Instructions for Form 8962 Instructions for Form 8962, Premium Tax Credit PTC 2021

Understanding Form 8962 Instructions

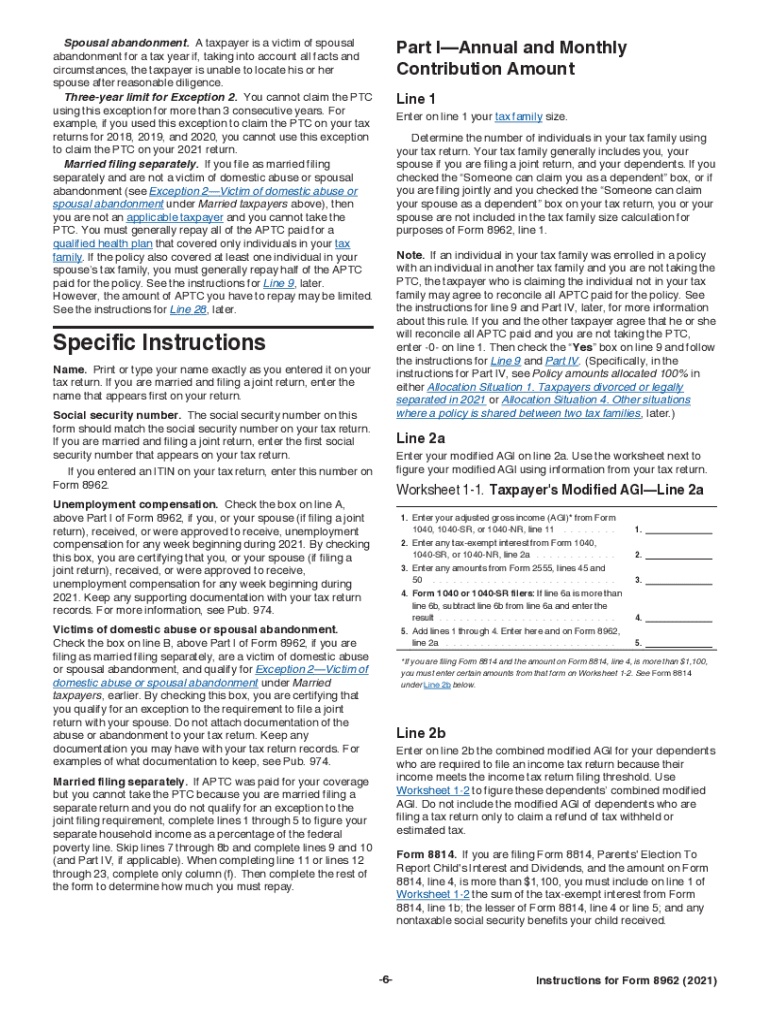

The Instructions for Form 8962 provide essential guidance for taxpayers who are claiming the Premium Tax Credit (PTC). This credit is available to individuals and families who purchase health insurance through the Health Insurance Marketplace. The instructions detail how to calculate the premium tax credit, the eligibility requirements, and how to report the credit on your tax return. Understanding these instructions is crucial for ensuring that you accurately complete your tax forms and receive the correct credit amount.

Steps to Complete Form 8962 Instructions

Completing the Instructions for Form 8962 involves several key steps. First, gather necessary documentation, including your Form 1095-A, which reports your health coverage. Next, follow the instructions to determine your household income and the number of individuals in your household. You will need to calculate your expected annual income and compare it to the federal poverty level to determine your eligibility for the PTC. Finally, fill out the form accurately, ensuring all calculations are correct, and submit it along with your tax return.

Eligibility Criteria for the Premium Tax Credit

To qualify for the Premium Tax Credit, you must meet specific eligibility criteria outlined in the Instructions for Form 8962. These criteria include having a household income between one hundred and four hundred percent of the federal poverty level, not being eligible for other qualifying health coverage, and filing a tax return for the year in which you are claiming the credit. Additionally, you must have purchased your health insurance through the Health Insurance Marketplace. Understanding these criteria is essential for ensuring that you can claim the credit correctly.

Required Documents for Form 8962

When completing the Instructions for Form 8962, it is important to have all required documents at hand. The most critical document is Form 1095-A, which provides information about your health insurance coverage. You should also gather your tax return from the previous year, any documentation related to your household income, and any other relevant financial records. Having these documents ready will streamline the process of filling out the form and help ensure that you provide accurate information.

IRS Guidelines for Form 8962

The IRS provides specific guidelines for completing the Instructions for Form 8962, which are crucial for ensuring compliance. These guidelines include detailed explanations of how to calculate your premium tax credit, how to report changes in income or household size, and the consequences of failing to file the form correctly. Familiarizing yourself with these guidelines can help you navigate the complexities of the tax filing process and avoid potential penalties.

Filing Deadlines for Form 8962

Understanding the filing deadlines for Form 8962 is essential for timely submission and avoiding penalties. Typically, the deadline for filing your tax return, including Form 8962, is April fifteenth of the following year. If you require additional time, you may file for an extension, but it is important to ensure that you still meet the requirements for claiming the Premium Tax Credit. Staying aware of these deadlines helps ensure that you do not miss out on potential tax benefits.

Quick guide on how to complete 2021 instructions for form 8962 instructions for form 8962 premium tax credit ptc

Complete Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC effortlessly

- Locate Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize critical sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 instructions for form 8962 instructions for form 8962 premium tax credit ptc

Create this form in 5 minutes!

How to create an eSignature for the 2021 instructions for form 8962 instructions for form 8962 premium tax credit ptc

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to create an e-signature from your smart phone

How to create an e-signature for a PDF document on iOS

How to create an e-signature for a PDF file on Android OS

People also ask

-

What are the form 8962 instructions for filing tax returns?

The form 8962 instructions provide detailed guidelines on how to fill out the form required for the Premium Tax Credit. You can find step-by-step instructions on calculating your premium tax credit, reporting income, and reconciling advance payments. Following these instructions is crucial to ensure your tax return is accurate and compliant.

-

How can airSlate SignNow assist with completing form 8962?

airSlate SignNow offers features that simplify the document signing process, enabling you to collect necessary signatures for form 8962 efficiently. Our platform also allows for easy integration with your existing workflows, ensuring that the form is completed accurately and submitted on time. You can easily track and manage all submissions related to form 8962 with our user-friendly interface.

-

Are there any costs associated with using airSlate SignNow for form 8962 instructions?

Yes, airSlate SignNow provides various pricing plans to accommodate different business needs. Depending on your chosen plan, you can access features tailored to help you manage, send, and eSign documents, including those related to form 8962. We also offer a free trial, allowing you to explore our tools before committing to a paid plan.

-

What features does airSlate SignNow offer that can help with form 8962?

airSlate SignNow includes features like secure eSigning, document templates, and automated workflows that are perfect for preparing form 8962. Our platform ensures that your documents are handled securely and efficiently, reducing the time spent on paperwork. Additionally, you can collaborate with team members to gather necessary information for the form quickly.

-

Can I integrate airSlate SignNow with other applications for form 8962 processing?

Absolutely! airSlate SignNow integrates smoothly with various applications, including CRM systems, cloud storage services, and project management tools. These integrations streamline the process of gathering and signing documents related to form 8962 instructions, making it easier to manage your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for tax document signing?

Using airSlate SignNow for tax document signing, including form 8962, provides a range of benefits such as reduced turnaround time, increased accuracy, and enhanced security. The digital signature process is both user-friendly and legally binding, ensuring compliance with tax regulations. Businesses can keep track of their documents and signings in real-time, minimizing the risk of lost paperwork.

-

Is customer support available for assistance with form 8962 instructions?

Yes, airSlate SignNow offers robust customer support to assist you with any questions regarding form 8962 instructions and the signing process. Our dedicated team is available through multiple channels, including live chat, email, and phone, ensuring you have the help you need for a smooth experience. Don’t hesitate to signNow out for guidance on completing your tax forms.

Get more for Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- Hawaii llc form

- Limited liability company llc operating agreement hawaii form

- Hi llc form

- Hawaii renunciation and disclaimer of property from will by testate hawaii form

- Hawaii lien form

- Quitclaim deed from individual to husband and wife hawaii form

- Warranty deed from individual to husband and wife hawaii form

- Transfer death deed form 497304283

Find out other Instructions For Form 8962 Instructions For Form 8962, Premium Tax Credit PTC

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online