Colorado SalesUse Tax Rates Colorado Department of 2020

Understanding the Colorado Sales/Use Tax Rates

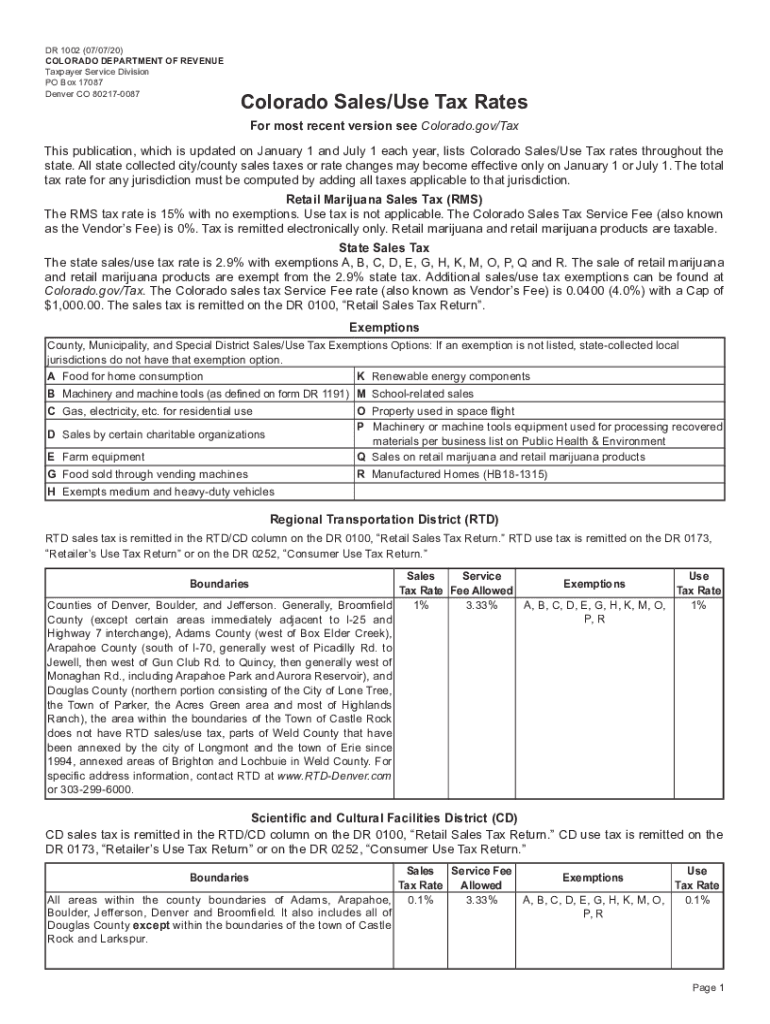

The Colorado sales/use tax rates are essential for businesses operating within the state. These rates vary depending on the location and type of goods or services being sold. The state imposes a base rate, but local jurisdictions may add additional taxes. It is crucial for businesses to be aware of these rates to ensure compliance and accurate tax collection.

As of recent updates, the state sales tax rate is 2.9%, but local rates can increase the total to over 10% in some areas. Understanding the specific rates applicable to your business location will help avoid potential penalties for non-compliance.

Steps to Complete the Colorado Sales/Use Tax Rates

Completing the Colorado sales/use tax rates involves several steps to ensure accuracy and compliance. First, identify the correct tax rate based on your business location and the type of products or services offered. This information can typically be found on the Colorado Department of Revenue website.

Next, calculate the tax amount by applying the appropriate rate to the total sales amount. For example, if your business sells goods totaling $1,000 and the applicable tax rate is 7%, the sales tax would be $70. Finally, report and remit the collected taxes to the state and local authorities by the specified deadlines.

Legal Use of the Colorado Sales/Use Tax Rates

Understanding the legal use of the Colorado sales/use tax rates is vital for businesses to avoid legal issues. The Colorado Department of Revenue outlines specific regulations regarding how sales tax should be applied. Businesses must ensure they are charging the correct rates based on the location of the sale and the nature of the transaction.

Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is recommended that businesses maintain accurate records of all transactions to support tax filings and compliance efforts.

Required Documents for Filing Sales/Use Tax

When filing sales/use tax in Colorado, businesses need to prepare several key documents. The primary document is the sales tax return, which details the total sales, taxable sales, and the amount of tax collected. Additionally, businesses should keep records of invoices, receipts, and any exemption certificates for tax-exempt sales.

Having these documents organized and readily available will facilitate the filing process and support compliance during audits. It is advisable to maintain these records for at least three years to align with state requirements.

Filing Deadlines and Important Dates

Filing deadlines for Colorado sales/use tax returns vary based on the frequency of filing assigned to your business, which can be monthly, quarterly, or annually. Generally, monthly filers must submit their returns by the 20th of the following month, while quarterly and annual filers have different deadlines.

It is crucial for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar with these important dates can help ensure timely submissions and compliance with state regulations.

Examples of Using the Colorado Sales/Use Tax Rates

Practical examples can help clarify how to apply the Colorado sales/use tax rates. For instance, if a retailer sells a dress for $100 in a city with a total sales tax rate of 8%, the tax collected would be $8, making the total sale $108.

Another example involves a service provider who charges $200 for a service in a location where the sales tax rate is 6%. The total amount billed to the customer would be $212, including $12 in sales tax. Understanding these calculations ensures accurate tax collection and compliance with state laws.

Quick guide on how to complete colorado salesuse tax rates colorado department of

Complete Colorado SalesUse Tax Rates Colorado Department Of effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed files, allowing you to obtain the accurate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Colorado SalesUse Tax Rates Colorado Department Of across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign Colorado SalesUse Tax Rates Colorado Department Of with ease

- Locate Colorado SalesUse Tax Rates Colorado Department Of and click on Get Form to begin.

- Utilize the features provided to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new file copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Colorado SalesUse Tax Rates Colorado Department Of and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado salesuse tax rates colorado department of

Create this form in 5 minutes!

How to create an eSignature for the colorado salesuse tax rates colorado department of

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What features does the dr 1002 offer for document signing?

The dr 1002 is equipped with robust features such as customizable templates, audit trails, and multi-party signing capabilities. These features ensure that your documents are secure and compliant, streamlining the signing process for all users. By choosing dr 1002, businesses can enhance their workflow and improve document management.

-

How much does the dr 1002 cost?

Pricing for the dr 1002 is competitive and varies based on the plan you select. airSlate SignNow provides flexible pricing options to accommodate businesses of all sizes. Whether you need basic features or advanced capabilities, the dr 1002 is designed to fit your budget.

-

Can the dr 1002 integrate with other software?

Yes, the dr 1002 seamlessly integrates with a variety of popular software applications. This includes CRM systems, cloud storage services, and productivity tools. By integrating dr 1002 into your existing systems, you can enhance efficiency and keep your document processes streamlined.

-

What benefits can businesses expect from using the dr 1002?

Businesses using the dr 1002 can expect signNow time savings and increased productivity through efficient document workflows. The user-friendly interface allows for easy adoption among team members, leading to faster turnaround times on important documents. Additionally, the dr 1002 enhances security with its advanced encryption features.

-

Is the dr 1002 suitable for small businesses?

Absolutely! The dr 1002 is designed to meet the needs of small businesses by providing an affordable and scalable e-signature solution. Its intuitive design makes it easy for anyone to use, ensuring that small teams can efficiently manage their document signing without any hassle.

-

What kind of customer support is available for dr 1002 users?

airSlate SignNow offers comprehensive customer support for dr 1002 users, including live chat, email, and a dedicated help center. Whether you need assistance with setup or have questions about features, support is readily available. This ensures that your experience with dr 1002 remains smooth and productive.

-

Can I track my document status with the dr 1002?

Yes, the dr 1002 allows you to easily track the status of your documents in real-time. You'll receive notifications when documents are opened or signed, providing full transparency throughout the process. This feature is essential for businesses that need to manage workflows and keep stakeholders informed.

Get more for Colorado SalesUse Tax Rates Colorado Department Of

Find out other Colorado SalesUse Tax Rates Colorado Department Of

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer