California Form 541 Schedule K 1 Beneficiary's Share of 2023-2026

What is the California Form 541 Schedule K-1 Beneficiary's Share Of

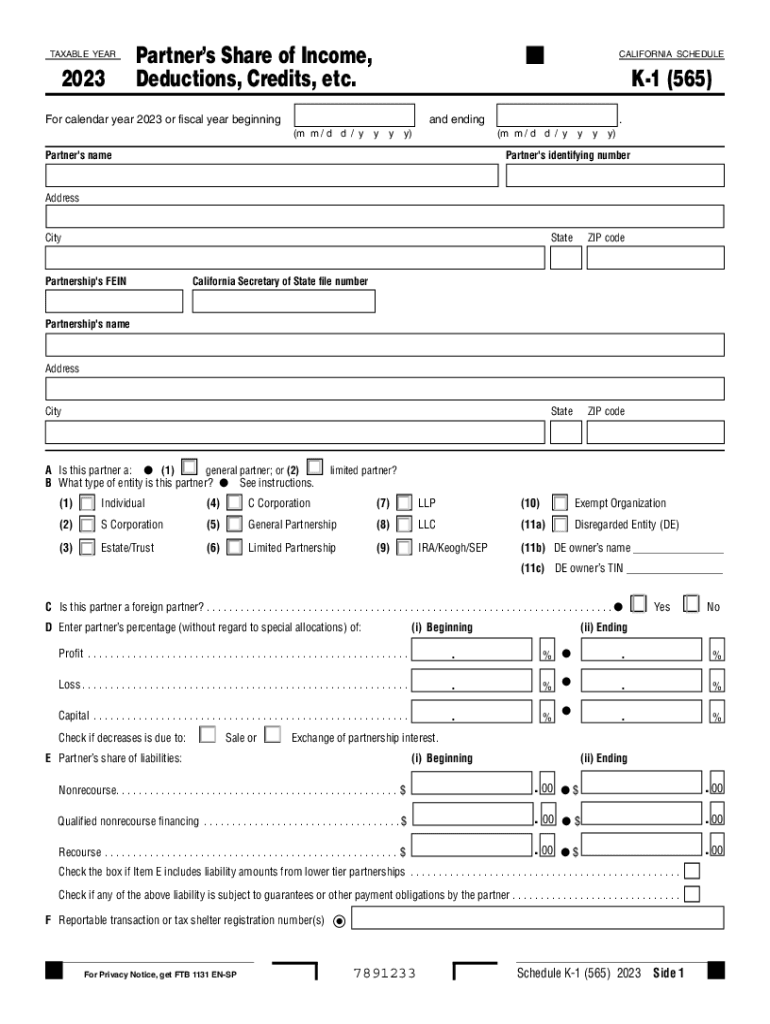

The California Form 541 Schedule K-1 is a tax document used to report the income, deductions, and credits allocated to beneficiaries of a trust or estate. This form is essential for beneficiaries to accurately report their share of the trust's or estate's income on their personal income tax returns. The information provided on the K-1 helps beneficiaries understand their tax obligations and ensures compliance with state tax laws.

How to use the California Form 541 Schedule K-1 Beneficiary's Share Of

To effectively use the California Form 541 Schedule K-1, beneficiaries should first review the form to understand the specific amounts allocated to them. This includes income types such as interest, dividends, and capital gains. Beneficiaries must then transfer this information to their personal tax returns, ensuring that they report all income accurately. It is crucial to keep a copy of the K-1 for personal records and future reference.

Steps to complete the California Form 541 Schedule K-1 Beneficiary's Share Of

Completing the California Form 541 Schedule K-1 involves several steps:

- Gather necessary information about the trust or estate, including its tax identification number.

- Fill out the beneficiary's name, address, and identifying information on the form.

- Report the amounts allocated to the beneficiary in the appropriate sections, such as income, deductions, and credits.

- Review the completed form for accuracy before submission.

- Provide a copy of the K-1 to the beneficiary and retain a copy for the trust's or estate's records.

Key elements of the California Form 541 Schedule K-1 Beneficiary's Share Of

Key elements of the California Form 541 Schedule K-1 include:

- Beneficiary Information: This section includes the beneficiary's name, address, and taxpayer identification number.

- Income Allocation: Details the various types of income allocated to the beneficiary, such as ordinary income, capital gains, and tax-exempt income.

- Deductions and Credits: Lists any deductions or credits that the beneficiary can claim based on their share of the trust or estate.

- Signature and Date: The form must be signed and dated by the trustee or executor to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the California Form 541 Schedule K-1. Beneficiaries must ensure that the information reported aligns with IRS requirements for reporting income from trusts and estates. It is important to refer to IRS publications and instructions for accurate filing and to understand any tax implications associated with the income reported on the K-1.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 541 Schedule K-1 typically coincide with the tax return deadlines for trusts and estates. Generally, the form must be completed and provided to beneficiaries by April 15 of the following tax year. Beneficiaries should be aware of their personal tax return deadlines to ensure timely reporting of the K-1 information on their returns.

Create this form in 5 minutes or less

Find and fill out the correct california form 541 schedule k 1 beneficiarys share of

Create this form in 5 minutes!

How to create an eSignature for the california form 541 schedule k 1 beneficiarys share of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a K1 tax form?

A K1 tax form is a document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's share of the entity's income, which is essential for accurate tax reporting. Understanding what a K1 tax form entails is crucial for anyone involved in these types of entities.

-

How do I obtain my K1 tax form?

To obtain your K1 tax form, you should contact the partnership or S corporation that you are involved with, as they are responsible for issuing this form. Typically, K1 forms are distributed after the entity has completed its tax filings, usually by March 15th. Knowing how to get your K1 tax form is important for timely tax preparation.

-

What information is included on a K1 tax form?

A K1 tax form includes various details such as the partner's share of income, deductions, credits, and other tax-related information. It also contains the entity's tax identification number and the partner's share of liabilities. Understanding what information is included on a K1 tax form can help you accurately report your taxes.

-

What are the deadlines for filing a K1 tax form?

The deadline for filing a K1 tax form typically aligns with the tax return deadlines of the partnership or S corporation, which is usually March 15th. However, if an extension is filed, the deadline may be extended to September 15th. Being aware of these deadlines is essential for timely tax compliance.

-

Can I eSign my K1 tax form using airSlate SignNow?

Yes, you can eSign your K1 tax form using airSlate SignNow, which provides a secure and efficient way to sign documents electronically. This feature allows you to complete your tax forms quickly without the need for printing or mailing. Utilizing airSlate SignNow for your K1 tax form can streamline your tax filing process.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents, including K1 forms, offers numerous benefits such as enhanced security, ease of use, and cost-effectiveness. The platform allows for quick document turnaround and ensures that all signatures are legally binding. Understanding these benefits can help you make informed decisions about your document management.

-

Is airSlate SignNow compatible with accounting software for K1 forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your K1 forms and other tax documents. This compatibility allows for efficient data transfer and reduces the risk of errors. Knowing that airSlate SignNow works well with your accounting tools can enhance your overall tax preparation experience.

Get more for California Form 541 Schedule K 1 Beneficiary's Share Of

Find out other California Form 541 Schedule K 1 Beneficiary's Share Of

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free