California Schedule K 1 565 Partner's Share of Income 2020

What is the California Schedule K-1 565 Partner's Share of Income

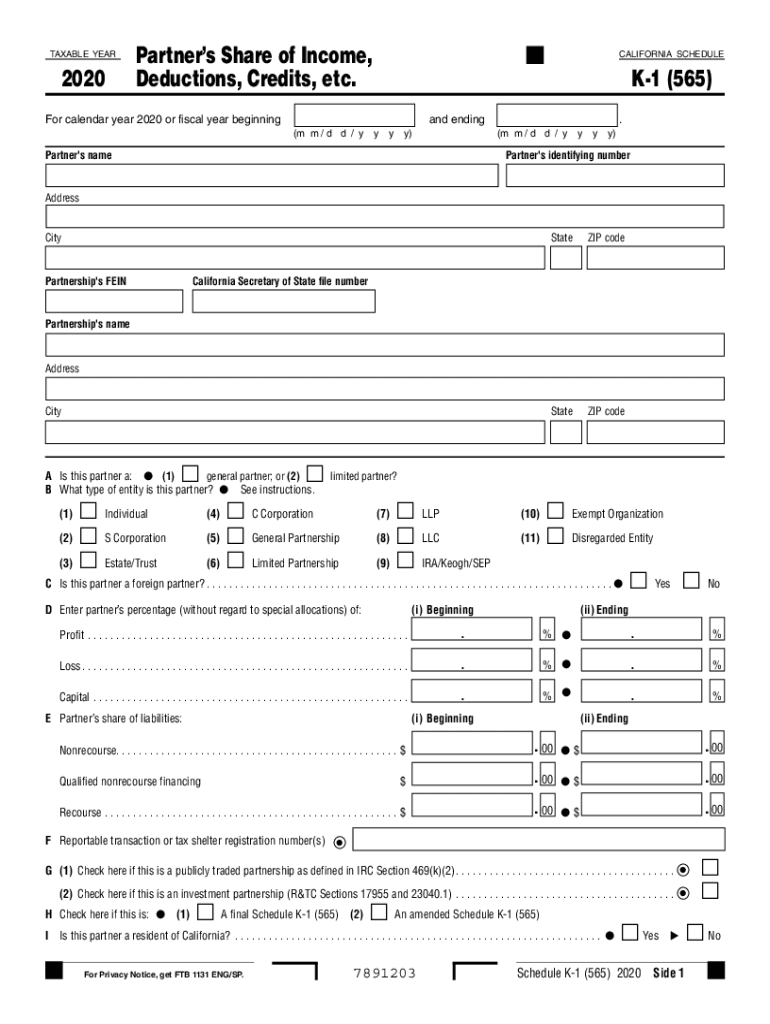

The California Schedule K-1 565 is a tax form used by partnerships to report each partner's share of income, deductions, credits, and other tax-related items. This form is essential for partners to accurately report their income on their individual tax returns. The K-1 provides detailed information about the partner's share of the partnership's income, which may include ordinary income, capital gains, and other types of income. Understanding the contents of this form is crucial for ensuring compliance with state tax regulations.

Steps to Complete the California Schedule K-1 565 Partner's Share of Income

Completing the California Schedule K-1 565 involves several key steps:

- Gather necessary financial information from the partnership, including income statements and expense reports.

- Fill out the partner's details, including name, address, and taxpayer identification number.

- Report the partner's share of income, deductions, and credits as provided by the partnership.

- Ensure accuracy by cross-referencing the information with the partnership's financial records.

- Submit the completed form to the California Franchise Tax Board along with the partner's individual tax return.

Legal Use of the California Schedule K-1 565 Partner's Share of Income

The California Schedule K-1 565 is legally binding and must be used in accordance with California tax laws. It is important for partners to retain a copy of the K-1 for their records, as it serves as proof of income received from the partnership. The information reported on this form must be accurately reflected on individual tax returns to avoid penalties or audits. Compliance with the legal requirements surrounding this form is essential for maintaining good standing with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the California Schedule K-1 565 are aligned with the general partnership tax return deadlines. Typically, partnerships must file their tax returns by the 15th day of the third month following the end of their fiscal year. For partnerships operating on a calendar year, this means the deadline is March 15. Partners should ensure they receive their K-1 in a timely manner to meet their individual tax return deadlines, which are usually April 15 for individual taxpayers.

Who Issues the Form

The California Schedule K-1 565 is issued by partnerships to their partners. Each partnership is responsible for preparing and distributing the K-1 forms to all partners, ensuring that they accurately reflect each partner's share of income and deductions. This form must be provided to partners by the filing deadline of the partnership's tax return, allowing partners to use the information for their own tax reporting purposes.

Examples of Using the California Schedule K-1 565 Partner's Share of Income

Partners may encounter various scenarios when using the California Schedule K-1 565. For instance, a partner receiving a share of income from a real estate partnership may report rental income and associated deductions on their individual tax return. Another example includes a partner in an investment partnership who receives capital gains distributions, which must also be reported accordingly. Understanding how to interpret and utilize the information from the K-1 is vital for accurate tax reporting.

Quick guide on how to complete 2020 california schedule k 1 565 partners share of income

Prepare California Schedule K 1 565 Partner's Share Of Income effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly option to traditional printed and signed paperwork, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage California Schedule K 1 565 Partner's Share Of Income on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest method to edit and electronically sign California Schedule K 1 565 Partner's Share Of Income without hassle

- Obtain California Schedule K 1 565 Partner's Share Of Income and click on Access Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Completed button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from the device of your choice. Edit and electronically sign California Schedule K 1 565 Partner's Share Of Income and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 california schedule k 1 565 partners share of income

Create this form in 5 minutes!

How to create an eSignature for the 2020 california schedule k 1 565 partners share of income

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the 2017 565 form used for?

The 2017 565 form is utilized by businesses to report certain tax information. Using airSlate SignNow, you can securely eSign and send this document effortlessly. Our platform simplifies the process, ensuring you can handle your tax filings efficiently.

-

How can airSlate SignNow help me complete the 2017 565 form?

With airSlate SignNow, you can fill out, eSign, and share the 2017 565 form quickly. Our user-friendly interface ensures that you can navigate the document easily, eliminating the hassle of traditional paperwork. Enjoy streamlined workflows that save you time and effort.

-

Is airSlate SignNow cost-effective for small businesses using the 2017 565?

Absolutely! airSlate SignNow offers affordable pricing plans that are friendly to small businesses. By using our solution for the 2017 565 and other documents, you're not only ensuring compliance but also saving valuable resources in the long run.

-

What key features does airSlate SignNow provide for the 2017 565 form?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage for the 2017 565 form. These tools enhance your document management experience, making it easier to stay organized and compliant with regulations.

-

Can I integrate airSlate SignNow with other software for the 2017 565?

Yes, airSlate SignNow seamlessly integrates with various software applications, making it ideal for completing the 2017 565. This includes popular platforms for account management and document storage, creating a comprehensive business solution tailored to your needs.

-

What are the benefits of using airSlate SignNow for the 2017 565 form?

Using airSlate SignNow to manage your 2017 565 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can eSign documents securely and access them from anywhere, ensuring your business remains compliant and streamlined.

-

How does airSlate SignNow ensure the security of the 2017 565 form?

airSlate SignNow prioritizes security with advanced encryption and authentication protocols for the 2017 565 form. Our platform safeguards your data, ensuring that sensitive information remains confidential and protected from unauthorized access.

Get more for California Schedule K 1 565 Partner's Share Of Income

Find out other California Schedule K 1 565 Partner's Share Of Income

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free