Instructions for Form 8962 Instructions for Form 8962, Premium Tax Credit PTC 2018

Understanding Form 8962 and the Premium Tax Credit

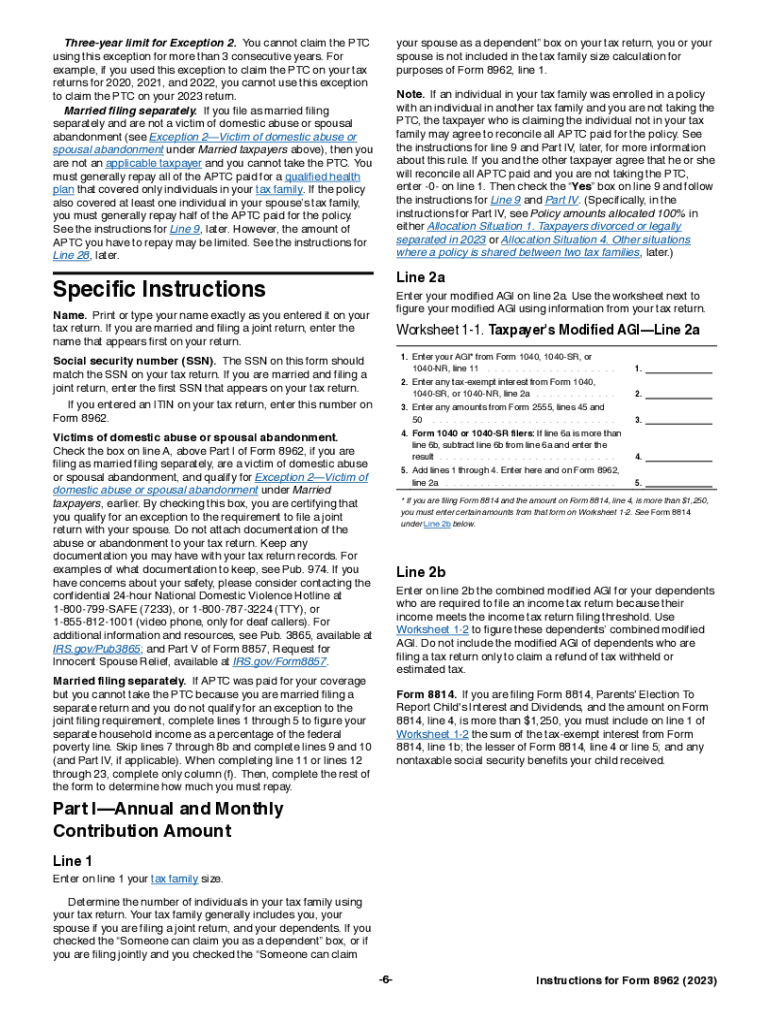

Form 8962 is used to calculate the Premium Tax Credit (PTC), which helps individuals and families afford health insurance coverage purchased through the Health Insurance Marketplace. This tax credit is available to those who meet specific income and eligibility requirements. The form allows taxpayers to reconcile the amount of premium tax credit they received in advance with the actual credit they qualify for based on their final income for the year.

Steps to Complete Form 8962

Completing Form 8962 involves several key steps:

- Gather necessary documents, including your Form 1095-A, which provides information about your health insurance coverage and the premium tax credits received.

- Input your personal information, including your name, Social Security number, and filing status.

- Complete Part I to determine your annual household income and the percentage of the federal poverty line applicable to your household size.

- Fill out Part II to calculate your premium tax credit based on the information from your Form 1095-A.

- Finalize the form by reviewing all entries and ensuring accuracy before submission.

Obtaining Form 8962

Form 8962 can be obtained directly from the IRS website in a downloadable PDF format. Additionally, it is often included as part of tax preparation software, which can streamline the process of filling it out. Ensure you have the correct version for the tax year you are filing, as forms can change annually.

Eligibility Criteria for the Premium Tax Credit

To qualify for the Premium Tax Credit, you must meet certain criteria:

- You must have purchased health insurance through the Health Insurance Marketplace.

- Your household income must fall within a specific range, typically between one and four times the federal poverty level.

- You must not be eligible for other affordable health coverage, such as Medicaid or Medicare.

IRS Guidelines for Form 8962

The IRS provides detailed guidelines for completing Form 8962. These guidelines include instructions on how to fill out each section of the form, the importance of accurate reporting, and the consequences of discrepancies. It is essential to refer to the IRS instructions for the most current and detailed information.

Filing Deadlines for Form 8962

Form 8962 must be filed with your federal tax return by the annual tax filing deadline, which is typically April 15. If you are unable to file by this date, you may request an extension, but you must still ensure that Form 8962 is submitted with your return to avoid delays in processing your tax credits.

Quick guide on how to complete instructions for form 8962 instructions for form 8962 premium tax credit ptc

Effortlessly prepare Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can easily locate the desired form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The simplest way to modify and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC without hassle

- Find Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, SMS, or invite link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious searches for forms, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8962 instructions for form 8962 premium tax credit ptc

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8962 instructions for form 8962 premium tax credit ptc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic requirements for filling out Form 8962 instructions 2019?

To complete Form 8962 instructions 2019, you need to gather your personal information, such as your Social Security Number, and details about your health insurance coverage. Additionally, you should have information about your premium tax credits and any household income. These elements are crucial for accurately filling the form and claiming your credits.

-

How can I find Form 8962 instructions 2019 online?

You can easily download Form 8962 instructions 2019 from the official IRS website or access various tax preparation services that provide this information. Many platforms offer guides and resources to help you understand the form better. Make sure you have the correct version for the tax year you are filing.

-

What features does airSlate SignNow offer for signing Form 8962 instructions 2019?

airSlate SignNow provides a range of features for electronically signing Form 8962 instructions 2019, including customizable templates, real-time collaboration, and secure cloud storage. This ensures your documents are not only easy to manage but also compliant with legal standards. Plus, you get the convenience of remote signing.

-

Are there any costs associated with using airSlate SignNow for Form 8962 instructions 2019?

airSlate SignNow offers a variety of pricing plans to suit different business needs, including options for teams and enterprises. Using the platform to eSign Form 8962 instructions 2019 can help reduce paper waste and improve efficiency, leading to cost savings in the long run. You can explore the pricing section on our website for more details.

-

Can I integrate airSlate SignNow with other applications to manage Form 8962 instructions 2019?

Yes, airSlate SignNow seamlessly integrates with numerous applications, such as Google Drive, Salesforce, and more. This makes it simpler to manage and send Form 8962 instructions 2019 alongside your other documents. Integrations enhance productivity and collaboration across your teams.

-

What is the benefit of using airSlate SignNow for Form 8962 instructions 2019?

The primary benefit of using airSlate SignNow for Form 8962 instructions 2019 is the signNow time savings in document preparation and signing. With an easy-to-use interface and robust features, you can streamline your tax document management process. This leads to faster turnaround times and reduced stress during tax season.

-

Is it safe to use airSlate SignNow for submitting Form 8962 instructions 2019?

Absolutely! airSlate SignNow employs state-of-the-art security measures to protect your sensitive data while completing Form 8962 instructions 2019. Our platform is compliant with industry standards, ensuring that your documents are safe and securely transmitted. You can focus on your tasks without worrying about data bsignNowes.

Get more for Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- Inches overdig of the dwelling footing form

- The proportion that the work done bears to the work to be done using the contract price or if there form

- Any excavation or other work required by the owner not specified in this agreement form

- Is no contract price using the reasonable value of the completed work form

- Is no contract price using the reasonable vale of the completed work form

- Agreement other than the usual and customary excavation and grading shall be agreed to in a form

- Size form

- House to kitchen sink form

Find out other Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template