DR 1002 Colorado SalesUse Tax Rates 2022

What is the DR 1002 Colorado Sales/Use Tax Rates

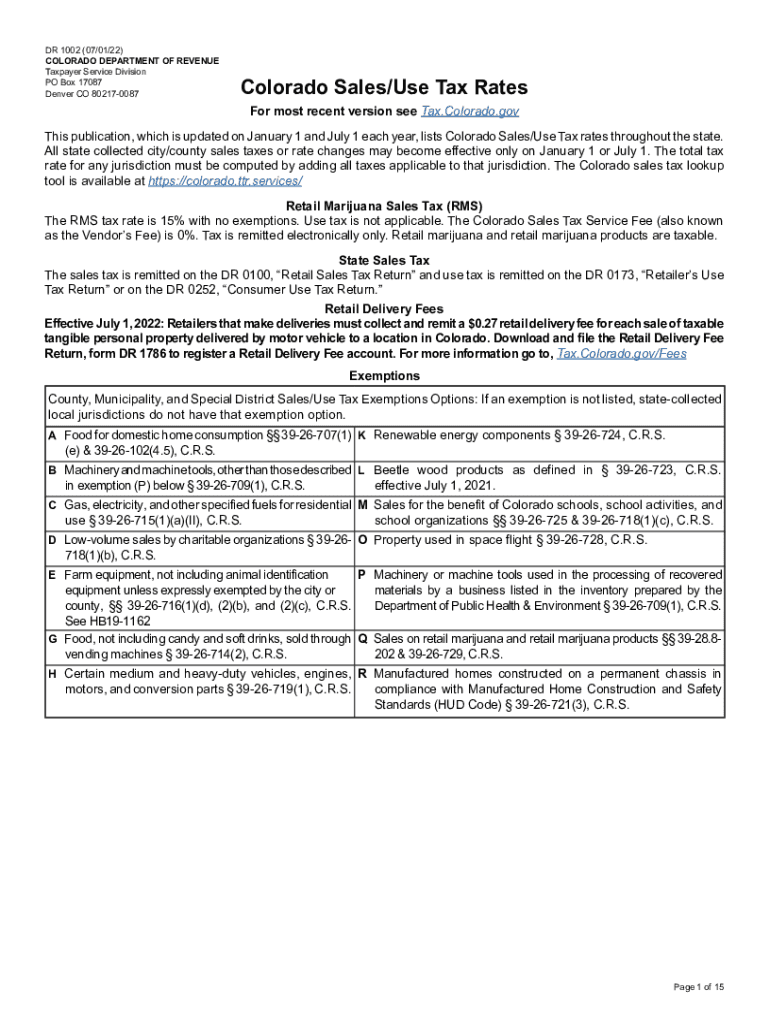

The DR 1002 is a form used in Colorado to report sales and use tax rates applicable to transactions within the state. This form is essential for businesses and individuals who engage in sales of tangible personal property or taxable services. The rates can vary by jurisdiction, and it is crucial to reference the correct rates when completing the form to ensure compliance with state tax laws.

How to Use the DR 1002 Colorado Sales/Use Tax Rates

Using the DR 1002 involves identifying the appropriate sales and use tax rates for your specific location in Colorado. Businesses must calculate the tax based on the total sales amount and apply the correct rate. This ensures that the correct tax is collected from customers and reported accurately to the state. It is advisable to check the Colorado Department of Revenue’s website for the most current rates and any updates to local tax jurisdictions.

Steps to Complete the DR 1002 Colorado Sales/Use Tax Rates

Completing the DR 1002 requires several steps:

- Gather all sales records for the reporting period.

- Identify the appropriate sales and use tax rates based on your location.

- Calculate the total sales tax by multiplying the sales amount by the applicable rate.

- Fill out the DR 1002 form with the calculated tax amount and other required information.

- Submit the completed form to the Colorado Department of Revenue by the designated deadline.

Legal Use of the DR 1002 Colorado Sales/Use Tax Rates

The DR 1002 is legally binding when completed accurately and submitted within the required timeframe. Compliance with Colorado tax laws is essential to avoid penalties and interest on unpaid taxes. It is important to ensure that all calculations are correct and that the form is submitted to the appropriate state agency.

Examples of Using the DR 1002 Colorado Sales/Use Tax Rates

Examples of when to use the DR 1002 include:

- A retail store selling clothing and accessories must report sales tax collected from customers.

- A contractor providing taxable services must calculate and report use tax on materials purchased for projects.

- Online businesses shipping products to customers in Colorado need to collect and remit sales tax based on the customer's location.

Filing Deadlines / Important Dates

Filing deadlines for the DR 1002 vary based on the reporting period. Typically, businesses must file monthly, quarterly, or annually, depending on their sales volume. It is crucial to be aware of these deadlines to avoid late fees and penalties. The Colorado Department of Revenue provides a calendar of important dates related to tax filings.

Quick guide on how to complete dr 1002 colorado salesuse tax rates

Complete DR 1002 Colorado SalesUse Tax Rates effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage DR 1002 Colorado SalesUse Tax Rates on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign DR 1002 Colorado SalesUse Tax Rates with ease

- Find DR 1002 Colorado SalesUse Tax Rates and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign DR 1002 Colorado SalesUse Tax Rates and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 1002 colorado salesuse tax rates

Create this form in 5 minutes!

People also ask

-

What is dr 1002 and how does it relate to airSlate SignNow?

dr 1002 is a unique identifier for a specific document template within the airSlate SignNow platform. This template facilitates streamlined document management and eSignature processes, allowing businesses to efficiently handle agreements and contracts using our user-friendly solution.

-

What are the pricing options for using dr 1002 with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include features like dr 1002. Depending on your business needs, you can choose from various subscription levels, ensuring that you only pay for what you use while maximizing the benefits of seamless eSigning.

-

What features does dr 1002 provide for users of airSlate SignNow?

With dr 1002, users access advanced features such as customizable templates, automated workflows, and integrations with other software. This makes it easier for businesses to create, send, and manage documents, all in one place.

-

How can businesses benefit from using dr 1002 in their document workflows?

Utilizing dr 1002 helps businesses enhance their efficiency by reducing the time spent on document management. By automating processes and ensuring secure eSignatures, companies can focus on their core operations and improve productivity.

-

Is dr 1002 compatible with other tools and applications?

Yes, dr 1002 is designed to integrate smoothly with various applications and services. This compatibility allows businesses to enhance their workflows, connecting airSlate SignNow with popular CRM, project management, and accounting software.

-

Can dr 1002 be customized for specific business needs?

Absolutely! The dr 1002 template can be tailored to meet the unique requirements of your business. Users can modify fields, add logos, and adjust settings, enabling personalized document creation that reflects your brand's identity.

-

How secure is the use of dr 1002 for sensitive documents?

Security is a top priority at airSlate SignNow. When using dr 1002, your documents are protected with advanced encryption protocols and comply with industry standards, ensuring that sensitive information remains confidential and secure.

Get more for DR 1002 Colorado SalesUse Tax Rates

- North carolina renunciation and disclaimer of joint tenant or tenancy interest north carolina form

- North carolina claim form

- Quitclaim deed by two individuals to llc north carolina form

- General warranty deed from two individuals to llc north carolina form

- Notice of claim subcontractor 12or 3rd tier corporation or llc north carolina form

- Notice of claim more remote than 3rd tier individual north carolina form

- Quitclaim deed by two individuals to corporation north carolina form

- General warranty deed from two individuals to corporation north carolina form

Find out other DR 1002 Colorado SalesUse Tax Rates

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast