Form 8962 Instructions 2018

What is the Form 8962 Instructions

The Form 8962 instructions provide detailed guidance for individuals claiming the Premium Tax Credit (PTC) on their federal tax returns. This form is essential for those who have received advance payments of the premium tax credit to help cover the cost of health insurance purchased through the Health Insurance Marketplace. The instructions outline the necessary steps to accurately complete the form, ensuring that taxpayers understand how to report their income and household information correctly. Understanding these instructions is crucial for compliance with IRS regulations and for maximizing potential tax benefits.

Steps to Complete the Form 8962 Instructions

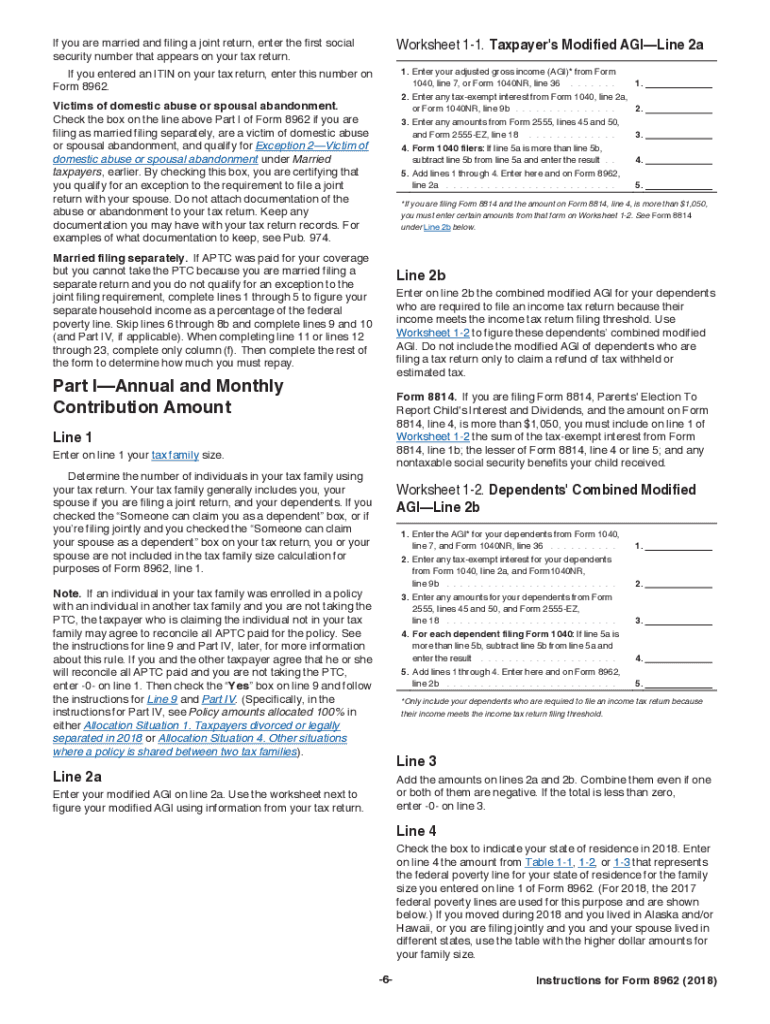

Completing Form 8962 involves several key steps. First, gather all necessary documents, including your Form 1095-A, which provides information about your health coverage. Next, you will need to determine your household size and annual income, as these factors influence your eligibility for the premium tax credit. The form requires you to calculate the premium tax credit based on the information provided in your Form 1095-A and your income. Be sure to follow the detailed instructions for each line of the form to avoid errors. Finally, review your completed form for accuracy before submitting it to the IRS.

Eligibility Criteria

To qualify for the premium tax credit and complete Form 8962, certain eligibility criteria must be met. Generally, you must be a U.S. citizen or a legal resident, and your household income must fall between one hundred and four hundred percent of the federal poverty level. Additionally, you must not be eligible for other types of minimum essential coverage, such as Medicaid or Medicare. Understanding these criteria is vital to ensure that you are eligible to claim the credit and that you provide accurate information on the form.

Required Documents

When filling out Form 8962, several documents are necessary to support your claims. The most important document is Form 1095-A, which details the health insurance coverage you received through the Marketplace. You should also have your tax return from the previous year, as it may provide relevant income information. Other supporting documents may include proof of income, such as W-2 forms or pay stubs. Collecting these documents in advance can streamline the process and help ensure that you provide accurate information on your Form 8962.

IRS Guidelines

The IRS provides specific guidelines for completing Form 8962, which are crucial for ensuring compliance. These guidelines include instructions on how to calculate your premium tax credit, how to report your household income, and how to handle any discrepancies in your reported income compared to what was reported on your Form 1095-A. Familiarizing yourself with these guidelines can help you avoid common pitfalls and ensure that your tax filing is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for Form 8962 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If you are unable to file by this date, you may apply for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is important to keep track of these dates to ensure timely submission of your form and avoid any potential issues with your tax return.

Quick guide on how to complete 2017 instructions tax 2018 2019 form

Explore the simplest method to complete and sign your Form 8962 Instructions

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow presents a superior method to complete and sign your Form 8962 Instructions and associated forms for public services. Our advanced electronic signature solution provides everything required to manage documents swiftly and in compliance with formal standards - robust PDF editing, managing, securing, signing, and sharing features all accessible through an easy-to-use interface.

Only a few steps are required to finish filling out and signing your Form 8962 Instructions:

- Insert the fillable template into the editor by clicking the Get Form button.

- Examine what details you need to include in your Form 8962 Instructions.

- Navigate between fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to input your details in the blanks.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Censor sections that are no longer relevant.

- Select Sign to generate a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished Form 8962 Instructions in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our solution also offers versatile form sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 instructions tax 2018 2019 form

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

Create this form in 5 minutes!

How to create an eSignature for the 2017 instructions tax 2018 2019 form

How to create an eSignature for your 2017 Instructions Tax 2018 2019 Form in the online mode

How to generate an eSignature for your 2017 Instructions Tax 2018 2019 Form in Chrome

How to make an electronic signature for putting it on the 2017 Instructions Tax 2018 2019 Form in Gmail

How to create an electronic signature for the 2017 Instructions Tax 2018 2019 Form straight from your smartphone

How to create an eSignature for the 2017 Instructions Tax 2018 2019 Form on iOS devices

How to generate an electronic signature for the 2017 Instructions Tax 2018 2019 Form on Android OS

People also ask

-

What are form 8962 instructions 2017?

Form 8962 instructions 2017 provide detailed guidelines for calculating the Premium Tax Credit for individuals who have purchased health insurance through the Marketplace. These instructions help taxpayers understand how to properly complete the form and ensure they receive the financial assistance they qualify for under the Affordable Care Act.

-

How do I fill out form 8962 using airSlate SignNow?

With airSlate SignNow, filling out form 8962 instructions 2017 becomes effortless. You can create templates that guide you through each section of the form, ensuring compliance with all necessary requirements while allowing for easy electronic signature collection.

-

Is there a cost to access the form 8962 instructions 2017 on airSlate SignNow?

Accessing form 8962 instructions 2017 through airSlate SignNow is part of our subscription plans, which offer cost-effective solutions for businesses. The pricing varies based on the features and number of users, making it accessible for individuals and organizations alike.

-

What features does airSlate SignNow offer to complete form 8962 instructions 2017?

AirSlate SignNow provides several features for completing form 8962 instructions 2017, including drag-and-drop document creation, eSignature capabilities, and real-time collaboration. These tools empower users to streamline the form submission process, saving time and reducing errors.

-

Can I integrate airSlate SignNow with other tools for form 8962 instructions 2017?

Yes, airSlate SignNow integrates seamlessly with various software applications such as Google Drive, Dropbox, and CRM platforms, enhancing your workflow for managing form 8962 instructions 2017. This allows users to centralize their document management processes and optimize productivity.

-

What are the benefits of using airSlate SignNow for form 8962 instructions 2017?

By using airSlate SignNow to manage form 8962 instructions 2017, you gain benefits such as improved accuracy, reduced processing time, and enhanced security for sensitive data. The platform’s user-friendly interface makes it easy for anyone to understand and complete the necessary steps without confusion.

-

Can airSlate SignNow help with eSigning form 8962 instructions 2017?

Absolutely! AirSlate SignNow is designed to simplify the eSigning process for documents like form 8962 instructions 2017. Users can easily send, sign, and track the document, ensuring a smooth and legally binding completion of the form.

Get more for Form 8962 Instructions

- Employer contribution and wage report illinois 2013 pdf 2014 2019 form

- Ky form tc 96 215 2014

- Breakdown sheet form

- Mech 2a california energy commission state of california energy ca form

- Domu lease form

- Form 021 hoc affidavit community property master listd

- Da 67 10 a1 form

- Sample pro forma balance sheet income statement

Find out other Form 8962 Instructions

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe