DR 1002 Form UpdatesDepartment of Revenue Taxation 2025-2026

Understanding the DR 1002 Form

The DR 1002 Form is essential for businesses in Colorado to report and pay sales and use tax. This form is used to calculate the total tax owed based on the sales made during a specific period. It is crucial for compliance with state tax regulations and helps ensure that businesses contribute appropriately to state revenue.

Steps to Complete the DR 1002 Form

Completing the DR 1002 Form involves several key steps:

- Gather all necessary sales records for the reporting period.

- Calculate the total sales made, including taxable and non-taxable sales.

- Determine the applicable Colorado sales tax rates for the period.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the form for any errors before submission.

Filing Deadlines for the DR 1002 Form

It is important to be aware of the filing deadlines for the DR 1002 Form to avoid penalties. Typically, the form is due on the 20th day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form must be filed by February 20.

Required Documents for Filing

When preparing to file the DR 1002 Form, ensure you have the following documents:

- Sales records detailing all transactions during the reporting period.

- Receipts for any tax-exempt sales.

- Documentation of any adjustments or credits claimed.

Penalties for Non-Compliance

Failing to file the DR 1002 Form on time or submitting inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, and potential audits. It is essential to adhere to all filing requirements to maintain compliance and avoid unnecessary costs.

Digital vs. Paper Version of the DR 1002 Form

The DR 1002 Form can be submitted either digitally or via paper. Digital submission is often more efficient, allowing for quicker processing and confirmation of receipt. However, some businesses may prefer the traditional paper method for record-keeping purposes. Ensure that whichever method you choose complies with state regulations.

Create this form in 5 minutes or less

Find and fill out the correct dr 1002 form updatesdepartment of revenue taxation

Create this form in 5 minutes!

How to create an eSignature for the dr 1002 form updatesdepartment of revenue taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the current Colorado sales tax rates?

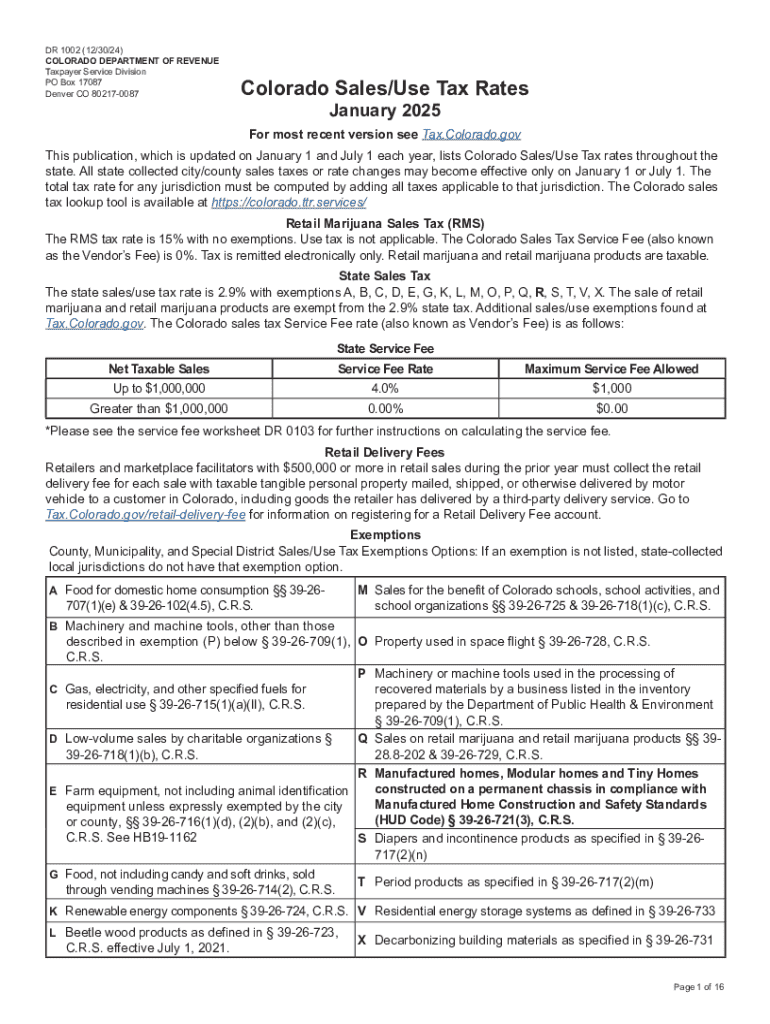

The current Colorado sales tax rates vary by location, as they include both state and local taxes. As of now, the state sales tax rate is 2.9%, but local jurisdictions can add their own rates, resulting in a total that can exceed 10% in some areas. It's essential to check the specific rates for your locality to ensure compliance.

-

How can airSlate SignNow help with managing Colorado sales tax rates?

airSlate SignNow offers features that streamline document management, including invoicing and tax calculations. By integrating your sales processes with our platform, you can easily apply the correct Colorado sales tax rates to your transactions, ensuring accuracy and compliance. This can save you time and reduce the risk of errors.

-

Are there any additional fees associated with using airSlate SignNow for Colorado sales tax calculations?

While airSlate SignNow provides a cost-effective solution for eSigning and document management, there may be additional fees depending on the features you choose. However, the platform is designed to help you manage Colorado sales tax rates efficiently, potentially saving you money in the long run by reducing tax-related errors.

-

Can I integrate airSlate SignNow with my accounting software to manage Colorado sales tax rates?

Yes, airSlate SignNow offers integrations with various accounting software solutions. This allows you to synchronize your sales data and automatically apply the correct Colorado sales tax rates, making your financial processes more efficient. Integrating these tools can help you maintain accurate records and streamline your tax reporting.

-

What features does airSlate SignNow offer to help with compliance regarding Colorado sales tax rates?

airSlate SignNow includes features such as customizable templates and automated workflows that can help ensure compliance with Colorado sales tax rates. By using our platform, you can create documents that automatically calculate the appropriate tax based on the location of your customers. This reduces the risk of non-compliance and helps you stay organized.

-

Is airSlate SignNow suitable for small businesses dealing with Colorado sales tax rates?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. With our platform, you can easily manage documents and ensure that you are applying the correct Colorado sales tax rates without needing extensive accounting knowledge.

-

How does airSlate SignNow ensure the security of documents related to Colorado sales tax rates?

Security is a top priority for airSlate SignNow. We use advanced encryption and secure cloud storage to protect your documents, including those related to Colorado sales tax rates. This ensures that sensitive information remains confidential and is accessible only to authorized users.

Get more for DR 1002 Form UpdatesDepartment Of Revenue Taxation

Find out other DR 1002 Form UpdatesDepartment Of Revenue Taxation

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form