Form Tpt Tax 2015

What is the Form Tpt Tax

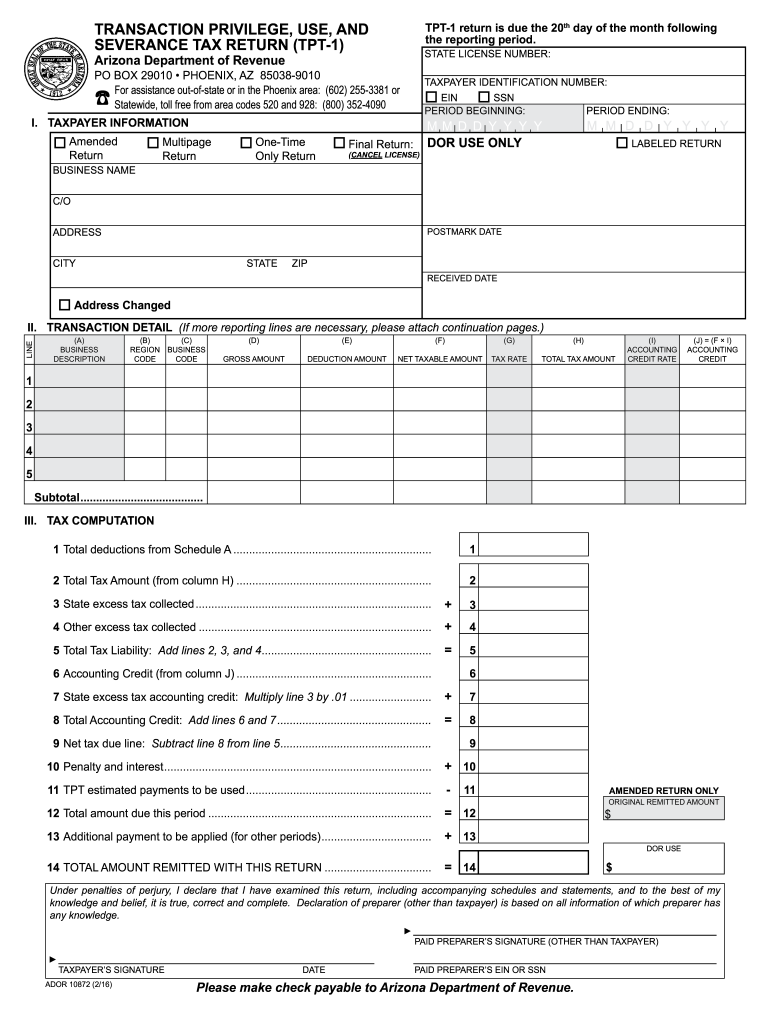

The Form Tpt Tax is a specific tax form used in the United States, primarily for reporting certain tax obligations. It is essential for individuals and businesses to understand its purpose and requirements to ensure compliance with tax regulations. The form serves as a tool for taxpayers to report their income, deductions, and any applicable credits, ultimately determining their tax liability. Proper completion of this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the Form Tpt Tax

Completing the Form Tpt Tax involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, receipts for deductions, and any relevant tax records. Next, carefully read the instructions provided with the form to understand the required information.

Fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income in the designated sections, ensuring that all figures are accurate and supported by documentation. Include any deductions or credits you are eligible for, and double-check your calculations to avoid errors. Finally, review the completed form for completeness before submitting it to the appropriate tax authority.

Legal use of the Form Tpt Tax

The Form Tpt Tax is legally binding when completed accurately and submitted in accordance with IRS regulations. To ensure its legal standing, taxpayers must adhere to the guidelines set forth by the IRS, including proper signatures and submission methods. Electronic signatures, when compliant with eSignature laws, can be used to sign the form digitally, enhancing convenience and efficiency. It is important to keep copies of the submitted form and any supporting documents for your records, as they may be needed for future reference or in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Form Tpt Tax vary depending on the specific tax year and the taxpayer's situation. Generally, individual taxpayers must file their forms by April 15 of the following year. However, extensions may be available under certain circumstances. It is crucial to stay informed about any changes in deadlines, as late submissions can result in penalties and interest on unpaid taxes. Mark your calendar with important dates to ensure timely filing and compliance with tax regulations.

Required Documents

To complete the Form Tpt Tax accurately, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any additional documentation related to credits or deductions

Having these documents readily available will streamline the completion process and help ensure that all necessary information is reported accurately.

Form Submission Methods (Online / Mail / In-Person)

The Form Tpt Tax can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the IRS. Common submission methods include:

- Online filing through approved tax software or e-filing services

- Mailing a paper copy of the completed form to the appropriate IRS address

- In-person submission at designated IRS offices or authorized locations

Choosing the right submission method can enhance the efficiency of the filing process and ensure that your form is received by the IRS in a timely manner.

Quick guide on how to complete form tpt tax 2015

Effortlessly Prepare Form Tpt Tax on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without unnecessary delays. Handle Form Tpt Tax seamlessly on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Efficient Ways to Edit and eSign Form Tpt Tax with Ease

- Obtain Form Tpt Tax and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools available from airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Form Tpt Tax to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form tpt tax 2015

Create this form in 5 minutes!

How to create an eSignature for the form tpt tax 2015

How to make an electronic signature for your Form Tpt Tax 2015 in the online mode

How to generate an eSignature for the Form Tpt Tax 2015 in Google Chrome

How to create an electronic signature for signing the Form Tpt Tax 2015 in Gmail

How to make an eSignature for the Form Tpt Tax 2015 from your mobile device

How to make an eSignature for the Form Tpt Tax 2015 on iOS devices

How to generate an eSignature for the Form Tpt Tax 2015 on Android devices

People also ask

-

What is the Form Tpt Tax and why is it important?

The Form Tpt Tax is a tax document required for certain transactions or entities in various jurisdictions. Understanding this form is crucial for compliance, as it helps businesses accurately report and pay necessary taxes, ensuring they avoid penalties and maintain good standing with tax authorities.

-

How can airSlate SignNow help with the Form Tpt Tax process?

airSlate SignNow streamlines the Form Tpt Tax process by allowing businesses to easily send, eSign, and manage documents securely online. With features like templates and automated reminders, you can ensure timely submission of your tax forms without the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for Form Tpt Tax?

airSlate SignNow offers a variety of pricing plans to fit different business needs. Each plan provides features to facilitate the completion of the Form Tpt Tax efficiently, ensuring you get maximum value whether you are a small business or a large enterprise.

-

Does airSlate SignNow support integrations for managing Form Tpt Tax?

Yes, airSlate SignNow integrates with various third-party applications that can help manage the Form Tpt Tax effectively. These integrations allow you to connect your accounting software and document management systems, ensuring seamless workflow and data accuracy.

-

What are the key benefits of using airSlate SignNow for Form Tpt Tax?

Using airSlate SignNow for your Form Tpt Tax offers several key benefits: enhanced security for your documents, reduced processing time, and improved collaboration among team members. This streamlined approach not only saves you time but also minimizes the risk of errors in your tax documentation.

-

Is it easy to eSign the Form Tpt Tax with airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly platform that makes eSigning the Form Tpt Tax straightforward. With just a few clicks, you can electronically sign your documents anywhere, anytime, eliminating the need for printing and scanning.

-

Can I track the status of my Form Tpt Tax documents with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your Form Tpt Tax documents. You can receive notifications when your forms are viewed, signed, or if any action is required, ensuring smooth communication and transparency.

Get more for Form Tpt Tax

Find out other Form Tpt Tax

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure