Www Irs Govpubirs Pdf2021 Schedule K 1 Form 1041 IRS Tax Forms 2021

What is the Schedule K-1 Form?

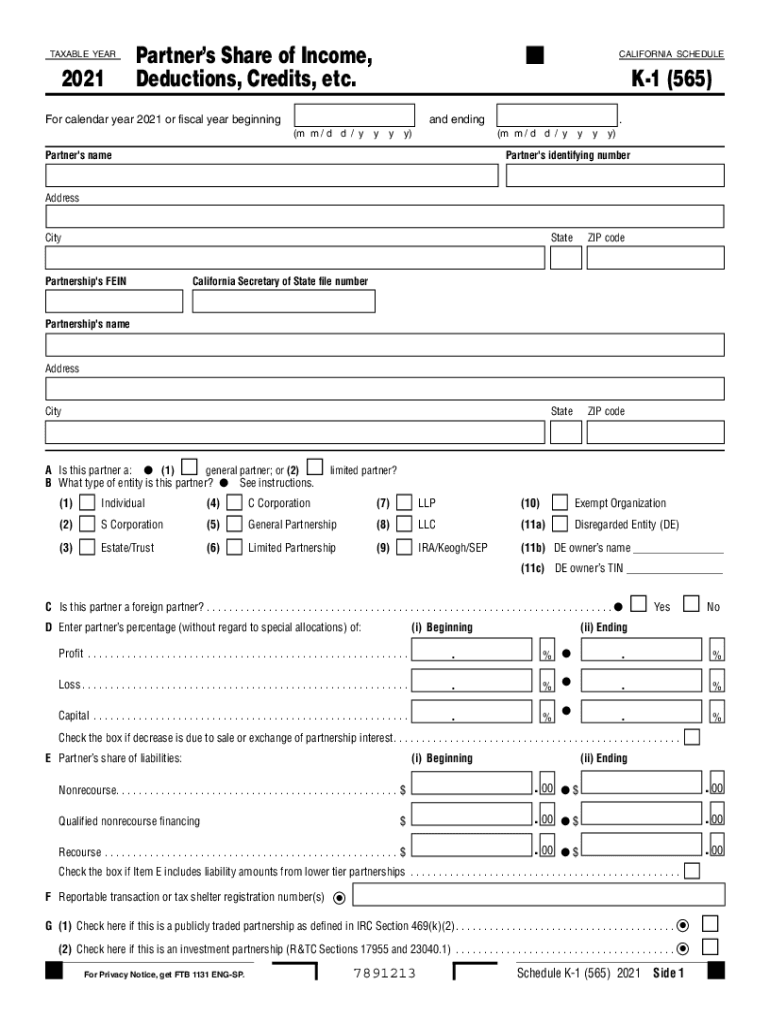

The Schedule K-1 is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It is essential for individuals who receive income from these entities, as it helps them report their share of the entity's income on their personal tax returns. The form provides detailed information about the taxpayer's share of income, losses, and other tax-related items, which are necessary for accurate tax filing.

Key Elements of the Schedule K-1 Form

The Schedule K-1 includes various critical components that taxpayers need to understand:

- Partnership Information: This section provides details about the partnership or entity, including its name, address, and Employer Identification Number (EIN).

- Partner's Information: Taxpayers' names, addresses, and tax identification numbers are listed here, ensuring that the IRS can match the income reported with the correct taxpayer.

- Income and Deductions: This part outlines the specific amounts of income, deductions, and credits allocated to the partner or shareholder for the tax year.

- Other Information: Additional details may include capital gains, foreign transactions, and other relevant tax items that affect the taxpayer's overall tax liability.

Steps to Complete the Schedule K-1 Form

Completing the Schedule K-1 requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather Necessary Information: Collect all relevant financial documents, including partnership agreements and previous tax returns.

- Fill Out Entity Information: Enter the name, address, and EIN of the partnership or entity at the top of the form.

- Provide Partner Information: Input the partner's name, address, and tax identification number in the designated fields.

- Report Income and Deductions: Accurately report the partner's share of income, deductions, and credits in the corresponding sections.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

Legal Use of the Schedule K-1 Form

The Schedule K-1 is legally recognized as a valid document for reporting income to the IRS. It is crucial for taxpayers to use this form correctly to ensure compliance with tax laws. Failure to report income from a K-1 can lead to penalties and interest on unpaid taxes. It is advisable to retain a copy of the K-1 for personal records and future reference.

Filing Deadlines for Schedule K-1

Filing deadlines for the Schedule K-1 can vary based on the type of entity:

- Partnerships: Generally, the deadline for partnerships to file their tax returns, including issuing K-1s, is March 15.

- S Corporations: Similar to partnerships, S corporations also have a deadline of March 15 for filing and issuing K-1s.

- Estates and Trusts: The deadline for estates and trusts is typically April 15, aligning with individual tax return deadlines.

Obtaining the Schedule K-1 Form

Taxpayers can obtain the Schedule K-1 form from various sources:

- IRS Website: The IRS provides downloadable versions of the Schedule K-1 on its official website.

- Tax Preparation Software: Many tax software programs include the Schedule K-1 form as part of their offerings.

- From the Partnership or Entity: Taxpayers should also receive a copy of the K-1 directly from the partnership, S corporation, estate, or trust that generated the income.

Quick guide on how to complete wwwirsgovpubirs pdf2021 schedule k 1 form 1041 irs tax forms

Prepare Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms effortlessly on any device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed materials, allowing you to locate the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven processes today.

How to modify and eSign Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms with ease

- Find Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or through an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious searching for forms, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms, ensuring excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 schedule k 1 form 1041 irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 schedule k 1 form 1041 irs tax forms

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

How to generate an e-signature for a PDF document on Android devices

People also ask

-

What is a Schedule K-1 and how is it used?

A Schedule K-1 is a tax form that partners, shareholders, and beneficiaries receive to report income, deductions, and credits. It helps in detailing each partner's or shareholder's share of the entity’s income, which is then used when filing personal tax returns. Using airSlate SignNow can simplify the process of distributing and signing Schedule K-1 forms electronically.

-

How does airSlate SignNow streamline the handling of Schedule K-1 forms?

airSlate SignNow provides an easy-to-use platform for sending and eSigning Schedule K-1 forms. Users can create templates for these forms, ensuring compliance and accuracy. For efficient management, documents can be tracked in real-time, allowing businesses to focus on their operations rather than paperwork.

-

What are the pricing plans for using airSlate SignNow for Schedule K-1 processing?

airSlate SignNow offers several pricing plans to cater to different business needs, allowing users to choose the best fit for handling Schedule K-1 forms. Plans are designed to be cost-effective and scalable, ensuring that businesses don’t overpay for features they don’t use. Additionally, trials are often available to help users assess the platform before committing.

-

Can I integrate airSlate SignNow with other accounting software for managing Schedule K-1?

Yes, airSlate SignNow supports various integrations with popular accounting software, making it easier to manage Schedule K-1 processes directly from your existing systems. This integration enables seamless data transfer and reduces the risk of errors, enhancing overall efficiency in handling tax documents.

-

What security features does airSlate SignNow provide for Schedule K-1 documents?

airSlate SignNow prioritizes security, incorporating features like encryption, two-factor authentication, and secure storage for your Schedule K-1 documents. These measures help protect sensitive tax information and ensure that only authorized users can access the documents, providing peace of mind when managing financial forms.

-

Is it easy to modify a Schedule K-1 using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that allows for easy modifications of Schedule K-1 forms. Users can make necessary adjustments quickly and resend documents for signatures without hassle, ensuring that information is always accurate and up-to-date.

-

What benefits does eSigning Schedule K-1 forms offer?

E-signing Schedule K-1 forms through airSlate SignNow offers numerous benefits including faster turnaround times, enhanced convenience, and reduced paper usage. This digital approach not only accelerates the process but also enables remote collaboration, making it easier for stakeholders to review and sign documents from anywhere.

Get more for Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms

- Ma marital agreement form

- Massachusetts assignments form

- Commercial sublease massachusetts form

- Residential lease renewal agreement massachusetts form

- Exercising option purchase 497309761 form

- Assignment of lease and rent from borrower to lender massachusetts form

- Assignment of lease from lessor with notice of assignment massachusetts form

- Letter from landlord to tenant as notice of abandoned personal property massachusetts form

Find out other Www irs govpubirs pdf2021 Schedule K 1 Form 1041 IRS Tax Forms

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors