Form 904 2019

What is the Form 904

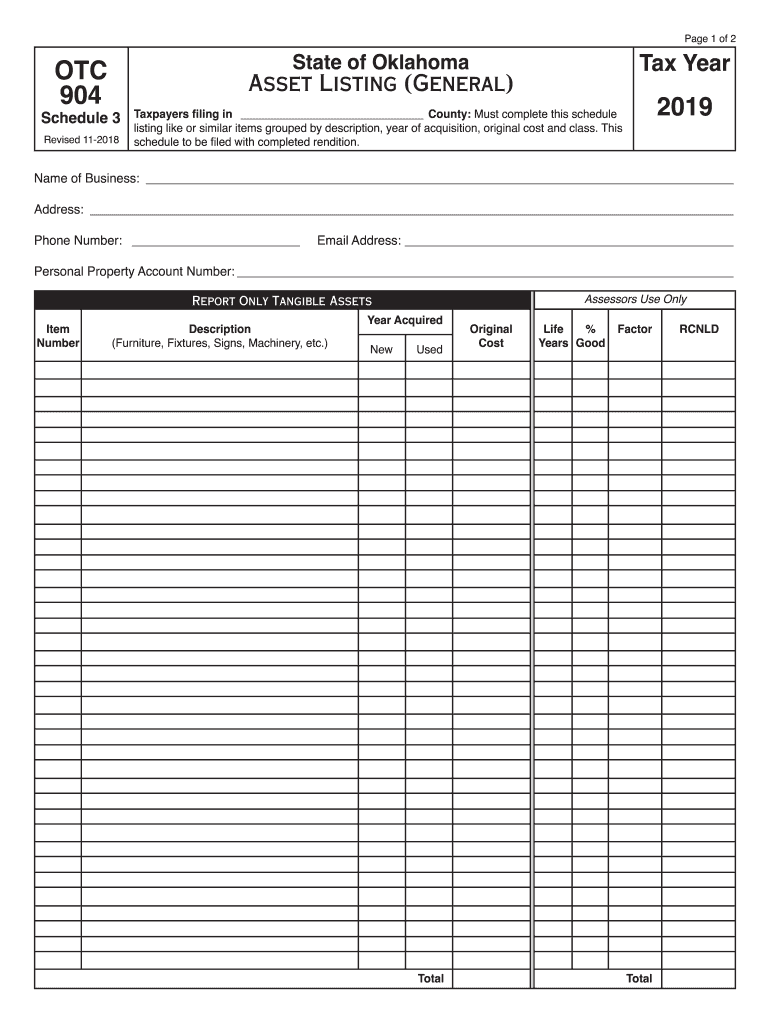

The Form 904, commonly referred to as the OTC Form 904, is a tax-related document used primarily in the state of Oklahoma. It is designed for individuals and businesses to report specific financial information to the Oklahoma Tax Commission. This form is essential for ensuring compliance with state tax regulations and is often used in conjunction with other forms to provide a comprehensive overview of a taxpayer's financial situation. Understanding the purpose and requirements of Form 904 is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form 904

Using the Form 904 involves several key steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and any relevant deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific guidelines provided by the Oklahoma Tax Commission.

Steps to complete the Form 904

Completing the Form 904 requires a systematic approach to ensure all necessary information is included. Follow these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and other income statements.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income and any applicable deductions as instructed on the form.

- Double-check all entries for accuracy, ensuring that calculations are correct.

- Sign and date the form before submission.

Legal use of the Form 904

The Form 904 holds legal significance as it is a formal declaration of a taxpayer's financial information to the state of Oklahoma. To ensure that the form is legally binding, it must be completed accurately and submitted in accordance with state regulations. This includes adhering to the deadlines set by the Oklahoma Tax Commission. Failing to comply with these legal requirements can result in penalties or audits, making it essential to understand the legal implications of submitting Form 904.

Filing Deadlines / Important Dates

Filing deadlines for the Form 904 are critical for compliance with state tax laws. Typically, the form must be submitted by April fifteenth of the tax year. However, taxpayers should verify specific deadlines for extensions or any changes announced by the Oklahoma Tax Commission. Keeping track of these important dates helps avoid late fees and ensures that all tax obligations are met in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the Form 904. Taxpayers can choose to file online through the Oklahoma Tax Commission's website, which may offer a more streamlined process. Alternatively, the form can be mailed directly to the commission's office. Some individuals may prefer to submit the form in person, especially if they have questions or require assistance. Each submission method has its own guidelines, so it is important to follow the instructions provided for the chosen method.

Quick guide on how to complete form 904 2019

Complete Form 904 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the correct format and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Form 904 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 904 with ease

- Find Form 904 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 904 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 904 2019

Create this form in 5 minutes!

How to create an eSignature for the form 904 2019

How to make an eSignature for your Form 904 2019 online

How to generate an electronic signature for your Form 904 2019 in Google Chrome

How to make an electronic signature for signing the Form 904 2019 in Gmail

How to create an eSignature for the Form 904 2019 from your smartphone

How to create an electronic signature for the Form 904 2019 on iOS devices

How to generate an electronic signature for the Form 904 2019 on Android

People also ask

-

What is Form 904 and how can airSlate SignNow help with it?

Form 904 is a specific document often used for various business purposes, including tax filings and compliance. With airSlate SignNow, you can easily create, send, and eSign Form 904, streamlining your document management process. Our platform ensures that your Form 904 is securely handled and legally binding.

-

Is airSlate SignNow compatible with Form 904?

Yes, airSlate SignNow is fully compatible with Form 904. Our platform allows users to upload, edit, and eSign this form seamlessly, ensuring that all necessary fields are completed accurately. This compatibility makes it easier for businesses to manage their documentation efficiently.

-

What features does airSlate SignNow offer for managing Form 904?

airSlate SignNow offers several features for managing Form 904, including customizable templates, automated workflows, and secure storage. These features allow users to create a personalized experience with Form 904 while ensuring compliance and security. Additionally, our real-time tracking keeps you updated on the status of your document.

-

How much does it cost to use airSlate SignNow for Form 904?

The pricing for using airSlate SignNow for Form 904 varies based on the plan you choose. We offer several subscription options tailored to fit different business needs, ensuring you get the best value for your investment. Visit our pricing page for detailed information on plans and features.

-

Can I integrate airSlate SignNow with other tools for processing Form 904?

Absolutely! airSlate SignNow offers robust integrations with various tools and software, making it easy to process Form 904 alongside your existing systems. Whether you use CRM solutions, cloud storage, or accounting software, our platform can connect and enhance your workflow.

-

What are the benefits of using airSlate SignNow for Form 904 eSigning?

Using airSlate SignNow for eSigning Form 904 brings numerous benefits, including enhanced efficiency and reduced turnaround times. Our platform ensures that all signatures are legally binding and secure, which minimizes the risk of errors. Additionally, the user-friendly interface simplifies the signing process for all parties involved.

-

Is it safe to eSign Form 904 with airSlate SignNow?

Yes, eSigning Form 904 with airSlate SignNow is completely safe. We prioritize security with advanced encryption and compliance with industry standards. Your documents, including Form 904, are stored securely, ensuring that sensitive information is protected throughout the signing process.

Get more for Form 904

Find out other Form 904

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors