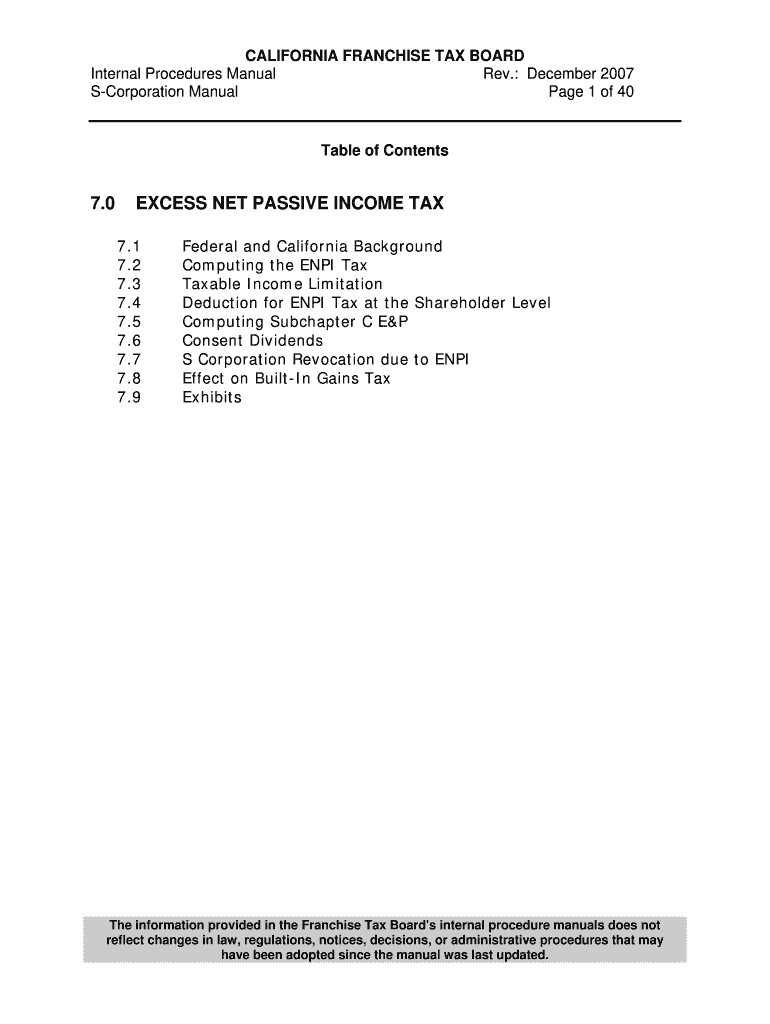

EXCESS NET PASSIVE INCOME TAX 2007

What is the EXCESS NET PASSIVE INCOME TAX

The excess net passive income tax is a tax imposed on certain corporations that have accumulated excess passive income. This tax is primarily relevant for S corporations that have passive investment income exceeding twenty-five percent of their gross receipts. If an S corporation meets these criteria, it may be subject to taxation on the excess amount, which is calculated based on the corporation's net passive income. Understanding this tax is crucial for S corporations to ensure compliance and avoid potential penalties.

Steps to complete the EXCESS NET PASSIVE INCOME TAX

Completing the excess net passive income tax form involves several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including income statements and balance sheets. Next, calculate your corporation's total passive income and determine if it exceeds the twenty-five percent threshold. If it does, you will need to calculate the excess amount. Once you have the necessary figures, fill out the form accurately, ensuring all calculations are correct. Finally, review the completed form for any errors before submission.

Legal use of the EXCESS NET PASSIVE INCOME TAX

The legal use of the excess net passive income tax involves adhering to specific IRS regulations. S corporations must report their passive income accurately to avoid misclassification. Failure to comply with these regulations can lead to penalties and interest charges. It is essential for corporations to understand the legal implications of their passive income to maintain their S corporation status and avoid unnecessary taxation. Consulting with a tax professional can help ensure that all legal requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the excess net passive income tax are crucial for S corporations to keep in mind. Generally, the tax must be filed by the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically falls on March fifteenth. It is important to stay informed about any changes to these deadlines, as failing to file on time can result in penalties. Always verify the specific dates for your tax year to ensure compliance.

Required Documents

To complete the excess net passive income tax form, several documents are necessary. These include:

- Income statements detailing passive income sources

- Balance sheets that reflect the corporation's financial position

- Prior year tax returns for reference

- Any supporting documentation for deductions or credits

Having these documents ready will streamline the completion process and help ensure that all information is accurate and up to date.

Penalties for Non-Compliance

Non-compliance with the excess net passive income tax regulations can lead to significant penalties. If an S corporation fails to file the required tax form, it may incur fines and interest on any unpaid taxes. Additionally, the IRS may revoke the corporation's S status if it consistently fails to comply with tax obligations. Understanding these potential penalties is essential for S corporations to maintain compliance and avoid financial repercussions.

IRS Guidelines

The IRS provides specific guidelines regarding the excess net passive income tax that S corporations must follow. These guidelines outline how to calculate passive income, the thresholds for taxation, and the reporting requirements. It is crucial for corporations to familiarize themselves with these guidelines to ensure accurate reporting and compliance. Regularly consulting the IRS website or seeking guidance from a tax professional can help keep corporations informed about any updates or changes to these regulations.

Quick guide on how to complete excess net passive income tax

Finish EXCESS NET PASSIVE INCOME TAX smoothly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed forms, allowing you to locate the right document and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without hold-ups. Manage EXCESS NET PASSIVE INCOME TAX on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

The easiest method to modify and eSign EXCESS NET PASSIVE INCOME TAX with ease

- Locate EXCESS NET PASSIVE INCOME TAX and click on Get Form to begin.

- Leverage the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and possesses the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your requirements in document management in just a few clicks from your chosen device. Alter and eSign EXCESS NET PASSIVE INCOME TAX and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct excess net passive income tax

Create this form in 5 minutes!

How to create an eSignature for the excess net passive income tax

How to create an eSignature for your Excess Net Passive Income Tax online

How to make an eSignature for your Excess Net Passive Income Tax in Google Chrome

How to generate an eSignature for signing the Excess Net Passive Income Tax in Gmail

How to make an eSignature for the Excess Net Passive Income Tax straight from your smartphone

How to generate an eSignature for the Excess Net Passive Income Tax on iOS devices

How to make an eSignature for the Excess Net Passive Income Tax on Android OS

People also ask

-

What is EXCESS NET PASSIVE INCOME TAX and how does it affect businesses?

EXCESS NET PASSIVE INCOME TAX refers to a tax applied to passive income generated by businesses that are classified as S Corporations. If your business earns passive income beyond certain limits, understanding this tax is crucial for compliance and financial planning. This tax can impact your overall revenue, so it's important to consider it when managing your business finances.

-

How can airSlate SignNow help with documenting EXCESS NET PASSIVE INCOME TAX?

airSlate SignNow allows businesses to easily create, send, and eSign important documents related to EXCESS NET PASSIVE INCOME TAX, such as tax forms and financial statements. Our platform simplifies the documentation process, ensuring that all necessary paperwork is securely signed and stored. This ensures you stay organized and compliant with tax regulations.

-

What features does airSlate SignNow offer that support EXCESS NET PASSIVE INCOME TAX compliance?

airSlate SignNow provides features like customizable templates, audit trails, and automatic reminders for important deadlines, all of which aid in EXCESS NET PASSIVE INCOME TAX compliance. With our platform, users can track document status and ensure timely submissions. This can signNowly reduce the risk of penalties due to late filings.

-

Is there a free trial available for airSlate SignNow, and does it cover EXCESS NET PASSIVE INCOME TAX features?

Yes, airSlate SignNow offers a free trial that includes access to all features related to EXCESS NET PASSIVE INCOME TAX documentation. You can test the platform's capabilities, including eSigning and document management, without any upfront cost. This allows you to evaluate how our solution can streamline your tax documentation processes.

-

How does airSlate SignNow integrate with other financial software for managing EXCESS NET PASSIVE INCOME TAX?

airSlate SignNow seamlessly integrates with popular accounting and financial software, enabling users to manage EXCESS NET PASSIVE INCOME TAX information more efficiently. By connecting with platforms like QuickBooks and Xero, you can ensure your documents and tax calculations are aligned. This integration helps to streamline workflows and improve accuracy in financial reporting.

-

What are the pricing options for airSlate SignNow, especially for businesses dealing with EXCESS NET PASSIVE INCOME TAX?

airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on managing EXCESS NET PASSIVE INCOME TAX. Each plan provides access to essential features, enabling you to choose the right level of service for your business size and requirements. Flexible pricing ensures that you can utilize our solution cost-effectively.

-

Can airSlate SignNow ensure the security of documents related to EXCESS NET PASSIVE INCOME TAX?

Absolutely, airSlate SignNow prioritizes document security, especially for sensitive information related to EXCESS NET PASSIVE INCOME TAX. Our platform uses advanced encryption and secure data storage to protect your documents and compliance records. You can confidently manage your tax-related paperwork knowing it is safeguarded against unauthorized access.

Get more for EXCESS NET PASSIVE INCOME TAX

Find out other EXCESS NET PASSIVE INCOME TAX

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors