason contractor package ohio form

- Demolition contractor package ohio form

- Security contractor package ohio form

- Insulation contractor package ohio form

- Paving contractor package ohio form

Find out other Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF