SFORMSWork Folder800 899TC 804 Cdr Tax Utah 2013

What is the SFORMSWork Folder800 899TC 804 cdr Tax Utah

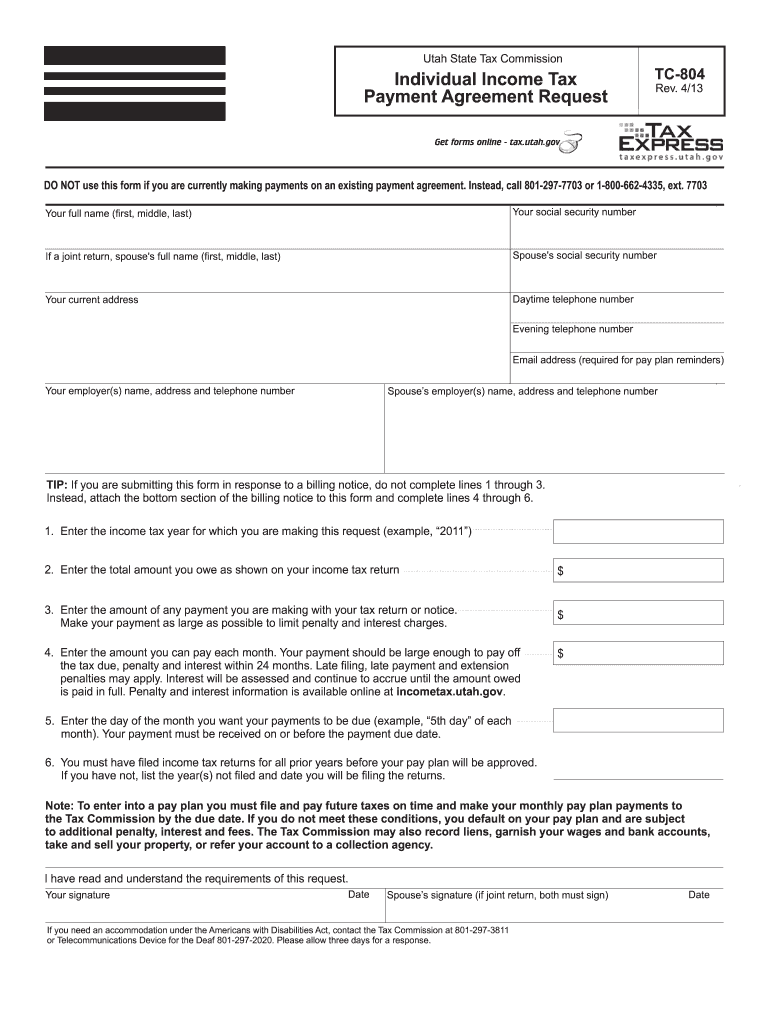

The SFORMSWork Folder800 899TC 804 cdr Tax Utah is a specific form used for tax-related purposes within the state of Utah. It is designed to facilitate the reporting of various tax obligations and ensures compliance with state tax regulations. This form is essential for individuals and businesses who need to report income, deductions, and other pertinent financial information to the Utah State Tax Commission.

How to use the SFORMSWork Folder800 899TC 804 cdr Tax Utah

Using the SFORMSWork Folder800 899TC 804 cdr Tax Utah involves several steps to ensure accurate completion. Start by gathering all necessary financial documents, including income statements and receipts for deductions. Carefully fill out each section of the form, providing accurate information as required. It is important to review the completed form for any errors before submission. Utilizing electronic tools can simplify this process and enhance accuracy.

Steps to complete the SFORMSWork Folder800 899TC 804 cdr Tax Utah

Completing the SFORMSWork Folder800 899TC 804 cdr Tax Utah requires a systematic approach:

- Gather all relevant financial documents.

- Access the form through an authorized platform.

- Fill in your personal and financial information accurately.

- Double-check for any errors or omissions.

- Sign the form electronically, if applicable.

- Submit the completed form according to state guidelines.

Legal use of the SFORMSWork Folder800 899TC 804 cdr Tax Utah

The legal use of the SFORMSWork Folder800 899TC 804 cdr Tax Utah is governed by state tax laws. To be considered legally binding, the form must be filled out accurately and submitted within the designated time frame. Electronic signatures are recognized under the ESIGN Act, ensuring that forms signed digitally hold the same weight as traditional signatures, provided they meet all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the SFORMSWork Folder800 899TC 804 cdr Tax Utah typically align with the annual tax filing schedule. It is crucial to be aware of these dates to avoid penalties. Generally, individual tax returns are due on April fifteenth, while extensions may be available. Always verify specific deadlines for the current tax year, as they may vary.

Required Documents

To complete the SFORMSWork Folder800 899TC 804 cdr Tax Utah, certain documents are required:

- W-2 forms from employers.

- 1099 forms for additional income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Quick guide on how to complete sformswork folder800 899tc 804cdr tax utah

Handle SFORMSWork Folder800 899TC 804 cdr Tax Utah effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents promptly without any delays. Manage SFORMSWork Folder800 899TC 804 cdr Tax Utah on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign SFORMSWork Folder800 899TC 804 cdr Tax Utah with ease

- Locate SFORMSWork Folder800 899TC 804 cdr Tax Utah and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign SFORMSWork Folder800 899TC 804 cdr Tax Utah and ensure seamless communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sformswork folder800 899tc 804cdr tax utah

Create this form in 5 minutes!

How to create an eSignature for the sformswork folder800 899tc 804cdr tax utah

How to generate an eSignature for your Sformswork Folder800 899tc 804cdr Tax Utah in the online mode

How to generate an electronic signature for your Sformswork Folder800 899tc 804cdr Tax Utah in Chrome

How to generate an eSignature for signing the Sformswork Folder800 899tc 804cdr Tax Utah in Gmail

How to make an eSignature for the Sformswork Folder800 899tc 804cdr Tax Utah from your mobile device

How to make an eSignature for the Sformswork Folder800 899tc 804cdr Tax Utah on iOS

How to create an electronic signature for the Sformswork Folder800 899tc 804cdr Tax Utah on Android OS

People also ask

-

What is the SFORMSWork Folder800 899TC 804 cdr Tax Utah?

The SFORMSWork Folder800 899TC 804 cdr Tax Utah is a specialized digital form designed for tax filing in Utah. It streamlines the process by allowing users to fill out and submit their tax forms electronically, ensuring compliance with state regulations. This tool simplifies tax preparation and helps avoid common errors associated with paper forms.

-

How does airSlate SignNow facilitate the use of the SFORMSWork Folder800 899TC 804 cdr Tax Utah?

airSlate SignNow provides a user-friendly platform that allows you to easily access and manage the SFORMSWork Folder800 899TC 804 cdr Tax Utah. With features like eSignature and document tracking, users can efficiently complete their tax submissions. This integration ensures that your tax filing process is not only fast but also secure.

-

What are the pricing options for using the SFORMSWork Folder800 899TC 804 cdr Tax Utah with airSlate SignNow?

airSlate SignNow offers flexible pricing plans for users of the SFORMSWork Folder800 899TC 804 cdr Tax Utah, making it accessible for businesses of all sizes. These plans include various features to meet your needs, from basic eSigning to comprehensive document management solutions. You can choose a plan that fits your budget and requirements.

-

Can I integrate the SFORMSWork Folder800 899TC 804 cdr Tax Utah with other software solutions?

Yes, airSlate SignNow allows you to seamlessly integrate the SFORMSWork Folder800 899TC 804 cdr Tax Utah with various software applications. This ensures that you can connect your tax filing processes with your existing systems, improving efficiency and data accuracy. Popular integrations include CRM systems, cloud storage, and accounting software.

-

What are the benefits of using the SFORMSWork Folder800 899TC 804 cdr Tax Utah for my business?

Using the SFORMSWork Folder800 899TC 804 cdr Tax Utah through airSlate SignNow offers numerous benefits for businesses, including faster tax processing, reduced paperwork, and enhanced compliance. The digital format minimizes errors and allows for easy tracking of submissions, ultimately saving time and resources. This efficiency supports better financial management for your business.

-

Is the SFORMSWork Folder800 899TC 804 cdr Tax Utah secure for sensitive information?

Absolutely! airSlate SignNow prioritizes security, especially for sensitive documents like the SFORMSWork Folder800 899TC 804 cdr Tax Utah. The platform utilizes advanced encryption and security protocols to ensure that your data remains confidential and protected against unauthorized access.

-

How do I get started with the SFORMSWork Folder800 899TC 804 cdr Tax Utah on airSlate SignNow?

Getting started with the SFORMSWork Folder800 899TC 804 cdr Tax Utah on airSlate SignNow is simple. You just need to create an account, select the tax form you need, and begin filling it out electronically. The intuitive interface guides you through the process, making it easy to complete your tax filings with confidence.

Get more for SFORMSWork Folder800 899TC 804 cdr Tax Utah

Find out other SFORMSWork Folder800 899TC 804 cdr Tax Utah

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now