Tc 804 2019-2026

What is the TC 804?

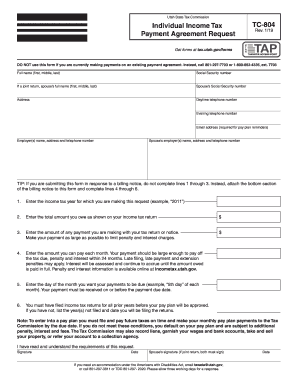

The TC 804 is a form used for making individual income tax payments in Utah. It is essential for taxpayers who need to report and pay their state income taxes. This form is designed to streamline the payment process and ensure compliance with state tax regulations. Understanding the TC 804 is crucial for anyone looking to manage their tax obligations effectively.

How to Use the TC 804

To use the TC 804, taxpayers must first complete the form accurately. This involves providing personal information, including your name, address, and Social Security number, along with the amount being paid. The form can be filled out digitally or printed for manual completion. Once completed, it must be submitted according to the preferred payment method, either online or by mail.

Steps to Complete the TC 804

Completing the TC 804 involves several key steps:

- Gather necessary personal information, including your Social Security number and income details.

- Access the TC 804 form, either online or in a printable format.

- Fill out the form with accurate payment amounts and personal details.

- Review the form for any errors or omissions.

- Submit the form through your chosen payment method, ensuring it is sent by the due date.

Legal Use of the TC 804

The TC 804 is legally binding when filled out and submitted according to Utah state laws. It is important for taxpayers to ensure that all information provided is accurate and truthful. Misrepresentation or errors can lead to penalties or legal repercussions. Utilizing a trusted platform for electronic signatures can enhance the validity and security of your submission.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the TC 804. The primary deadline for filing individual income tax payments typically aligns with the federal tax deadline. Staying informed about these dates is crucial to avoid late fees and ensure compliance with state tax regulations.

Form Submission Methods

The TC 804 can be submitted through various methods, providing flexibility for taxpayers. Common submission options include:

- Online submission via the Utah state tax website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices across Utah.

Required Documents

When completing the TC 804, certain documents may be necessary to support your payment. These can include:

- Your previous year’s tax return for reference.

- Documentation of income, such as W-2 forms or 1099 statements.

- Any relevant notices from the Utah State Tax Commission.

Quick guide on how to complete tc 804

Effortlessly Prepare Tc 804 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Tc 804 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The simplest method to modify and electronically sign Tc 804 with ease

- Find Tc 804 and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or errors that require reprinting new copies. airSlate SignNow caters to all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Tc 804 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 804

Create this form in 5 minutes!

How to create an eSignature for the tc 804

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to Utah tax payment?

airSlate SignNow is a digital solution that enables businesses to securely send and eSign documents. When it comes to Utah tax payment, our platform simplifies the documentation required for processing payments and filing forms, ensuring compliance with state regulations.

-

How can airSlate SignNow help streamline my Utah tax payment process?

With airSlate SignNow, you can quickly prepare and send tax-related documents for eSignature. This reduces the time spent on paperwork and ensures that your Utah tax payment forms are processed efficiently, minimizing the risk of delays.

-

Is there a cost associated with using airSlate SignNow for Utah tax payment?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our plans are cost-effective, and using our platform for your Utah tax payment documentation can save you time and resources, making it a worthwhile investment.

-

What features does airSlate SignNow offer for managing Utah tax payment documents?

airSlate SignNow provides features such as document templates, automated workflows, and real-time tracking for sent documents. These features enhance the efficiency of managing Utah tax payment documents, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other tools for handling Utah tax payment?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and ERP systems. This means you can connect it to your existing financial tools to simplify your Utah tax payment processing even further.

-

Are there any benefits to using airSlate SignNow for Utah tax payment over traditional methods?

Yes, using airSlate SignNow for Utah tax payment offers numerous benefits, such as speed, security, and convenience. Unlike traditional methods, our platform allows for instant access to signed documents and ensures secure storage of sensitive tax information.

-

How does the eSignature process work for Utah tax payment with airSlate SignNow?

The eSignature process with airSlate SignNow for Utah tax payment is straightforward. You simply upload your tax documents, send them for eSignature, and recipients can sign with just a click, making the entire process efficient and paperless.

Get more for Tc 804

- Inspection checklist complete this inventory checklist as soon as you sign the lease to your apartment form

- Deeg com form

- Fit to fly certificate pregnancy pdf form

- Mystery of history volume 2 pdf form

- Printable behavior observation forms

- City of chino police departmentchino ca form

- Safety data sheet wood pellets in bulk form

- End of partnership agreement template form

Find out other Tc 804

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself